Property managers are going to be busy in 2025. According to our 2025 Property Management Industry Report, 91% of property managers we surveyed plan to expand their portfolios in the next two years. Given the current economic climate, they’re looking to do that by finding creative, tech-led solutions to streamline their businesses while seeking out new clients.

With so much on the horizon for property managers, property management tax reporting, may be the last thing on their minds. But it’s still an essential part of 2025 planning.

That’s why we’ve created a guide (and a video) to help make the 1099 filing process as smooth as possible.

What Are 1099-MISC and W-9 Forms?

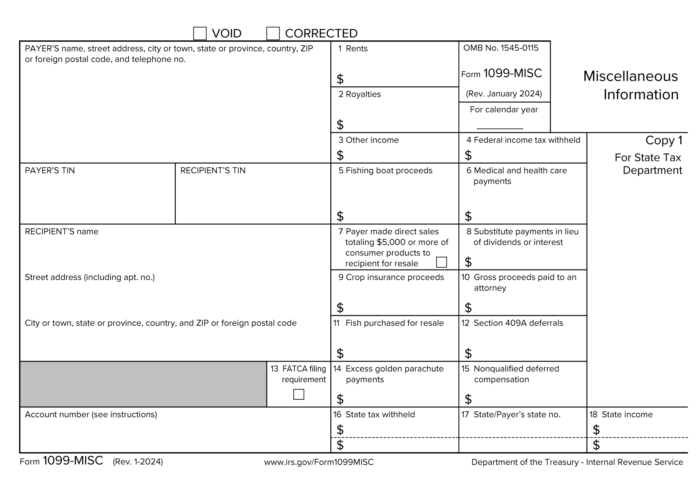

The IRS uses the 1099-MISC to report a variety of income received that isn’t reported on standard W2 forms. While non-employee compensation is now filed under the 1099-NEC (we’ll get to that later), you’ll still need to file a 1099-MISC for:

- Rent income

- Prizes and awards

- Cash paid from a notional principal contract to an individual, partnership, or estate

- Fishing boat proceeds

- Medical and health care payments

- Crop insurance proceeds

- Payments to an attorney

- Section 409A deferrals

- Non-qualified deferred compensation

- Other income payments

For property management tax filing, that means that 1099-MISC forms are the primary method to report:

- Rent provided to an owner from a leased property totaling $600 or more

- Attorney fees totaling $600 or more

Whenever a property manager brings on a new owner or law firm they should request a W-9 form. The W-9 form will give you their filing status and federal tax ID, so you can file your 1099-MISC forms accurately when the time comes.

Property managers are required to request a W-9 from and issue a 1099-MISC form to each owner, attorney, and contractor they work with, so long as payments meet or exceed the $600 threshold. The IRS makes (typically small) adjustments to the 1099-MISC form each year. For 2024, the form looks like this:

What Is a 1099-NEC form?

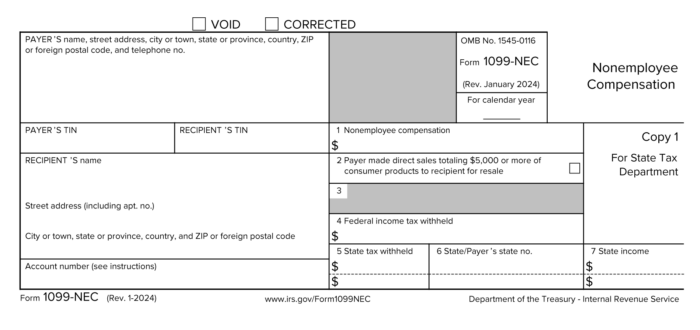

In 2020, the IRS began requiring businesses to report non-employee compensation in a separate form, the 1099-NEC. We’ve created a detailed breakdown of the form and what it means for property managers here, but here’s the basics of what you should know:

Property managers must file a 1099-NEC when they pay an unincorporated independent contractor $600 or more in a year for work done on a rental property owner’s behalf or directly for the manager’s own business. You’ll need to send a 1099-NEC instead of a 1099-MISC if you made a payment:

- Of at least $600 to an individual or organization during the year

- To anyone who isn’t an employee (this can be an individual, a partnership, an estate or, in some cases, a corporation)

- For services provided as part of your business (including to government agencies and nonprofit organizations)

For property managers, those criteria typically boil down to payments made to:

- Maintenance providers such as landscapers, plumbers, and HVAC professionals

- Service providers such as locksmiths, laundry and dry cleaning, or fitness instructors

It’s always a recommended practice to consult a tax professional if you’re unsure whether a particular payment falls into the right category for a 1099-NEC. To give you an idea of what to expect, the form for 2024 looks like this:

1099 Exemptions for Property Managers

There are a few scenarios in which property managers are exempt from filing a 1099. As mentioned earlier, 1099s aren’t required for any payments less than $600.

If the rental property owner is established as a corporation, you do not need to file a 1099-MISC form for payments made to that company. You’ll still need to file a 1099-MISC if the property owner is a limited liability company, or LLC, however.

You also do not need to file a 1099-NEC form for any maintenance work or other services done by an incorporated business. Again, this exemption does not apply to LLCs.

1099 Requirements for Property Owners

If you own the property you are managing (a private landlord), you do not need to file a 1099 for any work related to that property. This has been the case since the reporting requirements within the Affordable Care Act and Small Business Jobs Act were repealed in 2011.

When determining if a certain payment needs to be reported on a 1099, it’s always a good idea to meet with a tax professional to make sure you are filing correctly and to avoid any penalties.

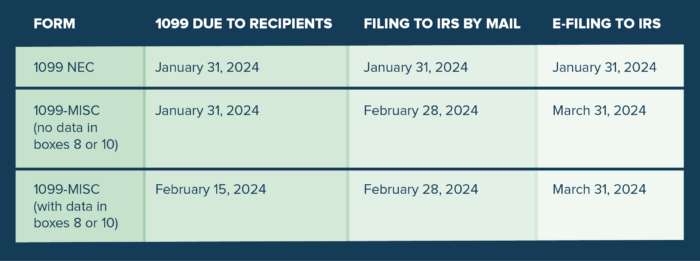

Deadline for 1099 Forms

The filing deadlines for 1099-MISC and 1099-NEC forms depend on how you’re filing and what information you’re providing in the forms. Take a look at the table below to determine when you should file:

All your 1099 forms must be submitted together, along with one copy of Form 1096, the IRS equivalent of a cover letter. You can obtain an original Form 1096, 1099 forms and any other official tax documents (photocopies won’t work) from the IRS directly through their website.

1099-MISC and 1099-NEC Filing Options for Property Managers

You have several options when filing 1099 forms. You can do it yourself, either by mailing the documents in person or electronically through the IRS’s Filing Information Returns Electronically (FIRE) system or you can hire an accountant or a CPA to do it for you.

It’s almost always easier, however, to file 1099s electronically (eFile) and the IRS requires you to do so if you’re filing 10 or more 1099-MISC forms.

It’s also a good practice (and recommended by the IRS) to keep copies of your 1099-MISC and 1099-NEC forms for at least 3 years (4 years if backup withholding was imposed).

eFiling through property management software can make each step of the process easier, allowing you to fill out 1099s in minutes and get them postmarked the same day. This not only speeds up the process for property managers, but also reduces the time and effort vendors, owners, and other partners have to spend.

How to File Create and Send 1099s in Buildium

Using existing, purpose-built software is often the fastest and most cost-effective way to go. Through Buildium’s property management software, you can generate and send 1099s, including both the 1099-MISC and 1099-NEC, to all of your owners, vendors, and contractors. Buildium also lets you start the process a whole month earlier than when filing officially opens with the IRS, so you can get a jump on tax season.

Buildium calculates 1099 tax totals based on the accounting data it has collected throughout the tax year. If you haven’t been using Buildium all year, not to worry. You can edit the amounts at any time.

Creating and filing 1099s takes just a few simple steps in Buildium:

- Navigate to Accounting in your Buildium dashboard and click on 1099 Tax Filings

- Click on the Create Batch button in the upper righthand corner.

- Select your date range from the calendar and then the property type for which you’re filing.

- Buildium will take you to a list of owners and vendors. Select the ones you’ll be filing for. These are your recipients.

- Buildium will suggest the amounts for your rental owners and vendors, which you will then be able to verify.

- Once your amounts are verified, you can save to file later or efile right away, if you’re getting started after January 1.

Staying on top of tax reporting is essential for any size property management company. Penalties for not filing 1099 forms can range from $50 to $280 per form and deductions tied to the income can be disallowed if you fail to file, meaning the owners you work with won’t be able to claim the property expenses as tax deductions.

Luckily, you’ve got the knowledge and tools to make filing 1099 forms for property management a breeze. A property management software platform can do a lot of the heavy lifting and keep you well ahead of deadlines, so, rather than looking back, you can focus on your business goals for 2025.

Frequently Asked Questions

What is a 1099 form in property management?

A 1099 form is a tax document used to report various types of income other than wages, salaries, and tips. In property management, it’s commonly used to report payments made to contractors, vendors, or service providers who perform work on your rental properties.

Who needs to receive a 1099 form?

You need to issue a 1099 form to any contractor, vendor, or service provider who is not an employee and who you’ve paid $600 or more over the course of the year for services related to your rental properties.

When do I need to send out 1099 forms?

1099 forms should be sent out to the recipients by January 31st of the year following the tax year in which the payments were made. The IRS copy of the form should be submitted by the end of February if filing by paper, or by the end of March if filing electronically.

What information do I need to prepare a 1099?

To prepare a 1099 form, you’ll need the contractor’s or service provider’s name, address, and taxpayer identification number (TIN). You’ll also need records of the total amount paid to each recipient during the tax year.

Can software help with 1099 preparation?

Yes, there are various software solutions available that can assist with generating, managing, and filing 1099 forms. These tools can simplify the process by tracking payments and automatically populating the necessary information for each form.

What happens if I don’t file a 1099 form?

Failing to file a 1099 form can result in fines and penalties from the IRS. It’s important to comply with the reporting requirements to avoid these issues and keep accurate records for your property management business.

Read more on Accounting & Reporting