The new year is fast approaching. With all the extra tasks on your plate—complying to COVID-19 health regulations, navigating eviction bans, calming anxious residents and owners—it’s easy to forget that tax filing deadlines are fast approaching for your 1099s. And these days, it’s important not to be caught unawares.

There’s a big change in your 1099 reporting this year. For the first time since 1982, the IRS is requiring businesses to break out non-employee compensation in a separate form, the 1099-NEC. To learn more about the 1099-NEC, click here.

But you’ll still have to file 1099-MISC forms, too. In this article we’ll talk about 1099-MISC forms: when you need to file them and how.

1099-MISC Forms: The “What”

1099-MISC forms are used to report a variety of income to the IRS. Before this year, contractors and freelancers received them from companies where they were earning regular income (over $600 over the previous year).

In property management accounting, they are used to report rent earned from a leased property, as well as income from contracted work. A form must be sent to each property owner that has earned $600 or more over the course of the tax year.

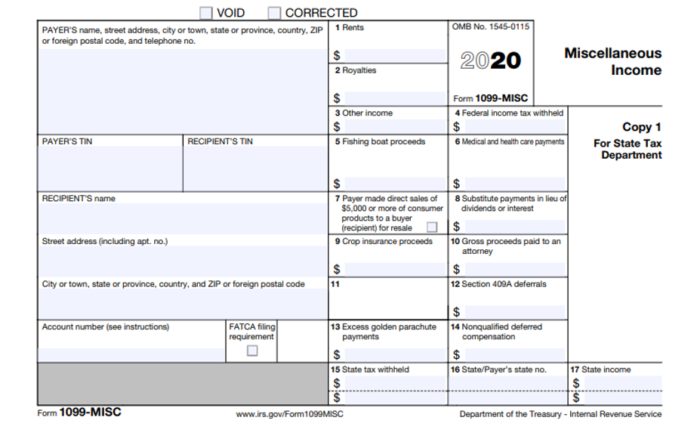

Because some of the payments have been broken out into the 1099-NEC, the IRS redesigned the 1099-MISC. This is what it looks like now.

According to the IRS, changes have been made to the following boxes:

- Payer made direct sales of $5,000 or more (checkbox) in box 7.

- Crop insurance proceeds are reported in box 9.

- Gross proceeds to an attorney are reported in box 10.

- Section 409A deferrals are reported in box 12.

- Nonqualified deferred compensation income is reported in box 14.

- Boxes 15, 16, and 17 report state taxes withheld, state identification number, and amount of income earned in the state, respectively.

1099-MISC Forms: The “When”

Generally, you’re required to send 1099-MISC forms and file with the IRS by January 31, 2021. This year, however, forms have to be postmarked and reported to the IRS by March 1 if you’re filing on paper. If you’re filing electronically, forms are due by March 31.

If you use Buildium for your 1099s, starting December 1st, you have to create 1099 batches before IRS filing is available on January 1st. You can start verifying tax information ahead of time, making filing faster and easier.

1099-MISC Forms: The “How”

This year, the IRS is breaking out non-employee compensation from the 1099-MISC. But you’ll still need to file one for the following:

- Rent income

- Prizes and awards

- Other income payments

- Cash paid from a national principal contract to an individual, partnership, or estate

- Fishing boat proceeds

- Medical and health care payments

- Crop insurance proceeds

- Payments to an attorney

- Section 409A deferrals

- Nonqualified deferred compensation

You probably didn’t pay out any fishing boat or crop insurance proceeds (unless you have some pretty impressive side gigs and alternative revenue streams). But you may have paid an attorney and you definitely paid out rent to your owners.

For those types of payments, you’ll still have to send and report a 1099-MISC.

There are a number of ways to file 1099-MISC forms:

- Do it yourself

- Hire an accountant or a CPA

- Find a provider to do it for you

You can even write your own software to e-File with the IRS if you want to (though, this is probably a “next year” thing if you haven’t started yet).

1099-MISC Forms: Tips and Recommendations

If you plan to file more than 250 1099-MISC forms with the IRS, you still must file electronically. In accordance with the Filing Information Returns Electronically (FIRE), they prefer that you e-File regardless of the number.

The IRS recommends keeping copies of filed 1099-MISC forms, or having the ability to reconstruct them, for at least 3 years following the due date of the returns. Retain copies of them for at least 4 years if backup withholding was imposed.

If you don’t file 1099-MISC forms at all, penalties range from $50 to $500 per form. Even worse, deductions tied to the income can be disallowed, too. This means that if you don’t file your 1099-MISC forms, your landlords won’t be able to claim the property expenses as tax deductions.

This year, the IRS added another step to 1099 forms for property managers. But if you use a filing service, getting both your 1099-MISC and 1099-NEC forms out on time doesn’t have to add extra time and money. Now that you know how the new tax code affects the 1099-MISC, be sure to read up on the 1099-NEC and then let your property management software help you get them out.

1099-MISC forms, from A to Z: Learn the what, why & how on the #BuildiumBlog now! Share on X Read more on Accounting & Reporting