Property management companies have had to adapt to a breakneck speed of change over the last few years. Though inflation has fallen since its peak in 2022, costs remain elevated. Though the labor shortage has softened somewhat, unemployment remains low. More apartment units are being built than we’ve seen in decades, the housing market is rebounding, and technologies such as artificial intelligence are becoming increasingly commonplace.

So many aspects of doing business look different than they did just a few years ago—and in order to succeed, it’s critical to know what kinds of changes lie ahead of us. That’s why we’ve compiled the five property management industry trends we expect to have the biggest impact in 2024.

These trends are pulled straight from our 2024 Property Management Industry Report. Every year, the Industry Report is here to help companies understand the environment they’re operating in so they can expand their business, plus attract and retain great residents and owner clients. For far more research on how property management companies are adapting to current rental market conditions, be sure to download your free copy of the report.

Trend #1: Property Management Companies’ Changing Growth Tactics

Property management companies are searching for new ways to grow as their plans for portfolio expansion outpace those of many rental owners.

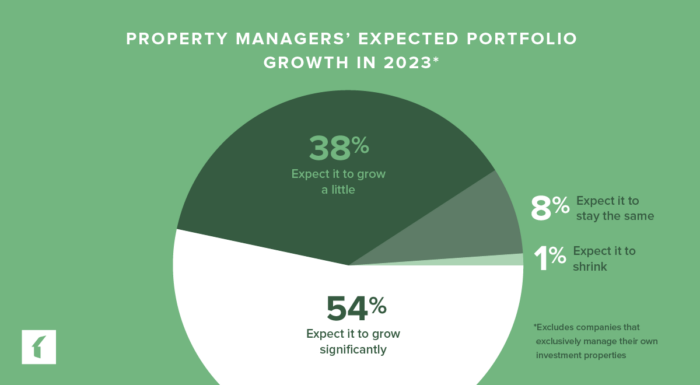

Property management companies’ focus on growth is a familiar story: For the third year in a row, more than 9 in 10 respondents to our annual survey of thousands of industry professionals have announced their companies’ intentions to expand their portfolios in the two years to come. However, going into 2024, this growth is playing out in a greater variety of ways than it has in the past.

Heading into 2023, respondents told us that their companies planned to grow primarily by recruiting new clients and encouraging current clients to acquire new properties. But with high property prices and interest rates slowing the pace at which rental owners are acquiring new properties, property management companies are turning to other tactics to continue their expansion.

In addition to continuing to recruit new, growth-oriented clients, companies are considering purchasing or building new properties of their own, acquiring other companies’ portfolios, and expanding both the property types they manage and the geographic areas they serve.

Trend #2: Elevated Costs in the Property Management Industry

Rising costs continue to strain property management companies and their clients, from increased insurance premiums and property taxes to materials and labor.

Property management companies and their rental owner clients are under strain due to the increased cost of operating a business in the current environment, compared to pre-COVID-19 conditions. Elevated costs—from insurance premiums (up 26% in the last year alone) to property taxes, utilities, materials, and labor—have companies focused heavily on operating as efficiently as possible.

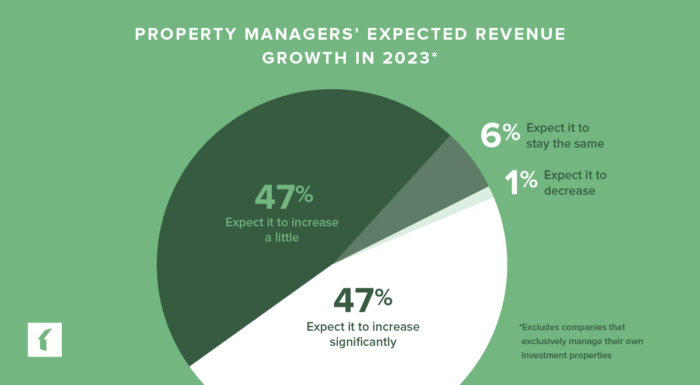

They’re also intent on finding new sources of revenue, with 94% of property management companies reporting that they expect their revenue to increase in the next two years. In line with that goal, 40% of property management companies plan to expand their services in the next two years, bringing new offerings to their customers such as cleaning and outdoor services; while 33% plan to expand the types of properties they manage, expanding to sectors such as vacation rentals and community associations.

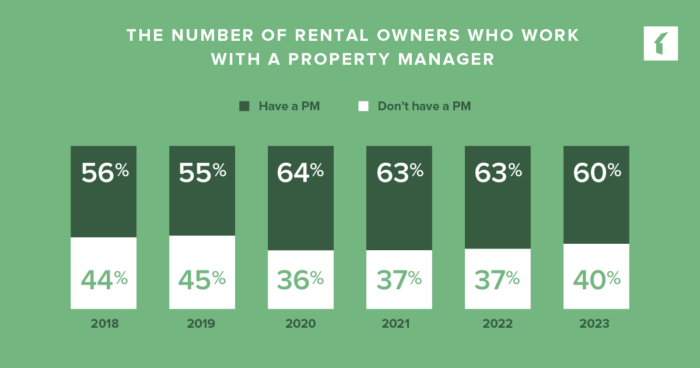

Property management companies are also determined to prove the value of their services to rental owners whose shrinking margins may tempt them to self-manage their properties. This reality has resulted in a very small decrease in the number of rental owners working with a property manager, though overall, the complexity of operating a rental property in today’s environment means that rental owners are more reliant on property managers’ expertise than ever.

Trend #3: Fierce Competition in the Property Management Industry

Property management companies of all sizes are facing competition from real estate agencies due to the slowing sales market, as well as from larger management firms.

As the sales market has slowed, property management companies have begun to see increased competition from real estate agencies. In March 2023, for example, there were 1.5 million Realtors, but just 563,000 homes on the market, driving some real estate agents and agencies to expand their services into property management.

As one respondent put it: “As the real estate market softens, real estate agents will try to get into property management, and it takes away opportunities. By the same token, it also creates opportunities because of their inexperience, which is where we can differentiate ourselves.”

In addition, smaller property management companies continue to face competition from larger firms that are able to offer lower prices due to economies of scale. In response, companies are differentiating themselves from the competition by offering more personalized customer service, and many are considering expanding their offerings to ensure they meet the full range of their clients’ needs.

Trend #4: Property Managers’ Renewed Focus on Resident Retention

Property management companies are devoting more resources to resident retention as the rental market cools and the supply of new apartments grows.

960,000 multifamily units are under construction in metros across the country—the largest amount in decades. Though this influx of new supply is exerting a much larger impact on the upper end of the market, across the rental sector, property management companies are searching for ways to hold onto their best renters. These efforts include providing high-quality services, renovating units, and limiting rent increases for existing residents.

One respondent told us: “Downtown Memphis is becoming much more competitive, with several hundred units entering the market. We plan to improve retention rates through select tenant events and recognitions (handwritten birthday cards, Wine-Down Wednesday, etc.). By keeping tenants for longer stretches, we can maximize profitability, maximize occupancy, and impress clients.”

In addition, property management companies are more focused on tenant screening to ensure they’re signing tenants who can afford to stay in the long term, including in the event of an economic downturn.

Trend #5: Technology’s Central Role in the Property Management Industry

Technology has never occupied a more pivotal role in property management companies’ operations—or in the employee and customer experience—than it does now.

By reducing the time spent on manual processes, property management software makes it possible for companies to focus on expansion without reducing the quality of their customer service, compensate for rising costs that threaten their margins, and navigate the ongoing labor shortage.

When it comes to technology, one survey respondent wrote, “The positive impact directly relates to efficiency, allowing staff to handle a larger number of contacts/connections. This leads to lower employee costs.”

Another explained that technology has impacted “overall job satisfaction for property managers, because it’s freeing up time to accomplish tasks that matter vs. being bogged down with cumbersome and rote tasks.”

Renters and rental owners have also grown significantly more comfortable with technology during the pandemic, and have come to expect to be able to complete a variety of transactions online. Today, a full 95% of rental owners and 90% of renters want to be able to interact with their property management company online through processes like electronic payments, document sharing, communications, and maintenance ticketing.

The 2024 State of the Property Management Industry Report

There’s so much more research packed into our 2024 Property Management Industry Report. This year’s report talks about the challenges that companies face in growing their portfolios in a time when rental owners aren’t as interested in acquiring new properties, competition has increased, and current team members are overburdened.

But it also shares the opportunities that industry professionals have discovered to differentiate themselves from the competition by better serving their customers’ needs—and how technology is making it possible for companies to grow without compromising the level of service they provide.

Read more on Industry Research