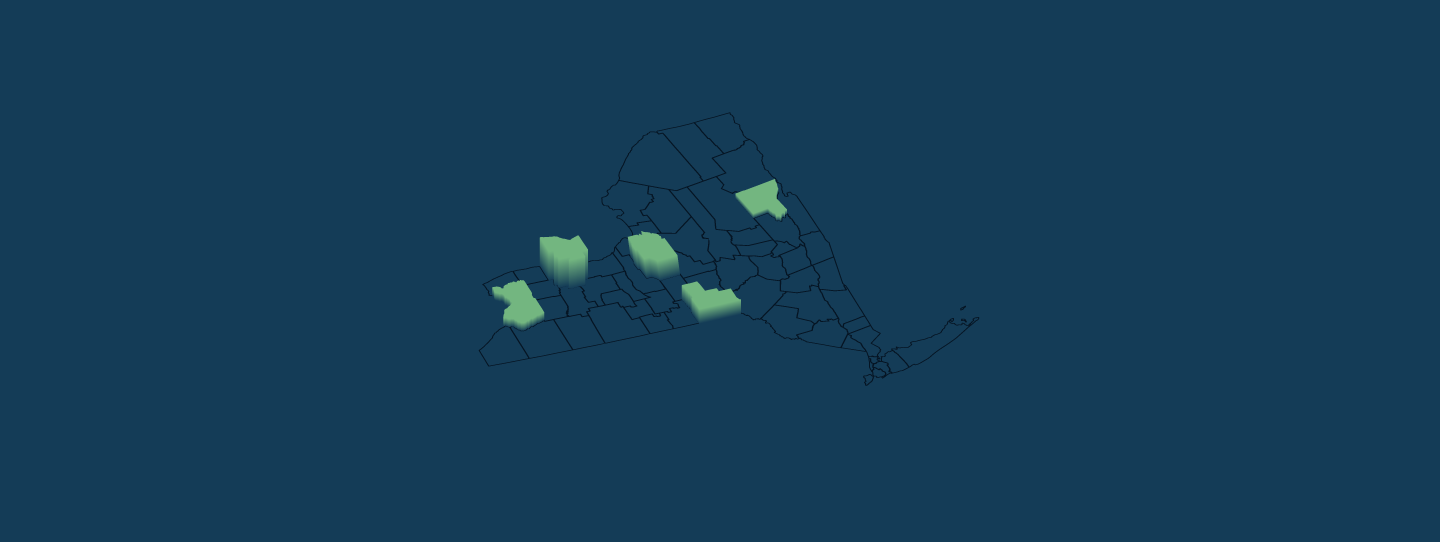

New York Rental Market Trends in 2025

When talking about New York rental markets, the Big Apple may be the first place that comes to mind—but in this post, we’ll focus on five lesser-known, more affordable markets across New York State that rental investors should keep an eye on in 2025. All five of the cities that we’ll cover ranked on our 2025 list of up-and-coming real estate markets, proof of the strength of their rental markets and their investment appeal in comparison with the rest of the U.S.

New York is the fourth-most populous state in the country, with approximately 20 million residents, one-third of whom live outside of the New York City metro area. While most companies located in the state have offices in Manhattan, big names like IBM, Mastercard, PepsiCo, and Wegmans are headquartered in other cities throughout the state.

Alongside the many positive factors that may pique real estate investors’ interest, there are three considerations that you may want to keep in mind when considering investing in New York State:

- Regulatory environment: Passed in 2019, the state’s Housing Stability and Tenant Protection Act dictates how landlords can operate rent-regulated units. Many of the cities on our list are also in the process of passing Good Cause Eviction Protections, which apply to market-rate units.

- High housing costs: New York is among the most expensive states in the country to live in, with relatively high taxes and a shortage of homes pushing prices even higher. However, the cities on our list are relatively inexpensive compared to pricier markets throughout the U.S.

- Declining population: Due to outmigration, low fertility rates, and an aging population, New York is losing residents, a trend that’s expected to continue in the coming years, including in many of the cities on our list.

If you’re a real estate investor or property manager looking to expand within New York State, this post will guide you through evaluating up-and-coming real estate markets for 2025. We’ll share rental market statistics for each city, including inventory growth, rent growth, vacancy rates, cap rates, and property price appreciation. We’ll also highlight economic and demographic trends in each market.

Top 5 Rental Markets in New York State for 2025

Without further ado, here are 5 New York State rental markets where our research indicates growth opportunities lie in 2025.

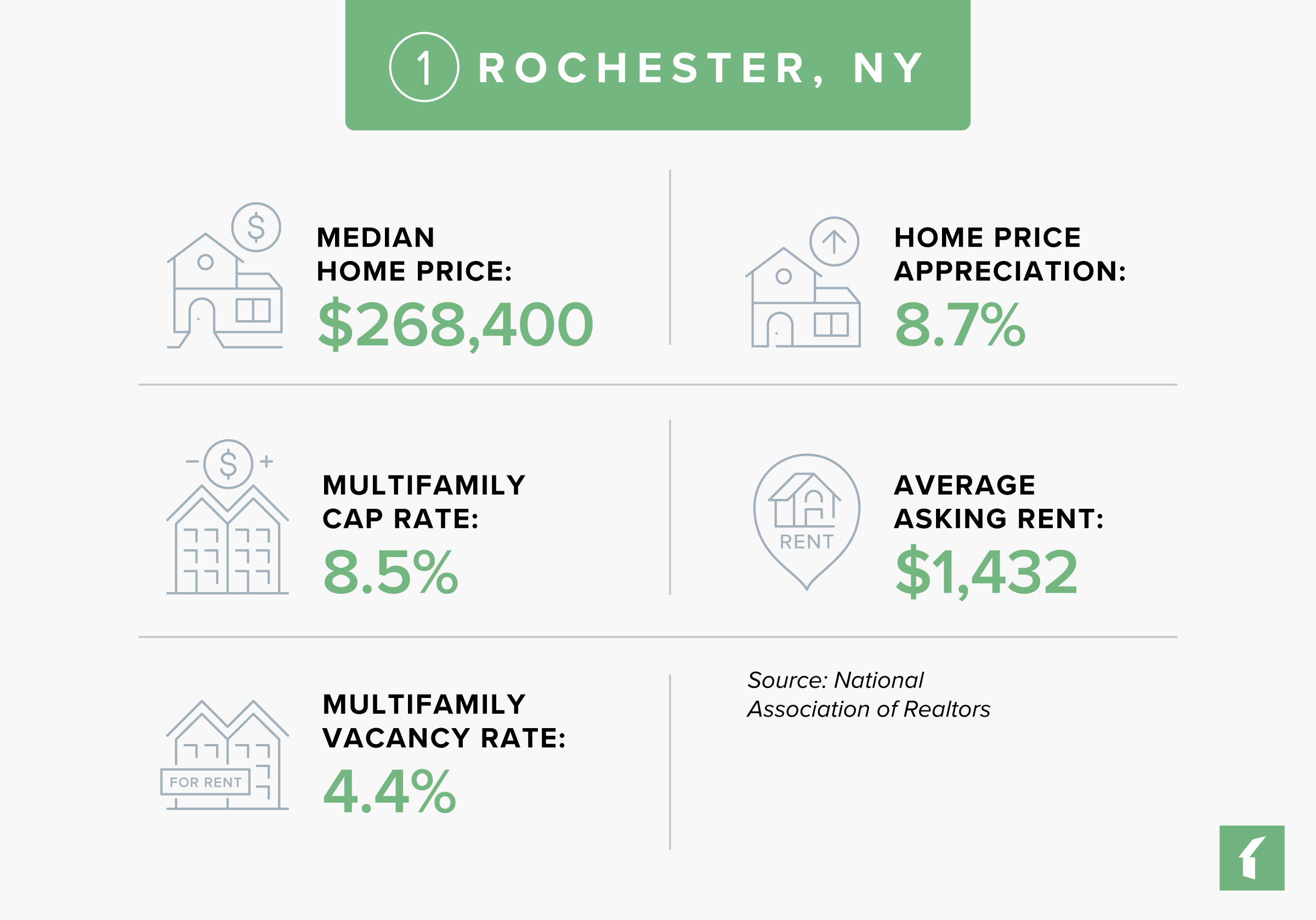

Market #1: Rochester, NY

Rochester, located in western New York, is a vibrant city with a metro area that’s home to 1,052,087 residents. The city is a hub for several major corporations, including Western Union, Kodak, Xerox, and Paychex, which contribute to a stable and diverse economy. Additionally, the presence of educational institutions like the University of Rochester and Rochester Institute of Technology drives a steady demand for rental properties. This demand is further supported by the city’s diverse job market, which includes sectors such as healthcare, technology, and manufacturing.

While winters in Rochester tend to be cold and snowy, the city offers a wealth of activities during the warmer months. Residents enjoy spending time at Lake Ontario, exploring its many parks, and attending frequent outdoor festivals.

Rochester ranked #2 on our 2025 list of up-and-coming real estate markets thanks to its strong cap rates, rent growth, occupancy rates, and property price appreciation in 2024. Its affordability, combined with the city’s economic stability, make it an appealing market for rental investors and residents alike. It is worth noting that Rochester recently implemented Good Cause Eviction Protections, intended to safeguard tenants from steep rent hikes and arbitrary evictions.

Rochester, New York Rental Market Statistics

- Rental Inventory (Q3-’24): 58,990

- Units Added Since Q3-’23: +0

- Asking Rent Growth Since Q3-’23: 4.1%

- Asking Rent (Q3-’24): $1,432

- Effective Rent (Q3-’24): $1,424

- Multifamily Vacancy Rate (Q3-’24): 4.4%

- Multifamily Cap Rate (Q3-’24): 8.5%

Source: National Association of Realtors

Rochester, New York Housing Market Statistics

- Median Home Price (Q3-’24): $268,400

- Home Price Appreciation Since Q3-’23: 8.7%

Source: National Association of Realtors

Rochester, New York Economic Statistics

- Population Growth (2022): -2.7%

- GDP Growth (2022): 5.3%

- Job Growth (Q3-’24): 1.7%

Source: National Association of Realtors

Lists That Mention Rochester, New York

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #34

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #32

- Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #18

- Best Real Estate Markets – Mid-Sized Cities (WalletHub): #51

- Best Places to Live (U.S. News): #74

Market #2: Syracuse, NY

Syracuse, located in central New York State, is a college town with a metro area population of 652,956. The presence of Syracuse University, along with other educational institutions, drives steady demand for rental properties. Syracuse’s economy has made the transition from manufacturing to a more diverse mix of healthcare, education, and technology sectors. The city’s largest employers, including SUNY Upstate Medical University, Syracuse University, and St. Joseph’s Health, contribute to a stable and diverse economy.

While the Syracuse area has some of the snowiest winters in the country, it offers a wealth of activities during the warmer months, between Lake Ontario and the city’s parks. Syracuse’s strong culture of performing arts, including an annual jazz festival, a symphony orchestra, and an opera company, adds to its appeal.

Syracuse ranked #5 on our 2025 list of up-and-coming real estate markets thanks to its strong property price appreciation, cap rates, and rent growth over the past year. Its affordability also contributes to its appeal for rental investors. Like Rochester, it’s important to be aware that Syracuse recently passed Good Cause Eviction Protections.

Syracuse, New York Rental Market Statistics

- Rental Inventory (Q3-’24): 34,461

- Units Added Since Q3-’23: +328

- Asking Rent Growth Since Q3-’23: 4.1%

- Asking Rent (Q3-’24): $1,297

- Effective Rent (Q3-’24): $1,291

- Multifamily Vacancy Rate (Q3-’24): 5.5%

- Multifamily Cap Rate (Q3-’24): 8.4%

Source: National Association of Realtors

Syracuse, New York Housing Market Statistics

- Median Home Price (Q3-’24): $262,200

- Home Price Appreciation Since Q3-’23: 13.0%

Source: National Association of Realtors

Syracuse, New York Economic Statistics

- Population Growth (2022): -0.1%

- GDP Growth (2022): 4.6%

- Job Growth (Q3-’24): 1.0%

Source: National Association of Realtors

Lists That Mention Syracuse, New York

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #149

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #114

- Best Places to Live (U.S. News): #73

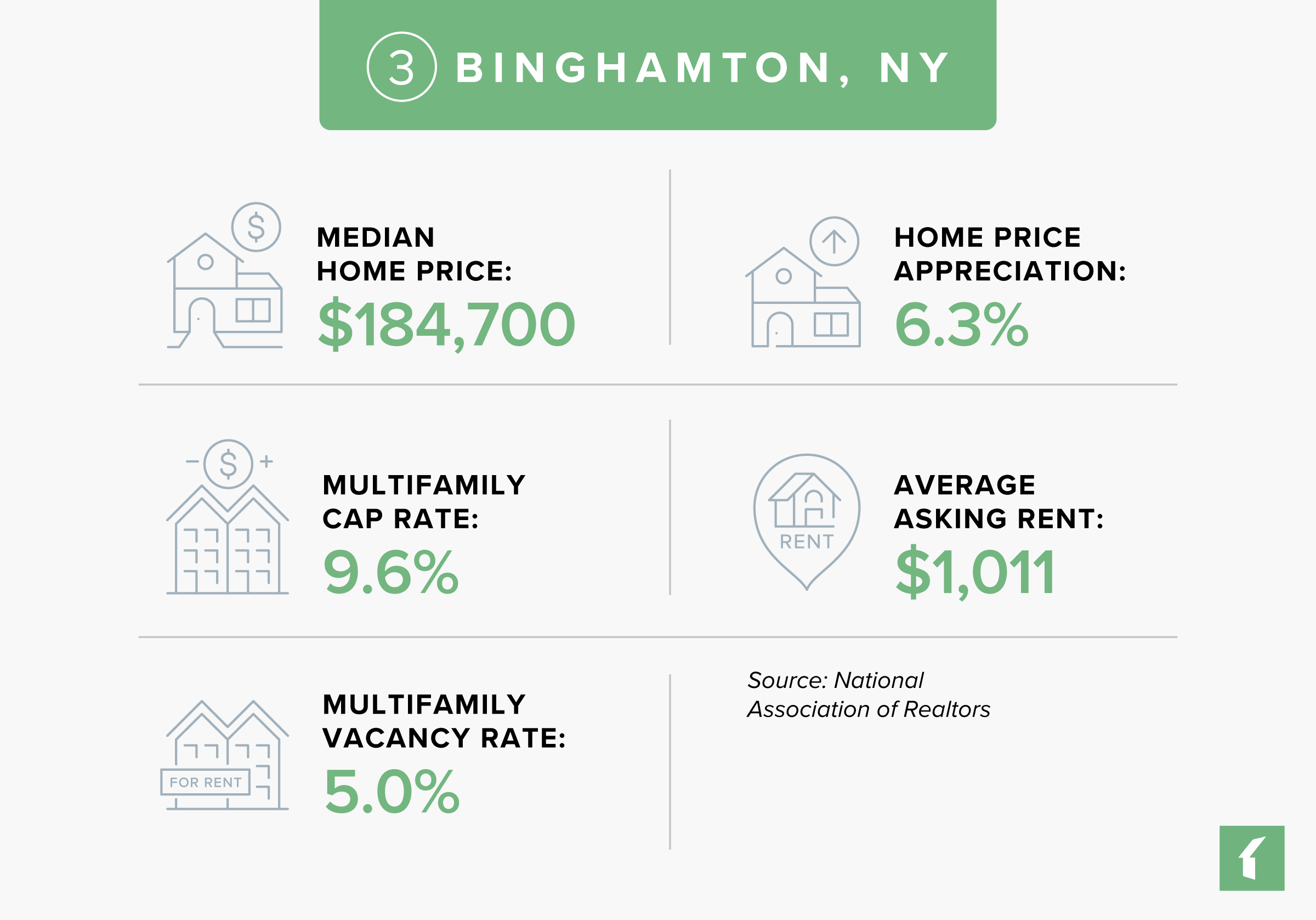

Market #3: Binghamton, NY

Binghamton, NY is located in the southern part of the state near the Pennsylvania border, and its metro area is home to 243,792 residents. Like other Rust Belt cities in New York, Binghamton has faced the challenge of transitioning from a manufacturing-based economy to one that focuses more on education and technology, with Binghamton University playing an important role in this evolution. The university is one of the city’s largest employers, along with United Health Services and Lourdes Hospital.

With its history as the Carousel Capital of the World, Binghamton has a rich cultural scene with several museums and parks located throughout the city, while two nearby rivers provide recreational opportunities. Though it’s smaller than other New York real estate markets like Rochester and Syracuse, its affordability relative to the rest of the state makes it an appealing place to live as well as to invest

Binghamton ranked as #7 on our 2025 list of up-and-coming real estate markets due to its strong rent growth, vacancy rates, and cap rates over the last two years. As with the other cities on our list, it’s important to be aware that Binghamton recently enacted Good Cause Eviction Protections.

Binghamton, New York Rental Market Statistics

- Rental Inventory (Q3-’24): 8,004

- Units Added Since Q3-’23: +0

- Asking Rent Growth Since Q3-’23: 3.6%

- Asking Rent (Q3-’24): $1,011

- Effective Rent (Q3-’24): $1,007

- Multifamily Vacancy Rate (Q3-’24): 5.0%

- Multifamily Cap Rate (Q3-’24): 9.6%

Source: National Association of Realtors

Binghamton, New York Housing Market Statistics

- Median Home Price (Q3-’24): $184,700

- Home Price Appreciation Since Q3-’23: 6.3%

Source: National Association of Realtors

Binghamton, New York Economic Statistics

- Population Growth (2022): -0.4%

- GDP Growth (2022): 5.5%

- Job Growth (Q3-’24): 2.0%

Source: National Association of Realtors

Lists That Mention Binghamton, New York

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #113

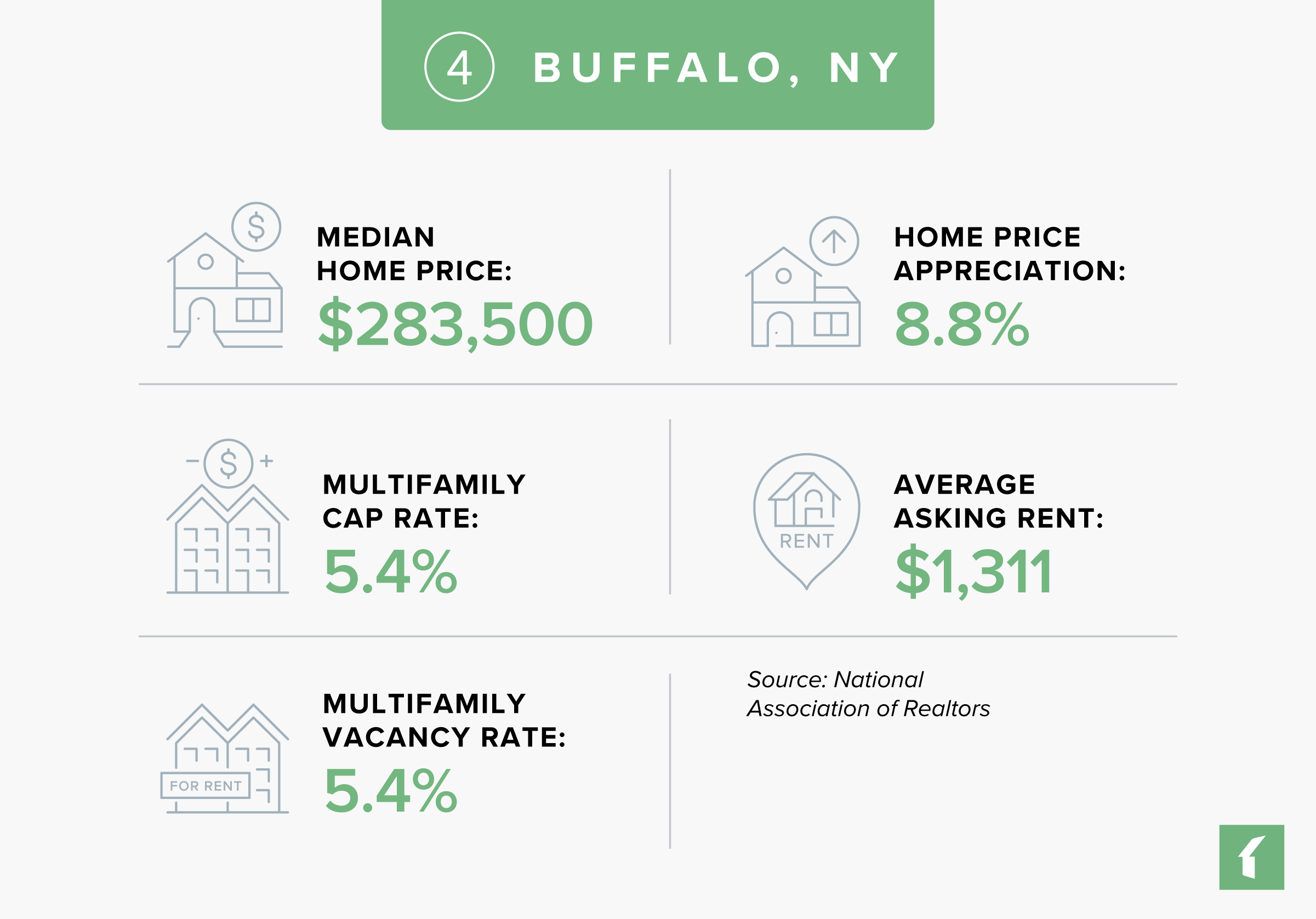

Market #4: Buffalo, NY

With 1,155,604 residents living in its metro area, Buffalo is the second-most populous city in the state of New York. It’s located in the western half of the state, close to Lake Erie as well as the Canadian border.

Buffalo’s economy transitioned away from steel production throughout the latter half of the twentieth century. The city now has a more diversified economy focused on healthcare, retail, logistics, education, and tourism (due to its location near Niagara Falls) as well as manufacturing. Education institutions located in the city, such as the University at Buffalo, Buffalo State University, and D’Youville University, contribute to the city’s dynamic environment.

Famous for its lake-effect snow and Buffalo chicken wings, the city also boasts the oldest urban parks system in the U.S. It’s a culturally vibrant city as well due to its museums, performing arts institutions, and festivals.

Buffalo ranked in position #15 on our 2025 list of up-and-coming real estate markets due to its strong rent growth, vacancy rates, and property price appreciation over the past year. Its affordability relative to the rest of the U.S., as well as its economic stability, hold appeal with residents and investors alike. As with the other cities on our list, it’s important to be aware that Buffalo recently enacted Good Cause Eviction Protections.

Buffalo, New York Rental Market Statistics

- Rental Inventory (Q3-’24): 46,936

- Units Added Since Q3-’23: +287

- Asking Rent Growth Since Q3-’23: 4.2%

- Asking Rent (Q3-’24): $1,311

- Effective Rent (Q3-’24): $1,302

- Multifamily Vacancy Rate (Q3-’24): 5.4%

- Multifamily Cap Rate (Q3-’24): 7.4%

Source: National Association of Realtors

Buffalo, New York Housing Market Statistics

- Median Home Price (Q3-’24): $283,500

- Home Price Appreciation Since Q3-’23: 8.8%

Source: National Association of Realtors

Buffalo, New York Economic Statistics

- Population Growth (2022): -0.5%

- GDP Growth (2022): 7.8%

- Job Growth (Q3-’24): 0.5%

Source: National Association of Realtors

Lists That Mention Buffalo, New York

- Overall Real Estate Prospects (PwC/ULI): #78

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #107

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #60

- Best Real Estate Markets – Mid-Sized Cities (WalletHub): #55

- Best Places to Live (U.S. News): #34

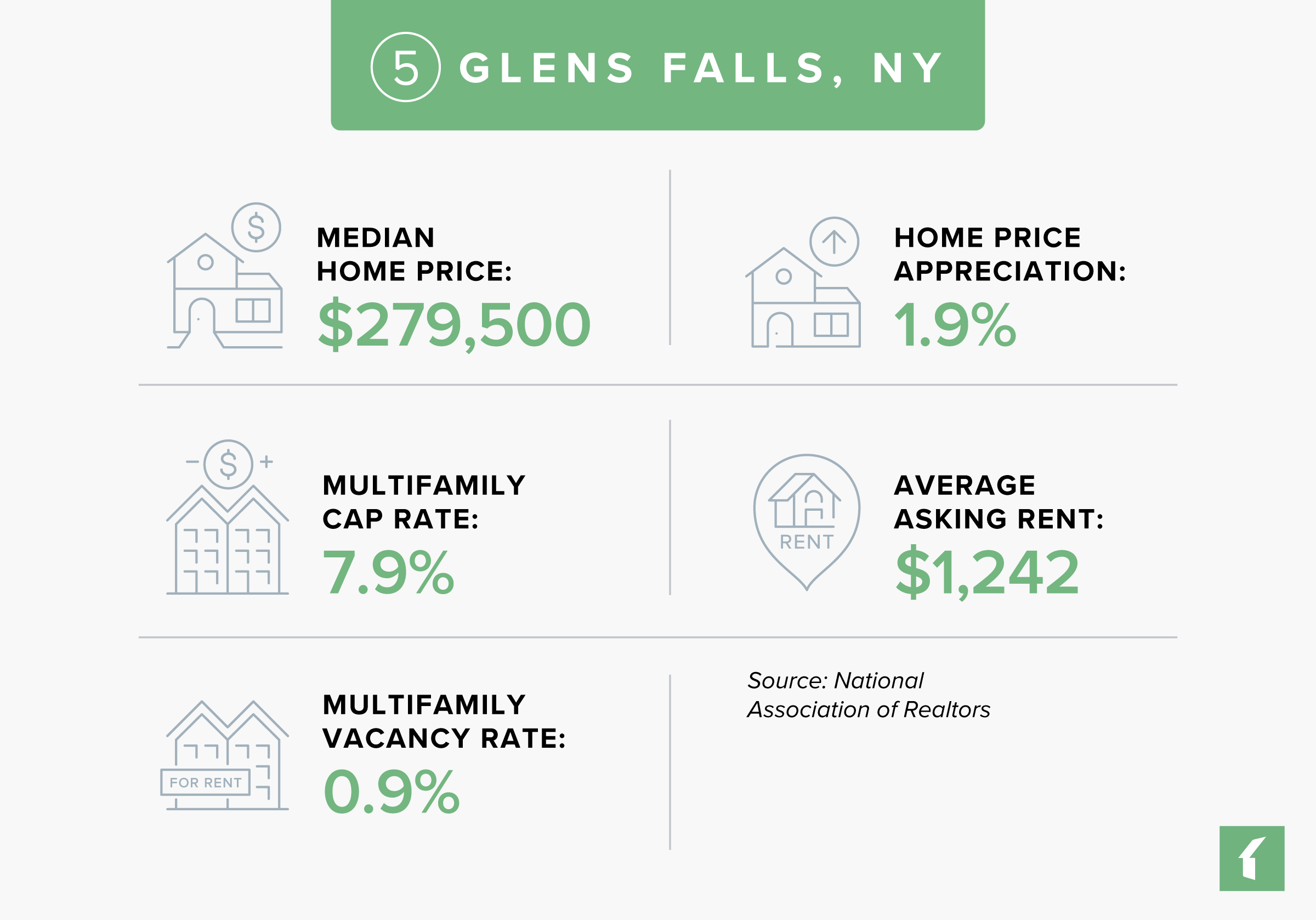

Market #5: Glens Falls, NY

By far the smallest New York real estate market on our list, Glens Falls has 125,427 residents living in its metro area. The city is located in eastern New York, less than an hour from the Vermont border. Its economy specializes in healthcare and medical device production, with Glens Falls Hospital, Hudson Health Network, Beckton Dickinson, and Medline/NAMIC representing some of the largest employers in the city. Other top employers outside of the medical sector include Finch Paper, Sagamore Resort, and Arrow Financial.

Known as the Gateway to the Adirondacks, and also located in proximity to Lake George, the city is full of recreational opportunities for its residents. It also boasts a number of historical landmarks, museums, galleries, performance venues, and annual festivals.

Glens Falls ranked in position #56 on our 2025 list of up-and-coming real estate markets. Though small in size, it showed attractive cap rates, tight occupancy, and relatively strong rent growth over the past year. It’s also more affordable than the U.S. overall for residents and investors alike. It’s worth noting that Glens Falls is in the process of phasing out unhosted short-term rentals.

Glens Falls, New York Rental Market Statistics

- Rental Inventory (Q3-’24): 3,557

- Units Added Since Q3-’23: +0

- Asking Rent Growth Since Q3-’23: 2.7%

- Asking Rent (Q3-’24): $1,242

- Effective Rent (Q3-’24): $1,238

- Multifamily Vacancy Rate (Q3-’24): 0.9%

- Multifamily Cap Rate (Q3-’24): 7.9%

Source: National Association of Realtors

Glens Falls, New York Housing Market Statistics

- Median Home Price (Q3-’24): $279,500

- Home Price Appreciation Since Q3-’23: 1.9%

Source: National Association of Realtors

Glens Falls, New York Economic Statistics

- Population Growth (2022): -0.8%

- GDP Growth (2022): 6.4%

- Job Growth (Q3-’24): -1.5%

Source: National Association of Realtors

Lists That Mention Glens Falls, New York

- None—this is an under-the-radar pick

How Do We Identify the Best Rental Markets in New York?

We use the following sources to help us ascertain the best rental markets in the U.S. across five different categories.

Industry Indicators

Measures of opportunity for rental property investors and property managers:

- Markets with the best overall real estate investment prospects, as measured by PwC and the Urban Land Institute

- Housing markets with emerging investment opportunities, as measured by the Wall Street Journal and Realtor.com

- Markets with a greater number of renters relative to homeowners, as measured by the National Association of Realtors

- Markets with a high rate of renter household formation, as measured by the National Association of Realtors

Housing Indicators

Measures of property prices and rent growth:

- Markets with the highest growth in asking rents, as measured by the National Association of Realtors

- Markets with the lowest rental property vacancy rate, as measured by the National Association of Realtors

- Markets with the highest rental property cap rates, as measured by the National Association of Realtors

- Markets with the most home price appreciation, as measured by the National Association of Realtors

- Markets with affordable monthly mortgage payments relative to income, as measured by the National Association of Realtors

Economic and Job Market Indicators

Measures of employment growth:

- Markets with the lowest unemployment rates, as measured by the National Association of Realtors

- Markets with the most employment growth, as measured by the National Association of Realtors

- Markets with the most GDP growth, as measured by the National Association of Realtors

- States with the most economic activity, as measured by the National Association of Realtors

Demographic Indicators

Measures of population growth:

- Markets with the greatest population growth, as measured by the National Association of Realtors

- The fastest-growing real estate markets, as measured by U.S. News

- The best places to live, based on analyses of quality of life and desirability, as measured by U.S. News

Climate Indicators

Measures of climate vulnerability:

- Markets with the lowest risk of natural disasters and extreme conditions, as measured by the Federal Emergency Management Agency

60 Up-and-Coming Real Estate Markets in 2025

In Buildium’s annual Up-and-Coming Real Estate Markets list, we analyzed 175 metro areas across the U.S. to determine which cities show promise for rental investors and property managers in the year ahead. We found that the Northeastern U.S. is one of three regions where growth and opportunity are concentrated heading into 2025, including these five New York rental markets.

Where else can rental investors and property managers find more growth opportunities in 2025? View the full list of emerging markets we’ve identified across the country.

Read more on Industry Research