Texas Rental Market Trends in 2025

With its robust economic growth, diverse population, and thriving job market, the state of Texas has attracted countless new residents and businesses in recent years. In fact, Texas has gained the most new residents of any state since 2000, with 9 million additional people calling Texas home in 2022, according to the Census Bureau. That’s out of a total of 30.5 million residents spread across more than 1,200 municipalities, making Texas the second-most-populous state in the U.S. What’s driving this growth is Texas’ business-friendly reputation and strong job creation across sectors like technology, healthcare, and energy.

This influx of new residents fuels demand for rental properties; and as a result, tens of thousands of rental units have been built in cities like Austin, Dallas, and Houston over the last several years. But due to this flood of new construction, rent growth and occupancy rates have recently floundered in these big-name cities.

That’s why this post will dig into 5 up-and-coming real estate markets where the data suggests there’s an opportunity for rental investors and property managers who are looking to expand into or within Texas in 2025. To help you assess the opportunity, we’ll share rental market statistics for each city, including inventory growth, rent growth, vacancy rates, cap rates, and property price appreciation; plus, figures that point to economic and demographic trends in each market.

Top 5 Rental Markets in Texas for 2025

Without further ado, here are 5 Texas rental markets where growth opportunities lie in 2025.

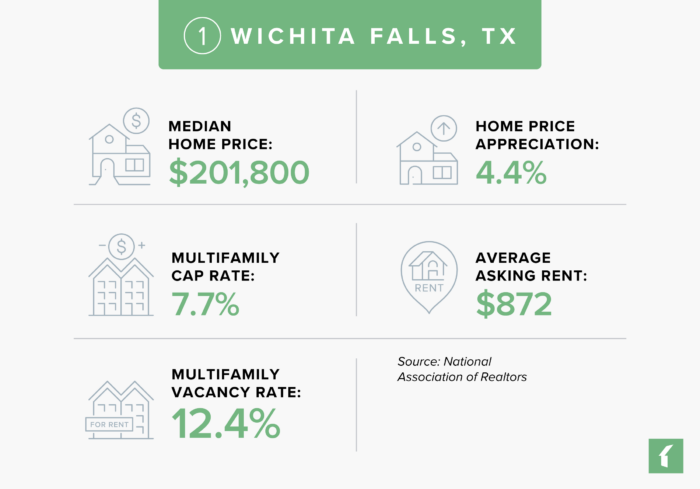

Market #1: Wichita Falls, Texas

Wichita Falls is a city located near the Texas-Oklahoma border, 115 miles northwest of Fort Worth. Its metro area is home to 149,947 residents. Top employers in the city include Sheppard Air Force Base, Wichita Falls Independent School District, and United Regional Health Care System. Midwestern State University is also located here.

Why did Wichita Falls make our list? In a time when larger cities in Texas are overburdened by supply, resulting in stagnating (and even negative) rent growth, Wichita Falls has seen a slower pace of construction and positive rent growth, while remaining affordable to renters and investors alike. Multifamily cap rates were healthy as of mid-2024, and the local economy was growing ahead of the U.S. overall.

Wichita Falls, Texas Rental Market Statistics

- Rental Inventory (Q2-’24): 6,565

- Units Added Since Q2-’23: +216

- Asking Rent Growth Since Q2-’23: 2.3%

- Asking Rent (Q2-’24): $881

- Effective Rent (Q2-’24): $872

- Multifamily Vacancy Rate (Q2-’24): 12.4%

- Multifamily Cap Rate (Q2-’24): 7.7%

Source: National Association of Realtors

Wichita Falls, Texas Housing Market Statistics

- Median Home Price (Q2-’24): $201,800

- Home Price Appreciation Since Q2-’23: 4.4%

Source: National Association of Realtors

Wichita Falls, Texas Economic Statistics

- Population Growth (2022): 0.2%

- GDP Growth (2022): 10.3%

- Job Growth (Q2-’24): 0.2%

Source: National Association of Realtors

Lists That Mention Wichita Falls, Texas

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #126

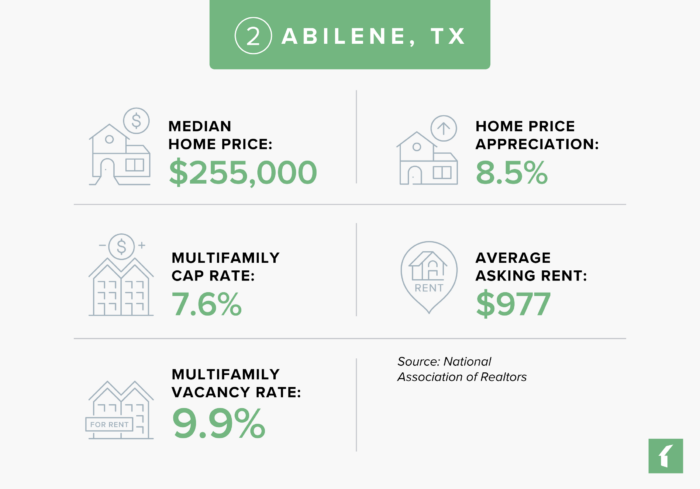

Market #2: Abilene, Texas

The Abilene, Texas metro area is home to 180,224 residents and is located close to the center of the state, about 150 miles from both Fort Worth and Midland. Major employers in Abilene include Dyess Air Force Base, Hendrick Health System, and Abilene Independent School District. There are also three universities located here: Abilene Christian University, McMurry University, and Hardin-Simmons University.

Abilene made our list for the first time in 2024 due to its strong rent growth compared to larger Texas markets. It also has appealing multifamily cap rates, home price appreciation, and GDP growth in comparison with the rest of the country. Though its resident base isn’t growing anywhere near as quickly as cities like Dallas and Austin, its population growth rate does put it ahead of the U.S. overall.

Abilene, Texas Rental Market Statistics

- Rental Inventory (Q2-’24): 8,467

- Units Added Since Q2-’23: +344

- Asking Rent Growth Since Q2-’23: 2.9%

- Asking Rent (Q2-’24): $977

- Effective Rent (Q2-’24): $966

- Multifamily Vacancy Rate (Q2-’24): 9.9%

- Multifamily Cap Rate (Q2-’24): 7.6%

Source: National Association of Realtors

Abilene, Texas Housing Market Statistics

- Median Home Price (Q2-’24): $255,000

- Home Price Appreciation Since Q2-’23: 8.5%

Source: National Association of Realtors

Abilene, Texas Economic Statistics

- Population Growth (2022): 1.3%

- GDP Growth (2022): 11.6%

- Job Growth (Q2-’24): 1.3%

Source: National Association of Realtors

Lists That Mention Abilene, Texas

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #223

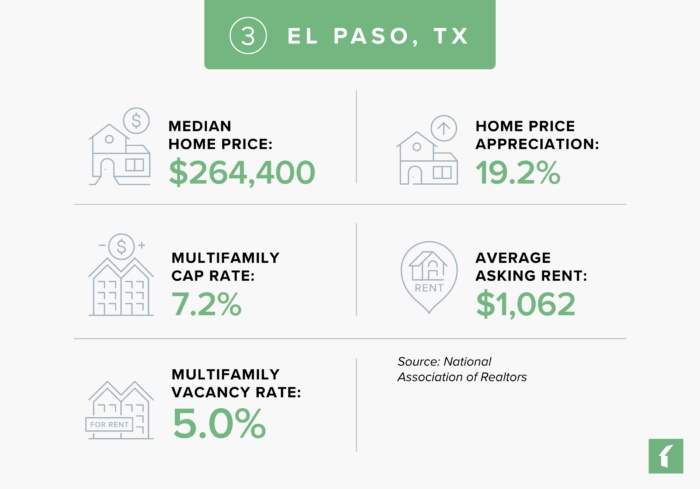

Market #3: El Paso, Texas

872,063 people reside in the El Paso, Texas metro area, which is located along the United States-Mexico border. More than 70 Fortune 500 companies are located in El Paso, including Boeing and Hoover; though the metro’s leading employer is Fort Bliss, bringing a large military presence to the city. The University of Texas also has a satellite location in El Paso.

Though El Paso is the sixth-most-populous city in Texas, it’s had comparatively few rental units added over the last several years, keeping its rent growth at a healthy level while remaining relatively affordable for residents. The local economy is growing ahead of the U.S. overall, and the housing market has seen rapid property price appreciation in recent years, bringing it onto our up-and-coming markets list for the first time in 2024.

El Paso, Texas Rental Market Statistics

- Rental Inventory (Q2-’24): 47,056

- Units Added Since Q2-’23: +605

- Asking Rent Growth Since Q2-’23: 2.8%

- Asking Rent (Q2-’24): $1,062

- Effective Rent (Q2-’24): $1,056

- Multifamily Vacancy Rate (Q2-’24): 5.0%

- Multifamily Cap Rate (Q2-’24): 7.2%

Source: National Association of Realtors

El Paso, Texas Housing Market Statistics

- Median Home Price (Q2-’24): $264,400

- Home Price Appreciation Since Q2-’23: 19.2%

Source: National Association of Realtors

El Paso, Texas Economic Statistics

- Population Growth (2022): 0.0%

- GDP Growth (2022): 11.9%

- Job Growth (Q2-’24): 1.5%

Source: National Association of Realtors

Lists That Mention El Paso, Texas

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #298

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #176

- Best Real Estate Markets – Small Cities (WalletHub): #34

- Best Places to Live (U.S. News): #62

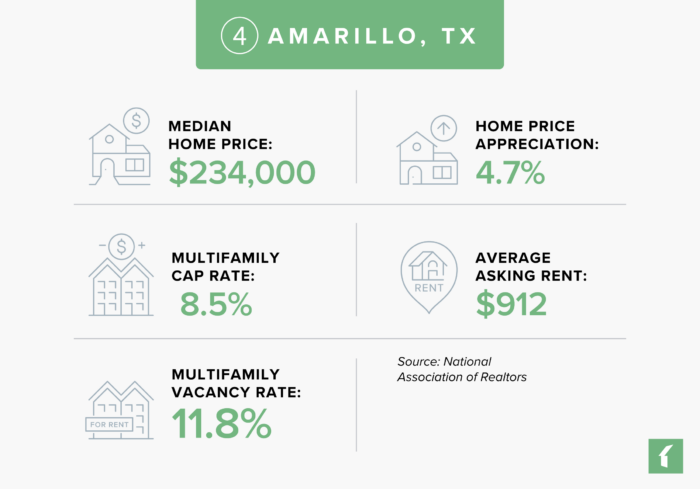

Market #4: Amarillo, Texas

Located in the Texas panhandle, the Amarillo, Texas metro area is home to 273,100 people, making it the sixteenth-largest city in the state. The area is known for meat-packing and agriculture, with Tyson Foods being the area’s largest employer, followed by the Amarillo Independent School District. Amarillo College is located here, as well as several university branch locations.

Amarillo didn’t quite make our short list this year due to its higher vacancy rate and middle-of-the-road economic and population growth. However, with its small amount of new inventory being added over the last few years in comparison with larger Texas cities, it’s seen positive rent growth and a healthy cap rate, making it worth a look in 2025. It also ranked relatively high on the Wall Street Journal/Realtor.com’s most recent list of the best housing markets in the U.S.

Amarillo, Texas Rental Market Statistics

- Rental Inventory (Q2-’24): 15,688

- Units Added Since Q2-’23: +38

- Asking Rent Growth Since Q2-’23: 2.1%

- Asking Rent (Q2-’24): $912

- Effective Rent (Q2-’24): $906

- Multifamily Vacancy Rate (Q2-’24): 11.8%

- Multifamily Cap Rate (Q2-’24): 8.5%

Source: National Association of Realtors

Amarillo, Texas Housing Market Statistics

- Median Home Price (Q2-’24): $234,000

- Home Price Appreciation Since Q2-’23: 4.7%

Source: National Association of Realtors

Amarillo, Texas Economic Statistics

- Population Growth (2022): 0.5%

- GDP Growth (2022): 8.3%

- Job Growth (Q2-’24): 1.6%

Source: National Association of Realtors

Lists That Mention Amarillo, Texas

- Best Real Estate Markets – Mid-Sized Cities (WalletHub): #78

- Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #162

- Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #154

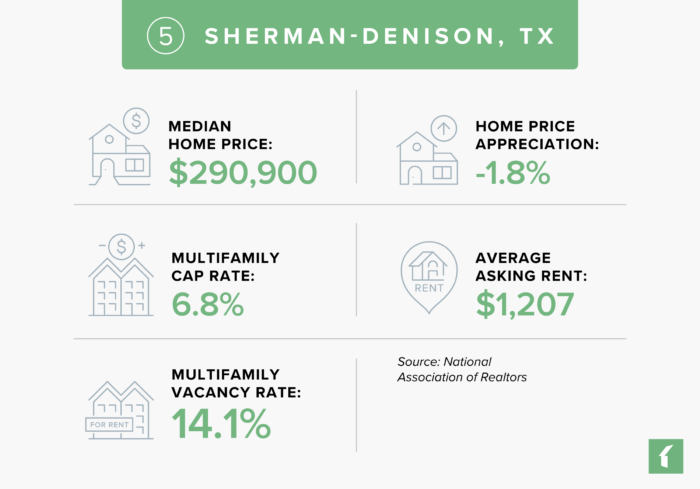

Market #5: Sherman-Denison, Texas

146,907 people live within the Sherman-Denison metro area, which is located along the Oklahoma border, just outside of the reaches of the Dallas-Forth Worth metro area. The area’s largest employers include Tyson Foods, Texoma Health Systems, Texas Instruments, Cigna, and Wilson N. Jones Health Systems. Sherman-Denison is also home to two small colleges: Grayson College and Austin College.

Sherman-Denison didn’t make our short list this year due to its slower rent growth and higher vacancy rate in comparison with other Texas rental markets, as well as its slightly negative property price appreciation in 2024. However, it is seeing faster growth in its population, jobs, and rents than the U.S. at large.

Sherman-Denison, Texas Rental Market Statistics

- Rental Inventory (Q2-’24): 6,610

- Units Added Since Q2-’23: +426

- Asking Rent Growth Since Q2-’23: 0.4%

- Asking Rent (Q2-’24): $1,207

- Effective Rent (Q2-’24): $1,192

- Multifamily Vacancy Rate (Q2-’24): 14.1%

- Multifamily Cap Rate (Q2-’24): 6.8%

Source: National Association of Realtors

Sherman-Denison, Texas Housing Market Statistics

- Median Home Price (Q2-’24): $290,900

- Home Price Appreciation Since Q2-’23: -1.8%

Source: National Association of Realtors

Sherman-Denison, Texas Economic Statistics

- Population Growth (2022): 2.7%

- GDP Growth (2022): 9.1%

- Job Growth (Q2-’24): 3.0%

Source: National Association of Realtors

Lists That Mention Sherman-Denison, Texas

- None – this is an under-the-radar pick

How Do We Identify the Best Rental Markets in Texas?

We use the following sources to help us ascertain the best rental markets in the U.S. across five different categories.

Industry Indicators

Measures of opportunity for rental property investors and property managers:

- Markets with the best overall real estate investment prospects, as measured by PwC and the Urban Land Institute

- Housing markets with emerging investment opportunities, as measured by the Wall Street Journal and Realtor.com

- Markets with a greater number of renters relative to homeowners, as measured by the National Association of Realtors

- Markets with a high rate of renter household formation, as measured by the National Association of Realtors

Housing Indicators

Measures of property prices and rent growth:

- Markets with the highest growth in asking rents, as measured by the National Association of Realtors

- Markets with the lowest rental property vacancy rate, as measured by the National Association of Realtors

- Markets with the highest rental property cap rates, as measured by the National Association of Realtors

- Markets with the most home price appreciation, as measured by the National Association of Realtors

- Markets with affordable monthly mortgage payments relative to income, as measured by the National Association of Realtors

Economic and Job Market Indicators

Measures of employment growth:

- Markets with the lowest unemployment rates, as measured by the National Association of Realtors

- Markets with the most employment growth, as measured by the National Association of Realtors

- Markets with the most GDP growth, as measured by the National Association of Realtors

- States with the most economic activity, as measured by the National Association of Realtors

Demographic Indicators

Measures of population growth:

- Markets with the greatest population growth, as measured by the National Association of Realtors

- The fastest-growing real estate markets, as measured by U.S. News

- The best places to live, based on analyses of quality of life and desirability, as measured by U.S. News

Climate Indicators

Measures of climate vulnerability:

- Markets with the lowest risk of natural disasters and extreme conditions, as measured by the Federal Emergency Management Agency

60 Up-and-Coming Real Estate Markets in 2025

In Buildium’s annual Up-and-Coming Real Estate Markets list, we analyzed 175 metro areas across the U.S. to determine which cities show promise for rental investors and property managers in the year ahead. We found that the South Central U.S. is one of three regions where growth and opportunity are concentrated heading into 2025, including 3 Texas rental markets.

Where else can rental investors and property managers find more growth opportunities in 2025? View the full list of emerging markets we’ve identified across the country.

Read more on Industry Research