As the COVID-19 crisis has raged around the world, rental owners and property managers have been under intense pressure to mitigate the immediate impacts of the pandemic within their properties. But now, many real estate professionals are looking toward the future, wondering which areas of their business and the rental market have the potential to prove profitable in the “new normal.”

Chart of Accounts

Want clearer, cleaner books? What about a more useful view into your properties or just easier accounting in general?

Get the GuideWhere should real estate businesses devote their resources for the remainder of 2020, even as they might be continuing to fight the spread of the virus in their communities? That’s the question we’ll tackle in this post, based on our recent survey on COVID-19’s impact on property management businesses so far. We’ll examine how property managers’ outlook for profitability and portfolio growth has shifted over the last few months. And what you see may surprise you: Though the numbers clearly show the impact that the pandemic and recession have had on their plans for growth, property managers have shown remarkable resilience and grit in facing these challenges head-on.

The Impact of COVID-19 & the Recession on Property Managers’ Revenue Growth

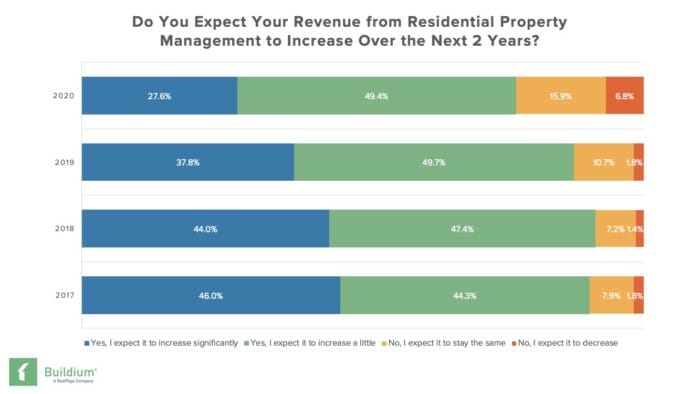

First, let’s take a look at how property managers’ expectations for revenue growth have shifted since the pandemic began. To do this, we’ll compare the results of two surveys: Our May 2020 survey of 1,200 property managers, which assessed the impact that the pandemic and financial crisis have had so far; and our May 2019 survey of 1,738 property managers, which established a baseline of how their businesses were faring before any of the current conditions were in place. Here’s what we found:

The number of property managers who anticipate revenue growth has fallen by 11 percentage points since 2019.

- 77% of property managers now expect their revenue to increase over the next 2 years, in comparison with 88% a year ago.

- In the 4 years that we’ve been tracking this number, the most that it had ever fallen previously was 3 points. Though this represents a significant decrease, it’s important to focus on the fact that 3 in 4 property managers still anticipate revenue growth in spite of the headwinds they’re facing.

Third-party property managers have higher expectations for revenue growth than owner/operators.

- 81% of third-party property managers expect their revenue to grow in the next 2 years, in comparison with 75% of owner/operators.

- A year ago, 89% of third-party property managers and 86% of owner/operators anticipated their revenue growing over the coming 2 years.

64% of property managers report that COVID-19 has had a negative impact on the profitability of their business—a number that isn’t surprising, but shows the scale of the pandemic’s impact on property managers’ finances.

What’s responsible for this downturn in revenue growth? In a word: rents. Property managers have had to put revenue growth on the back burner as COVID-19 brought financial struggles to many of their residents’ doors, and property managers have done their part to help them weather this unexpected crisis:

- 67% of property managers have worked with residents to establish plans to pay back their rent over time. With 2 in 3 property managers having residents who are not able to pay their rent in full, some may not be getting paid their full management fees.

- 36% of property managers have kept rents flat or offered concessions upon lease renewal, and 28% have done so for new leases, even as the cost of running a rental property increases year after year. In many cities—particularly expensive coastal markets—rent growth has plateaued and even declined as the pandemic initially suppressed leasing activity, and as the recession limits residents’ ability to afford rent increases.

- 79% of property managers have waived fees that are a major source of revenue, such as late fees or convenience fees.

Next, we’ll dig into property managers’ expectations for portfolio growth in light of the current crisis.

The Impact of COVID-19 & the Recession on Property Managers’ Portfolio Growth

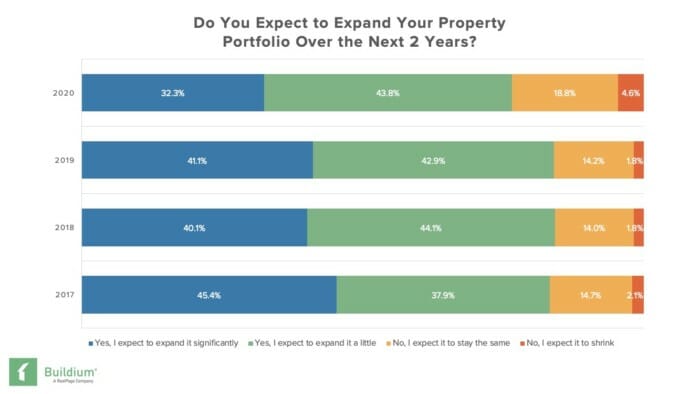

Rental owners and property managers have largely adopted a “wait and see” approach to acquiring new properties in this tumultuous time, but are now wondering where to place their bets as parts of the economy reopen. Here’s what our data has to say about property managers’ current plans for growth:

The number of property managers who expect to expand their portfolios has fallen by 8 percentage points in the last year.

- 76% of property managers now anticipate portfolio growth in the next 2 years, in comparison with 84% a year ago.

- In the 4 years that we’ve been tracking this, the number of property managers who expect to expand in the coming years has held steady year after year—it’s never fallen before now. However, 3 in 4 property managers still expect to expand in the next 2 years.

Third-party property managers have higher expectations for portfolio growth than owner/operators.

- 82% of third-party property managers anticipate expanding their portfolios in the next 2 years, in comparison with 73% of owner/operators.

- A year ago, 87% of third-party property managers and 80% of owner/operators anticipated expanding their portfolios over the coming 2 years.

35% of property managers say that COVID-19 has negatively impacted the rate at which they’re growing their portfolios, of which 38% say it’s had a strong negative impact.

- 35% of third-party property managers say that the pandemic has had a negative impact on their ability to find new clients.

Our analysis of property managers’ growth outlook continues in our report.

We dig into how optimistic property managers are feeling about each of the different rental property subtypes at this point in the crisis, and how rental owners’ perception of property managers’ value has changed in recent months. You can download your free copy of the report here.

Read more on Industry Research