Disclaimer: While this post is intended to provide general information about condo and HOA insurance, it’s always recommended to reach out to a legal professional for specific advice on regulations, coverage and policy options.

HOA insurance—and insurance for the companies that manage them—can ease the financial—and mental—burden of unforeseen events so you and your associations can focus on your residents. But with so many different kinds of insurance out there, where do you start?

In this guide, we’ll walk through common terminology, and give you a step-by-step guide to help you evaluate the right policies for your business and your association boards to ensure you’re getting the protection you need at the best rates possible.

Defining Common Community Management Insurance Terms

To better navigate this guide, here’s a quick refresher on the most important terms you need to know when choosing the right insurance for your business.

Claim: A formal request for compensation or coverage made by the insured to the insurer

Coverage: What the policy covers, including the types of risks and liabilities

Deductible: What you must pay out of pocket before the insurance kicks in; lower premiums typically come with higher deductibles

Exclusions: Particular risks or circumstances that the insurance policy does not cover

Indemnity: A promise to compensate another party for specific losses or damages

Insured: The person or entity (in this case, the property management company) covered by the insurance policy

Insurer (or underwriter): The insurance company providing the coverage and financial risk

Limit: The maximum amount an insurance policy will pay out on a claim. This may also be known as per-occurrence limit, aggregate limit, or sub-limit for specific coverages

Liability: Responsibility for injuries or damage caused to others, such as tenants, visitors, or staff

Peril: A specific event that damages or destroys property, such as theft or a natural disaster

Policy: Your insurance contract that outlines the details of your coverage

Premium: The monthly, quarterly, or yearly fee you pay for coverage with an insurance company

Umbrella insurance: A supplemental liability insurance policy that provides coverage beyond the limits of your primary insurance policies

6 Main Risks of Running a Community Management Business

The first step to finding the right policy is to understand the risks that come with the community management business. Here are the six most costly risks that insurance can cover:

Legal and regulatory compliance: Community managers must comply with laws on the federal, state, and local level.

Resident delinquency: Residents may engage in illegal behavior, make late payments, or disrupt your community.

Professional negligence: Hiring unlicensed contractors or omitting important clauses in your governing documents and HOA contracts may lead to a lawsuit.

Natural disasters: Your area may be prone to tornadoes, flooding, wildfires, or other natural disasters that may damage your property.

Accidents and injuries: Residents, guests, contractors, or staff may suffer from injury on your property.

Liability: You can be held legally responsible for injuries, legal disputes, accidents, or damage on properties you manage.

The best way to minimize these and other risks is to find HOA insurance that works for your clients, as well as insurance that protects your own business. There are a lot of different options you can go with, which we will break down step-by-step in further detail.

What Kind of Property Management Insurance Does Your Company Need?

No matter how many properties you manage, having the right insurance will safeguard you from the unexpected.

Property management insurance addresses the specific risks associated with the business operations of property managers. It covers the risks they face in their profession, not the properties they manage. Property-specific incidents would typically be covered by the property owner’s insurance or the association’s insurance, which we will cover later on.

For now, let’s take a look at the different kinds of property management insurance you might need.

General Liability Insurance

This type of insurance covers a wide range of general claims, including bodily injury, property damage, advertising injury, copyright infringement, reputational harm, and personal injury.

General liability insurance boosts your reputation as a community manager, as well. It assures boards and residents that coverage is in place to address potential accidents or injuries.

While not required by federal law, check local regulations to see if it’s required for business licensing or permitting in your area. Mortgage lenders and common interest communities may require it, as well.

For example, if someone trips on ice in front of your doorstep, general liability insurance would help cover legal expenses and potential settlements.

Workers Compensation Insurance

Worker’s compensation insurance covers the costs associated with workplace accidents and injuries including medical expenses, death expenses, vocational rehabilitation, missed wages, employee injuries, and permanent disability.

How it works:

- If an employee becomes injured or ill due to work-related activities, the employee reports the incident to the employer.

- The employer puts in a claim with their insurance provider.

- The employee seeks medical treatment, which is typically covered by worker’s compensation insurance.

- The insurance covers compensation from missed workdays.

- The employee receives additional compensation for long-term disability or permanent impairment.

Employees receive additional compensation for long-term disability or permanent impairment.

Most states require worker’s compensation insurance, but the minimum number of employees you need before it’s required varies. It’s best to consult a legal or insurance professional to determine whether or not you need worker’s comp.

Errors and Omissions Insurance (E&O)

Also known as professional liability insurance, E&O insurance covers professional mistakes that cause damages to your clients such as negligence, errors in the form of service, inaccurate advice, and omissions in legal documentation. This could include everything from hiring unlicensed contractors, a mistake that resulted in financial loss for an association or homeowner, or providing false information.

For example, if you’re managing multiple associations across different states, you will have multiple contract templates, each containing clauses pertinent to each state. If, by mistake, you use the wrong template or copy over a clause that is enforceable in one state but not another, that could lead to a lawsuit, which E&O may cover.

Business Income Insurance

Business income insurance works along with your regular insurance. It covers loss of income due to property loss caused by an event covered by your original policy (peril, flood, fire, hurricane, etc.).

So, if one of your condo properties is a complete loss after a fire, business income insurance will cover the income lost from the loss of that property.

Some business income insurance policies will include extra expenses. Businesses who suffer a loss of income can also claim extra expenses incurred from the loss, beyond normal operating costs.

Associations can carry business income insurance, as well, to cover income losses. For example, if a laundry room floods and the coin- operated machines are unusable, the association can make a claim with their business income insurance.

Cyber Liability Insurance

Contracts, applications, and payment information all contain highly confidential information that requires strict security. In the case of a cyber attack, cyber liability insurance covers the damages and losses from data breaches that may expose sensitive information.

What Kinds of HOA Insurance Does Your Company Need?

A community management company should carry policies to cover itself as well as its employees from loss and liability.

But when it comes to insurance having to do with the HOAs and COAs you manage, much of that insurance will be held by the board itself.

By making yourself well-versed in HOA and other related insurance policies, you can expand the services you offer and make your business more appealing to prospective clients. That’s because boards often look to their community managers to advise them on the types of insurance in which they should invest and help them negotiate costs and coverage.

Here is a rundown of the most common types of insurance you should be aware of.

HOA Insurance

HOA insurance protects against property damage and liability. It is held by the homeowner’s association and covers the common areas it maintains.

For example, if someone breaks into the package delivery facility, damaging lockers and stealing packages, the HOA insurance will cover the damage and possibly the lost packages.

If a guest of one of your residents trips over a broken sidewalk and sues the HOA for injuries they incurred, the insurance will cover that, as well.

Most HOAs must maintain some form of insurance coverage, and in states such as Arizona, insurance coverage is mandated. State- specific laws necessitate that HOAs maintain insurance covering 80% of the common property’s value and general liability insurance determined by the HOA board.

The coverage that HOA insurance provides for individual homeowners varies from minimal to more robust coverage for specific parts of a homeowner’s property.

There are three types of HOA coverage:

- Bare walls coverage: Typically, this type of coverage includes the outside walls and the roof into the studs.

- Walls-in coverage: Also known as single-entity coverage, this covers exterior structures as well as some interior features that were included in the original build. That includes drywall, paint, flooring, cabinets, fixtures and some appliances.

- All-in coverage: Basically, this is upgraded walls-in coverage. It includes renovations, as well as appliances and fixtures that the homeowner upgrades.

Condo Insurance

Owners of their own free-standing homes within an HOA will have their own homeowner’s insurance policy, much like homeowners who don’t live in HOAs.

Condo owner’s however, will have condo insurance, which will cover damage and liability to your condo. But the type of coverage an owner gets will depend on the type of HOA master insurance their association carries.

Once you understand the type of coverage your HOA’s master insurance covers, you can build your condo insurance to fill in the gaps.

D&O Insurance

Directors and Officers (D&O) insurance covers board members who are sued personally. It usually includes both monetary and non- monetary liability coverage. Typically, D&O insurance will cover lawsuits pertaining to the following:

- Breach of contract or governing documents

- Fraud, theft, or embezzlement

- Discrimination or selective enforcement of HOA rules

- Illegal eviction

- Violation of privacy, libel, or slander

- Injury

- Negligence

Fidelity Bond Coverage

This is also called crime insurance. It protects HOAs from fraud, theft, and other crimes committed by board members, owners, employees, and others.

What Kinds of Weather-Based HOA Insurance Does Your Association Need?

Your choice of insurance should align with the level and type of natural disaster risk in your area. General insurance typically doesn’t cover certain disasters, which is why finding supplemental insurance may be a good idea. Here are the most common insurance coverages based on geographical location.

Drought insurance covers damages caused by rainfall and water shortages, particularly in dry regions such as California, Nevada, Utah, and Arizona.

Earthquake insurance covers earthquake-prone locations susceptible to seismic activity, including areas on fault zones and within the seismic belt, also known as The Ring of Fire where 81 percent of the largest earthquakes occur. Those areas include Washington, Alaska, and California.

Flood insurance covers regions in flood zones, including coastal areas, floodplains, or homes near bodies of water. The Federal Emergency Management Association (FEMA) provides maps of flood zones, as well as flood insurance resources.

Hail insurance covers regions prone to hailstorms, particularly in the central United States.

Hurricane insurance covers wind, debris, and flood damage, which is important for regions along the coastline of the Atlantic Ocean.

Snow and ice insurance covers damages from heavy snowstorms and sleet storms.

Tornado insurance covers regions at high risk for tornadoes, which is usually required if your property is along Tornado Alley in the United States.

Tsunami insurance covers regions prone to tsunamis, including coastal properties.

Volcano insurance covers damage from volcanic eruptions, which are common in Hawaii, and do happen from time to time in Washington, Oregon, and Alaska.

Wildfire insurance covers regions at high risk of wildfires. California, Texas, Arizona, and Nevada are the regions most prone to wildfires.

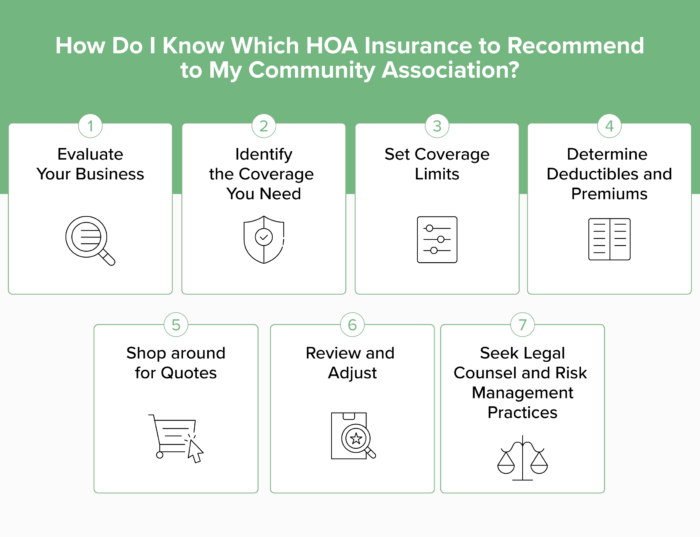

How Do I Know Which HOA Insurance to Recommend to My Community Association?

So how do you get started? We’ve devised a comprehensive seven-step process that will help you choose the right policy at the best price point you can afford.

Step 1: Evaluate Your Business

For your business:

- What kinds of assets do I need to protect?

- How many employees do I have?

- Which natural disasters are associated with my location? Is my office in a flood zone?

- How much liability coverage do I want?

- What kinds of insurance is required by my state?

For your community associations:

- What kinds of properties do I manage (condos, free- standing homes, etc.)?

- Which natural disasters are my associations at risk for? Are they in a flood zone?

- How are the crime rates in my area?

- What insurance policies are required in my state?

- What business operations do I hire for?

- What is my property value?

Step 2: Identify the Coverage You Need

From the data you’ve gathered in step one, determine which types of insurance are absolutely essential for your property business. As a refresher, this includes, general liability, worker’s compensation, employment practices liability, errors and omissions, and business income.

Step 3: Set Coverage Limits

There isn’t a one-size-fits all solution to setting how much coverage you should have. You want to strike a balance between covering as much as you can with allocating that budget on actually growing your business. But knowing your lender’s limits and the value of your property are key. As a property manager, knowing how much the cost of fixing your property in case of a natural disaster is a good start. Sometimes there are legal minimums, so seek legal counsel to ensure you’re compliant with local laws.

Step 4: Determine Deductibles and Premiums

Insurance is a numbers game, and determining deductibles and premiums is the main equation. This all depends on your risk tolerance and your budget. Higher deductibles means lower premiums, which means you’ll have to shell out more of the initial costs if a claim is made. Alternatively, lower premiums can save you money upfront, but may offer less coverage or higher deductibles, potentially resulting in higher overall costs in the future if there is a claim.

Step 5: Shop around for Quotes

Get a lay of the land by contacting multiple insurance providers, brokers, and agents who specialize in property management 5 Shop around for quotes STEP insurance. With all the information you’ve gathered, they should be able to provide accurate quotes based on your assets and needs. And depending on your needs, find quotes for additional coverage, such as cyber liability insurance.

Another important factor to consider is customer service. Even if an insurance company may be cheaper for the same coverage, it may be worth considering the speed and access of service so you’re not jumping through unnecessary hoops and claims are managed promptly.

Step 6: Review and Adjust

After you’ve made your decision, it’s important that you revisit your insurance every year. Your business may change in size and your needs may evolve over time.

Step 7: Seek Legal Counsel and Risk Management Practices

Work with an insurance professional or attorney who specializes in property management to review your insurance policies to ensure you’re compliant and get all your bases covered.

How Property Management Technology Can Help with HOA Insurance

The good news is, property management tech can make insurance easier to manage. Buildium’s insurance solution takes policy management off your plate, so you can focus on building your business. Since Buildium works with MSI, every resident is pre-approved and can sign up for their insurance plan through the Resident Center. To get started, sign up for a free, 14-day trial—no credit card required.