The Tax Cuts and Jobs Act (TCJA) is now the law of the land. This mammoth tax reform law creates momentous tax changes for all Americans.

We’ve all been wondering how the new tax plan affects property managers. In general, you’ll be relieved to hear, we predict that many property managers will do well under the new law. Indeed, it’s likely that your income taxes will go down for 2018.

The major changes affecting owners of property management businesses are summarized below. Keep in mind that all of these changes took effect on January 1, 2018. Thus, they do not apply to your 2017 taxes, except where otherwise noted.

Note: Are you a property owner? We have a separate version of this post just for you: Here’s How the New Tax Law Impacts Rental Property Owners

How the New Tax Plan Affects Property Managers

Lower Individual Tax Rates

Most property managers operate pass-through businesses (more information on these in the next section). Thus, they pay taxes on their business income at their individual income tax rates.

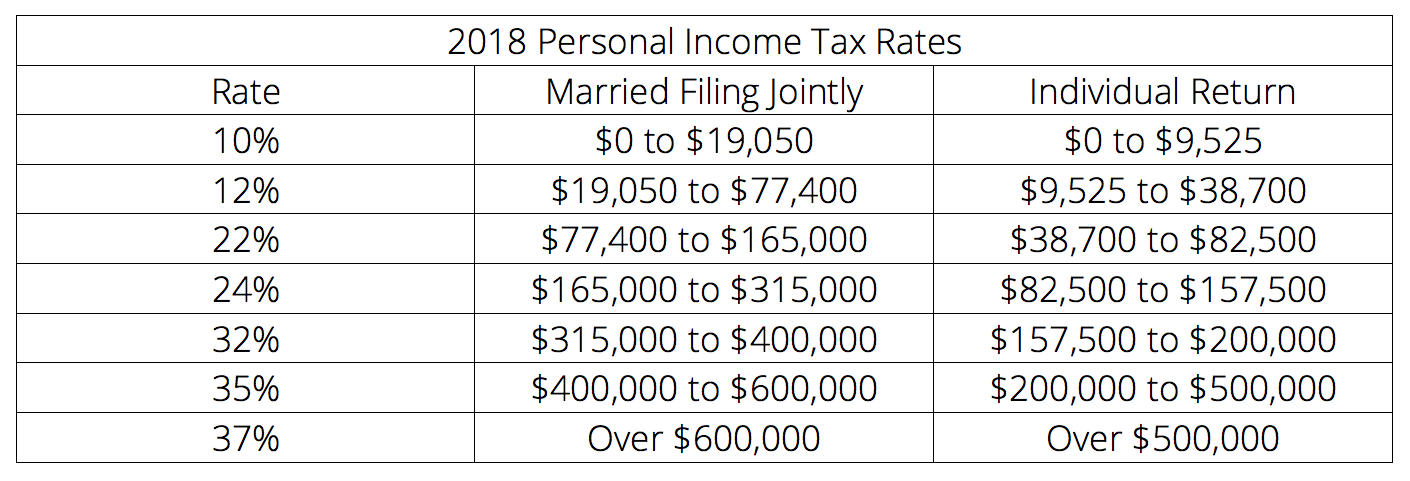

The TCJA enacted a new set of income tax rates that are generally lower than 2017 rates. The top income tax rate is now 37%, down from 39.6% under prior law. The new rates alone should save you money on your income taxes in 2018.

New Pass-Through Tax Deduction

Perhaps the sexiest new provision in the TCJA is a brand new tax deduction for business owners who operate pass-through entities, which includes the vast majority of property managers. You can qualify for this deduction if you own and operate your business as a sole proprietorship (a one-owner business in which the owner personally owns all of the business assets), a limited liability company, an S corporation, or a partner in a partnership.

If you qualify for the deduction, you can deduct an amount equal to up to 20% of your net income from your business. This is in addition to your other business deductions. The pass-through deduction is a personal deduction that pass-through owners can take on their returns whether or not they itemize their deductions. For example, if you earn $50,000 in profit from your property management business and qualify for the pass-through deduction, you may deduct $10,000.

However, you’re entitled to the full 20% pass-through deduction only if your taxable income from all sources after deductions is less than $315,000 if you’re married filing jointly, or $157,500 if you’re single. If your business income exceeds these limits, your deduction may be limited to the greater of:

- 50% of your share of W-2 employee wages paid by your business, or

- 25% of W-2 wages plus 2.5% of the acquisition cost of depreciable property used in your business

Thus, if you have no employees or depreciable business property, you get no deduction.

The details of this complex deduction have yet to be worked out by the IRS. If property management is viewed as a personal service business by the IRS, the pass-through deduction will be phased out when your income exceeds $315,000/$157,500. It will disappear entirely for married couples filing jointly whose income exceeds $415,000, and for single filers whose income exceeds $207,500. It’s unclear, however, if this phase-out will apply to property managers.

New Corporate Tax Rate

The cornerstone of the TCJA is a new lower rate for regular C corporations. “C” corporations are separate tax-paying entities with their own tax rates. Under the TCJA, all C corporations are subject to a single flat tax rate of 21%. This replaces the tax rates ranging from 15% to 35% that C corporations paid under prior law.

Few property managers operate as C corporations. However, if your business income is high—over $400,000 to $500,000—it could save you money to convert your business to a C corporation to take advantage of the lower tax rate. You should consult a tax professional about this.

100% Bonus Depreciation

The cost of long-term assets—those with a useful life of more than one year, such as computers and other business equipment—must ordinarily be deducted a little at a time over several years. This process is called depreciation. However, a special tax law called “bonus depreciation” allows a business owner to deduct a substantial amount of the cost of a long-term asset in a single year.

Before the TCJA, bonus depreciation allowed 50% of an asset’s cost to be deducted within the first year. The TCJA increases the bonus depreciation amount to 100%. The increase goes into effect for long-term assets placed in service after September 27, 2017.

The 100% bonus amount is scheduled to remain in effect through 2022. Note that bonus depreciation may only be used for tangible personal property, not real property.

There are also two changes to the kind of items that can be depreciated. For the first time, bonus depreciation may be used for the purchase of both new and used property. In addition, bonus depreciation could formerly only be used for computers if they were used for business over 50% of the time. The TCJA eliminates this requirement.

Read it on the #BuildiumBlog: 9 ways that the new tax plan impacts property managers. Share on X

$1 Million Section 179 Expensing

Under prior law, a provision of the tax law called Section 179 allowed business owners to deduct the cost of personal property that they purchased and used for their business over 50% of the time. They could deduct up to $510,000 per year, which the TCJA has now increased to a maximum of $1 million. The $1 million amount is reduced by the amount by which the cost of property placed in service during the year exceeds $2.5 million (but not below zero).

Increased Automobile Depreciation Deduction

During the first year in which you place a passenger automobile in service within your business, you choose whether to use the standard mileage rate to deduct your business driving costs (54.5 cents per mile in 2018) or to deduct your actual expenses, including gas and repairs. If you elect to deduct your actual expenses, you may take an annual deduction for depreciation, subject to annual limits.

The TCJA has increased the amount that you can depreciate each year. Starting in 2018, you may deduct $10,000 for the first year in which the vehicle is in service; $16,000 for the second year; $9,600 for the third year; and $5,760 for the fourth year and beyond. This is by far the most annual depreciation that has ever been allowed for automobiles.

If you use the vehicle over 50% of the time for business, you may also take bonus depreciation of up to $8,000. In order to take the full $8,000 deduction, you must use the vehicle for business 100% of the time.

Limits on Deducting Net Operating Losses

Your property management business has a net operating loss (NOL) if its expenses exceed its income for the year. Under prior law, you could deduct an NOL on up to two years of back taxes, resulting in a refund of all or part of the taxes paid in those years.

The TCJA eliminates such carry-backs of NOLs—that is, they may only be deducted in current and future years. Additionally, you are only allowed to deduct NOLs for up to 80% of taxable income. Unused NOL amounts may be carried forward and deducted in any number of future years.

No Meal or Entertainment Deduction

For decades, businesspeople have been allowed to deduct 50% of the cost of business-related meal and entertainment expenses. For example, you could deduct the cost of a meal in a restaurant with a client if you had a business discussion before, during, or after the meal. You could also deduct 50% of the cost of providing a client with a ticket to a sporting event, theater ticket, or other entertainment expenses.

The TCJA completely eliminates the deduction for meal and entertainment expenses. However, 50% of the cost of meals can still be deducted while traveling for business, as this qualifies as a travel expense rather than entertainment.

Obamacare Individual Tax Penalty Repealed

The Affordable Care Act (colloquially known as “Obamacare”) required individuals to obtain minimally adequate health insurance for themselves and their dependents. Those that failed to comply had to pay a tax penalty to the IRS. This is known as the individual mandate.

The TCJA permanently eliminates this penalty starting in 2019, effectively making individual compliance with the ACA purely voluntary. However, the penalty remains in effect for 2018. Thus, you must obtain minimally adequate health insurance for yourself and your dependents for 2018. Otherwise, you’ll be responsible for paying a tax penalty of $695 per uncovered adult and $347.50 per child under 18, up to a maximum of $2,085 per family.

How does the new tax plan impact property managers? Find out on the #BuildiumBlog! Share on X

Read more on Industry Research