During the early months of COVID-19, the rental sector faced a terrifying question: What would happen if large numbers of renters lost their jobs and couldn’t pay their rent? In response, industry organizations and software companies (including our parent company, RealPage) came together to publish weekly updates on the percentage of renters that had been able to make their monthly rent payments. The results have been unexpectedly heartening: Over the last 6 months, rent payments have only fallen below the previous year’s rates by an average of 1.7 percentage points. By the end of January 2021, 93.2% of renters had reportedly paid their rent.

Chart of Accounts

Want clearer, cleaner books? What about a more useful view into your properties or just easier accounting in general?

Get the GuideHowever, while the industry’s attention has been focused on rent payment rates in the properties for which there’s a lot of data—large, professionally managed apartment buildings—owners and residents of small rental properties have been quietly struggling. The property managers who help to run the small multifamily and single-family rental properties owned by individual investors have been doing their best to keep their clients and residents above water, often sacrificing their own profitability in the process.

We’ve reached out to rental owners, renters, and property managers at multiple points since COVID-19 began, focused on better understanding the crisis’ continued impact on a segment of the market that research often overlooks. This post will combine our primary research data from 2019 to 2021 with two research organizations’ analyses of Census data from 2015 to 2018 to paint a clear picture of the precarious financial position in which COVID-19 has left many small rental property owners and their residents. For more of our findings on how the pandemic and recession have impacted rental owners—and where property managers can make the biggest difference—be sure to check out Volume 1 of the 2021 Rental Owners’ Report.

How Many Small Rental Properties Are Owned by Individual Investors?

Small rental properties are far more likely to be owned by individual investors without the financial resources to weather difficult times when their rental income is under threat.

75% of single-family and 77% of small multifamily properties were owned by “mom and pop” landlords as of 2018, in comparison with just 18% of large apartment buildings. This means that small rental properties are far less likely to be owned by investment firms with the funds to cover lost rent.

To put this into perspective: If an individual investor’s rental portfolio consists of one single-family home (as was the case for nearly 1 in 3 of the rental owners we surveyed), when their tenant can’t pay rent, the owner has lost 100% of their rental income. In addition, 35% of owners of small rental properties are of retirement age, increasing the likelihood that their property represents their primary source of income.

These rental owners were also unlikely to benefit from the provisions of the CARES Act in 2020. They’re less likely to hold federally backed mortgages, exempting these owners and their residents from Fannie Mae and Freddie Mac’s assistance programs. In addition, since they tend to either manage their rentals themselves or with the help of a single property manager, they weren’t eligible for small business support or payroll protection programs.

How Many Small Rental Property Owners Own Their Properties Outright?

Owners of small rental properties are less likely to own their properties outright, leaving a larger share of rentals in this category vulnerable to foreclosure in a financial crisis.

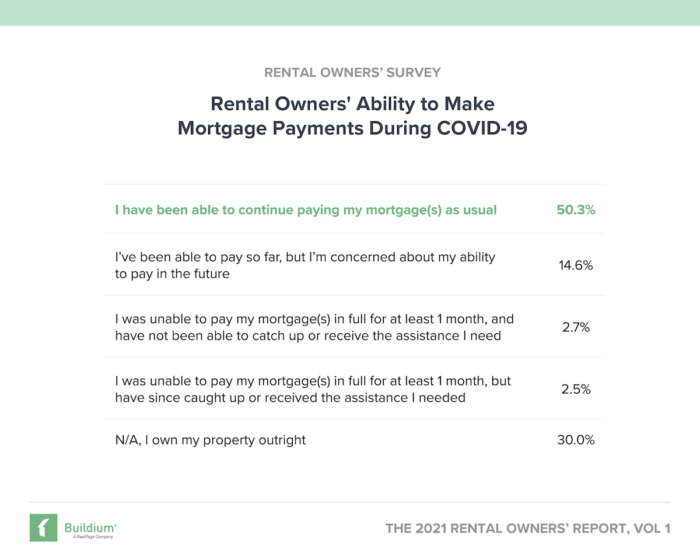

Just 30% of the rental owners we surveyed own their properties outright, meaning that 70% of rental owners are responsible for making mortgage payments each month—even when their residents are unable to pay rent. This is especially true among owners of small multifamily properties (such as duplexes and triplexes), who were less likely to own their properties outright than single-family investors by 21 percentage points.

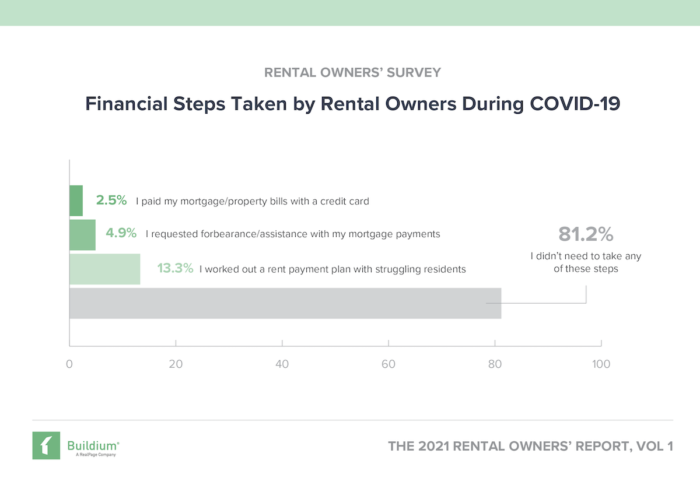

The good news is that in our survey, 93% of rental owners who make mortgage payments each month have been able to keep up with their payments so far. However, 23% of these owners voiced concern about their ability to continue paying on time in the future. 7% of the owners we surveyed have missed at least one payment, of which half are still behind; 5% have requested forbearance or assistance with their mortgage payments; and 3% have paid their mortgage or other property bills with a credit card, presumably because their monthly rental income fell short.

How Dependent Are Small Rental Property Owners on Rental Income to Pay the Bills?

Monthly rents cover a smaller share of small rental properties’ operating expenses, leaving many individual investors reliant on their own savings to pay the bills—even in good times.

Across nearly two-thirds of small rental properties, monthly rental income covers less than 80% of their operating expenses. As a result, when the flow of rent payments is interrupted, individual investors are forced to dip into their own savings or apply for loans to cover mortgage payments, property taxes, maintenance expenses, and other bills. In comparison, this shortfall in rental income occurs in just 18% of large apartment buildings, where investors tend to have larger portfolios and more diverse revenue streams.

How Have Residents of Small Rental Properties Been Impacted by COVID-19?

Residents of small rental properties are more likely to have had their income put at risk by COVID-19; less likely to be able to meet their financial obligations when they lose their job; and less likely to be protected by federal aid measures.

31% of residents living in single-family rentals and 29% in small multifamily properties have seen a decrease in income during COVID-19. In comparison, this was the case for just 18% of residents of large apartment buildings—likely because so many of the properties in this category that were built over the previous decade were priced for higher-income renters.

Residents of small multifamily properties are also more likely to be living paycheck-to-paycheck. When they lose their source of income, they’re less likely than residents of larger properties to be able to cobble together the funds to pay their rent in full by 8 percentage points.

All in all, more than half of renters whose income has been threatened by the pandemic live in small rental properties. However, because they’re less likely to have federally backed mortgages, only 12% of units located in small rental properties were covered by the protections of the CARES Act, in comparison with half of apartment building units.

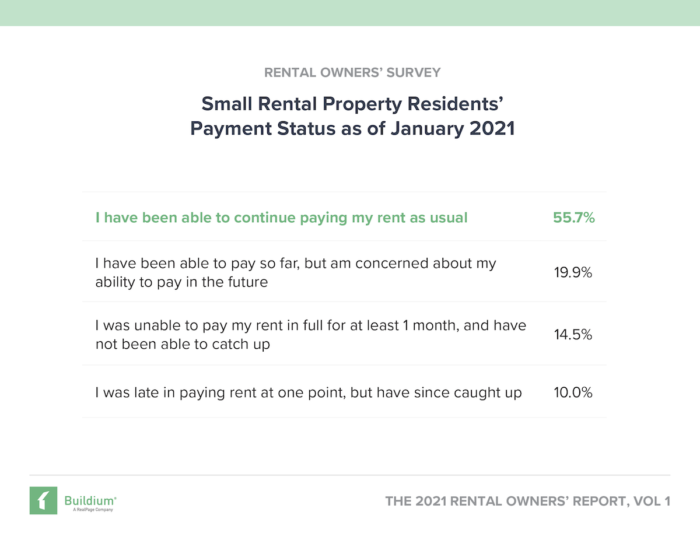

We surveyed nearly 1,700 renters in January, half of whom live in single-family or small multifamily properties. Among residents of these small rental properties, 76% have been able to keep up with their rent so far, though 26% who are current on their payments are worried about their ability to continue paying in the future. 25% had fallen behind on their rent for at least a month since COVID-19 began, of which 59% still haven’t been able to catch up. In addition, over the span of the last year:

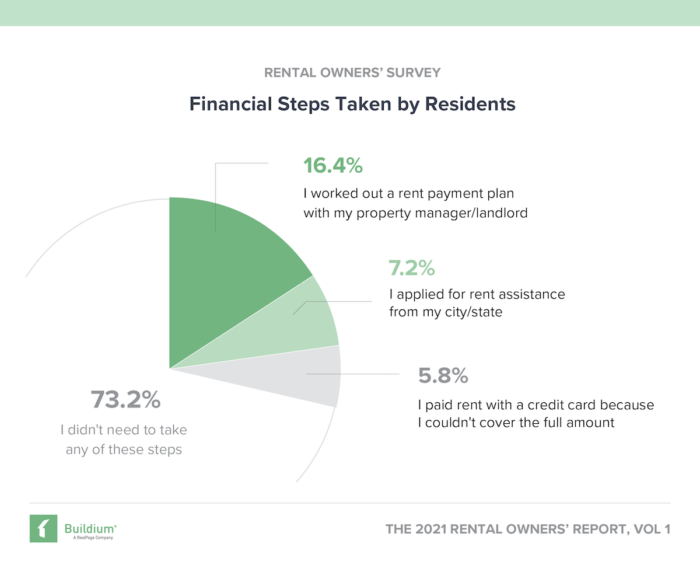

- 16% of respondents had worked out a payment plan with their property manager

- 7% had applied for rental assistance from their city or state

- 6% had paid rent with a credit card because they couldn’t cover the full amount

How Does the Solvency of Small Rental Properties Impact the Broader Rental Market?

The plight of small rental property owners and residents could have a ripple effect on the entire rental market.

Naturally occurring affordable rental units—those that are not subsidized by government programs, but whose owners price them at rates affordable to low- and middle-income workers—are rapidly disappearing. More than 4 million units renting for less than $1,000 a month were lost between 2014 and 2018 as some were sold to investors or homeowners, while others were torn down or converted to other uses.

At the same time, units renting for more than $1,000 a month increased by 4.6 million as tight supply and rising building costs pushed up prices. By the end of 2018, these higher-cost units represented close to half of the national stock of rental housing; and this trend has continued in the years since.

A majority of these naturally occurring affordable rental units are owned by individual investors. If these rental owners sell their properties or lose them to foreclosure, they’re likely to be purchased either by investment companies who will raise rents to market rates; or by homebuyers, removing the unit from the rental market altogether.

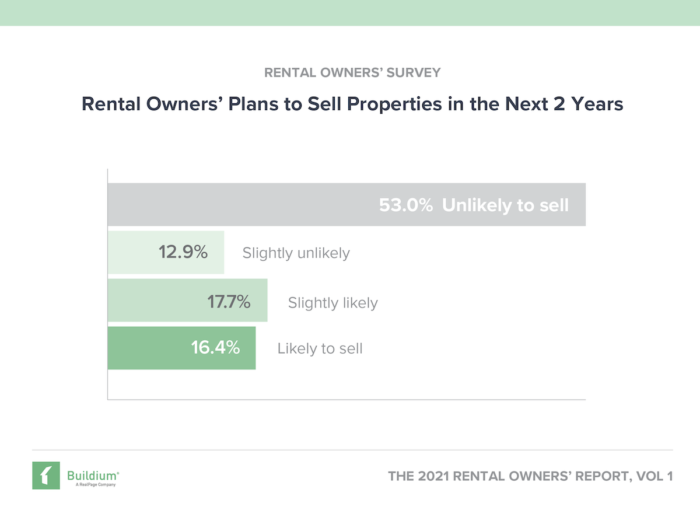

1 in 3 of our rental owner respondents are considering selling some or all of their rental properties in the next 2 years, though some will purchase new properties in their place. As a result, the lack of assistance for owners and residents of small rental properties could take affordable rentals off the market just when low- and middle-income workers need them most.

The 2021 Rental Owners’ Report

Our annual 2021 Rental Owners’ Report reveals more of the insights we’ve gained from our recent surveys of small-business rental owners and investors. The report explores the opportunities that property managers have to better serve their current customers and win the business of the rental owners growing tired of navigating the complex landscape of regulations, profitability, and pandemic guidance on their own. Be sure to download your free copy of the 2021 Rental Owners’ Report – Vol. 1 now!

Read more on Industry Research