There’s a reason why single-family rentals have been the subject of an unprecedented surge in demand over the last few years: They give couples and families access to the indoor and outdoor space that’s rare in other property types. They’re located in suburban and rural neighborhoods that may have been inaccessible to renters in the past. And they allow renters who can’t afford a home of their own (or who don’t want the burden of property upkeep) to enjoy the benefits of living in a single-family home without having to qualify for a mortgage.

2023 Property Management Industry Report

It's here! Read our definitive guide on the property management industry and how to succeed in 2023.

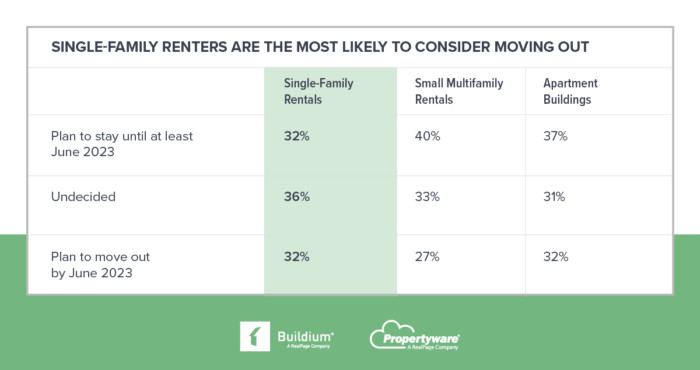

Get the GuideThat’s why we were surprised at the results of our annual Renters’ Survey, which showed that single-family renters were the least certain they’d still be living in their current property a year from now. Just 32% of renters living in single-family properties were certain that they would renew their lease between mid-2022 and mid-2023.

In this post, we’ll dig into the data behind this seemingly counterintuitive trend, including which kinds of renters are attracted to single-family rental properties and why; the reasons why single-family renters are considering moving; and how property managers can tweak their single-family resident retention strategy to both keep units full and attract new renters in the year to come. All of our research is drawn from this year’s Renters’ Report: What Attracts Renters to Single-Family Properties, and What Keeps Them from Moving Out.

The Demographics of Renters Living in Single-Family Rental Properties

First: Who tends to live in single-family rental properties? There are three main groups attracted to the space that single-family rentals provide:

- Couples: 51% of single-family residents live with a significant other

- Multigenerational families: 43% of single-family households contain relatives of different generations, such as parents living with their adult children (or vice-versa)

- Families with kids: 29% of single-family households have kids under age 18

Source: Buildium’s 2022 Renters’ Survey

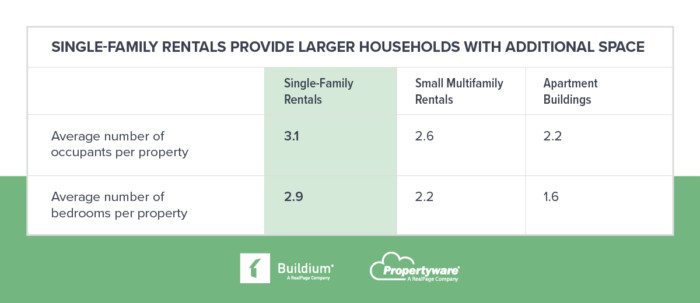

Because single-family rentals have the space that families need to live comfortably, they tend to attract larger households: Our research found that single-family rentals have an average of 3.1 occupants, as opposed to 2.1 in small multifamily rentals and 1.9 in apartment buildings.

Going forward, we expect couples with kids and multigenerational families to remain the two fastest-growing renter demographics. With the ongoing shortage of starter homes limiting the number of renters who can make the transition to homeownership, we expect demand for single-family rentals to continue to rise in the near term.

What Do Renters Find Appealing About Single-Family Rentals?

To understand how to retain residents living in single-family properties, it’s helpful to establish what it is that attracted them to the property in the first place. Here are the three main motivations that today’s renters cite in their decision to live in a single-family rental property.

#1: The Comforts of Living in a House, Without the Risk

Single-family rentals offer residents many of the conveniences and comforts of living in a house—without the financial obligation of a down payment, mortgage, and property upkeep. These properties often have features that homeowners might take for granted, but that can be hard to find in multifamily properties, such as an in-unit washer and dryer; air conditioning; and a kitchen with counter space and a dishwasher.

Being able to live in a single-family home is particularly meaningful for two groups of renters:

- The 47% of renters who rent primarily because they can’t afford to buy a home of their own, whether they’re young adults who are building up their credit and savings; or middle-aged adults who are rebuilding their finances after a setback, such as divorce, foreclosure, or bankruptcy.

- The 21% of renters who rent primarily because they don’t want the responsibility of owning and maintaining a home. This includes many older adults who have owned a home in the past, but no longer want to deal with the burden and expense of property upkeep.

Source: Buildium’s 2022 Renters’ Survey

#2: Greater Indoor and Outdoor Space

Although couples and families may have long wished for a larger home, the pandemic increased their sense of urgency. Suddenly, they needed a space that was conducive to remote work or learning, or a backyard where they could relax and their kids and pets could play. Many were willing to sacrifice the convenience of downtown living to find it.

With a typical single-family rental household containing 2 to 4 residents—whether that’s a family with kids, a couple with pets, or a multigenerational household—space is a primary consideration when these renters search for a place to live. And as the only rental property type where three or more bedrooms are common, single-family rentals are an important offering for families who rent their homes.

Source: Buildium’s 2022 Renters’ Survey

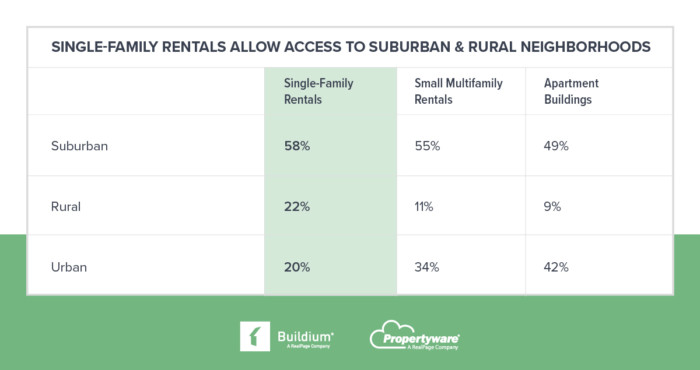

#3: Access to Lower-Density Neighborhoods

Single-family renters told us that they place a higher priority on living in a neighborhood that’s quiet, safe, low-density, and family-friendly, as opposed to a community that’s highly amenitized or has lots of stores and restaurants close by. Increased construction of single-family rental properties over the last several years, in addition to the conversion of owner-occupied homes to rentals, has brought housing options to lower-density neighborhoods that were less accessible to renters in the past. This has given renters greater access to employment opportunities and schools in suburban and rural communities across the country.

Source: Buildium’s 2022 Renters’ Survey

Why Are Two-Thirds of Single-Family Renters Considering Moving?

More so than other property types, single-family rentals can accommodate a wide range of needs over time. Renters told us that they turned to single-family rentals for the space they provided for remote work and learning, as well as for relaxation and recreation; and for their ability to accommodate changes in their family over time. In theory, this should translate to renters staying in these properties for longer periods of time; but the single-family renters we surveyed had moved into their property more recently than other renters, and were the most likely to consider moving out over the next year.

At the time of our survey, 32% of single-family renters said that they planned to move out of their current property between mid-2022 and mid-2023, and an additional 36% were considering moving. This adds up to 68% of single-family renters who are at risk of moving out in the next year, in comparison with 63% of renters living in apartment buildings, and 60% of renters living in small multifamily properties.

Source: Buildium’s 2022 Renters’ Survey

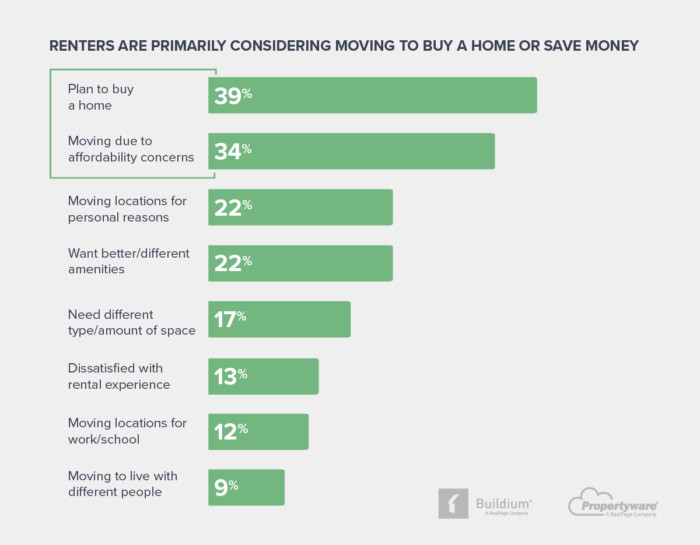

To understand why this is the case, we asked renters directly: What are the factors influencing your decision to stay or go? Renters living in single-family properties told us that overall, their desire to own a home of their own and their concerns about the affordability of their current rental are the main factors motivating them to search for a new place to live. Reasons that property managers can more directly influence—such as the desire for better amenities, or a better rental experience—were further down the list.

Source: Buildium’s 2022 Renters’ Survey

But the nuances of renters’ responses lead us to believe that these reasons are more interrelated than they might seem at first glance. The overarching consideration behind renters’ decision to renew their lease is their sense of value within their current property. This sense of value encompasses their satisfaction in three main areas:

- The quality of service they receive from their property manager or landlord

- The condition of the property and attention paid to maintenance issues

- The amenities and services that are available to them

As a result, we found, property managers may have more influence on renters’ decision to stay or go than they might think: Among renters who expressed a desire to become homeowners in the near future, we found that those who are more satisfied with their current property are less likely to plan to buy a home right away, even if it’s still their goal in the long term. And among renters for whom price is a leading consideration in their decision to move, it’s not necessarily a simple matter of their income versus the price of rent, though this is certainly a primary concern in today’s market. It’s their perception of value—the question of whether their rental experience is worth the price that they’re paying to live there—that can push them to stay or go, particularly when their household’s finances are stretched thin by high prices for housing, utilities, groceries, gas, and other necessities.

How Can Property Managers Improve the Single-Family Rental Experience?

Though two-thirds of single-family renters are considering moving out in the next year, it’s important to keep in mind that most renters would rather not deal with the hassle and expense of moving if their current rental meets their needs. With inertia on their side—as well as high prices for new leases—property managers should consider reaching out well in advance of the lease’s expiration date to find out what might improve these renters’ experience enough for them to consider renewing.

Here’s what renters living in single-family properties told us would improve their experience in their current rental, or influence their choice of one rental over another.

The Technologies Single-Family Renters Expect

Making rental processes as seamless as possible for renters of all ages should be a key component of property managers’ efforts to improve the rental experience they provide in the coming year. As of 2022, 79% of single-family renters are interested in completing at least some rental processes online, including 90% of young adults, 77% of middle-aged adults, and 64% of older adults.

The processes that a majority of renters have come to expect they’ll be able to take care of online include:

- Making payments

- Communicating with their property manager/landlord

- Signing and accessing their lease

- Submitting and tracking maintenance requests

- Finding and applying for available rental properties

Learn more about how property managers can offer these capabilities to their renters.

In addition, we’ve seen sizable gains in single-family renters’ interest in two capabilities over the past year, indicating that they can serve as differentiators for the property managers who offer them:

- Rent reporting: Having rent payments reported to credit bureaus so that renters can build their credit

- Utility billing: Helping renters set up utilities for their rental and pay their bills online

The Amenities Single-Family Renters Want

The single-family renters we surveyed put a premium on living in a property that offers the comforts associated with owning a home, such as air conditioning, an in-unit washer and dryer, a dishwasher, a backyard, and the option to have a pet. Other features that can catch their attention are high-speed internet, reserved parking, and garbage pick-up services.

Here are amenities and services that single-family renters wish they had access to at their current property—and that could present potential revenue opportunities for property managers:

- “A community kitchen where we could have gatherings” (Age 51)

- “Garden space to grow my own food; on-site composting” (Age 25)

- “Garbage pick-up and recycling” (Age 38)

- “Off-street parking” (Age 72)

- “Pest control” (Age 47)

- “Lawn care services” (Age 51)

- “Smart home technology” (Age 50)

- “A playground” (Age 54)

- “High-speed internet” (Age 49)

- “An ATM on site” (Age 65)

The Benefits of Resident Benefit Packages

Resident benefit packages are bundled services that can increase resident retention and generate revenue for property managers. Common offerings include:

- HVAC & refrigerator filter delivery and installation

- Virtual concierge for keyless entry, package receipt, and more

- Resident portal for online payments, messages, documents, and more

- Maintenance portal for 24/7 maintenance requests

- Utility management to streamline utility setup and payments

- Renters insurance to cover damage and liability

- Services like dog-walking, dry-cleaning, and more

Single-Family Renters’ Advice for Property Managers

We asked renters how their property manager or landlord could improve their experience in their rental. Here’s what they told us:

- “Be proactive. Come to the residence once a year to see what may need fixing or updating that the renter hasn’t brought up.” (Age 50)

- “Be transparent about the state of the rental property and the terms for renting the space. Keep an open [line of] communication with the renters so any issues that arise can be resolved without hassle.” (Age 29)

- “The property manager should give complete information regarding a property—the cost of rent [and] utilities, conduct expectations, maintenance, and contact information.” (Age 72)

- “Fix problems as they arise, do not wait until something completely breaks down. Have planned services like HVAC exams before summer, provide extermination services on a planned schedule, and [include] yard services in [the] rent.” (Age 59)

- “Be more open-minded about using technology for processes if you haven’t already started using it. It makes things easier for your tenants and yourself.” (Age 26)

The 2022 Renters’ Reports

All of the research in this post was drawn from the first of two Renters’ Reports we’ve released this summer, focused on how property managers can attract and retain single-family renters. Download your free copy of the report for a deep dive into each of the trends that we discussed in this post, as well as the following topics:

- Single-family renters’ expectations of their property manager and the technology they provide at all points of the lead-to-lease cycle

- Single-family renters’ financial health in comparison with other renters at this point in the pandemic recovery

- The impact that institutional investors are having on small-portfolio owners and property managers within the single-family rental sector

And don’t miss the second part of our report, which focuses on 2- to 4-unit properties: What Attracts Renters to Small Multifamily Properties, and What Keeps Them from Moving Out.

Read more on Industry Research