Imagine that a tenant owes you $1,290 for the following things:

- Rent: $1,000

- Parking: $200

- Utlities: $75

- Renters insurance: $15

If they send you a check for $1,000, how would you apply that money to all of the above items?

The default setting in Buildium is to apply money to the item with the greatest balance first (typically, that would be rent). That works great in a lot of cases, but there may be a number of reasons to apply the money to another due balance, first.

To answer this need, we’ve rolled out a new custom payment allocation feature. That way, you decide how payments are applied to delinquent accounts.

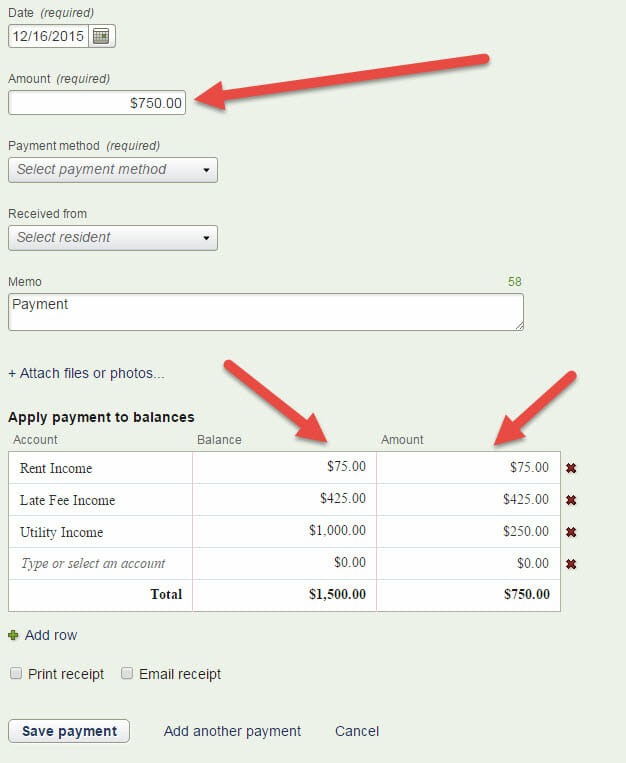

For example, let’s say you’d prefer for rent to be paid before utilities or late fees. But, like in the example below the utilities balance is more than rent owed. The default setting would have settled the utilities balance first, but custom allocation allows for rent to always be paid first.

If all due rent is paid up, the system will skip over it and apply the balance to the next item on the list. In the example above, it would apply it to late fees.

Once all balances are paid, it will default to the “largest balance first” rule to cover any outstanding accounts not covered by your allocations.

For example, if you’ve set your custom order as:

- Rent Income

- Renters Insurance Income

- Late Fee Income

And the tenant makes a partial payment for $1,050 for the following accounts:

-

- Rent: $1,000

- Late Fee: $100

Renters Insurance: $14.50

Rent will be paid first, followed by renter’s insurance, and then late fees. The tenant will be left with a $64.50 balance for late fees.

Ready to set up your custom allocations? They can be applied:

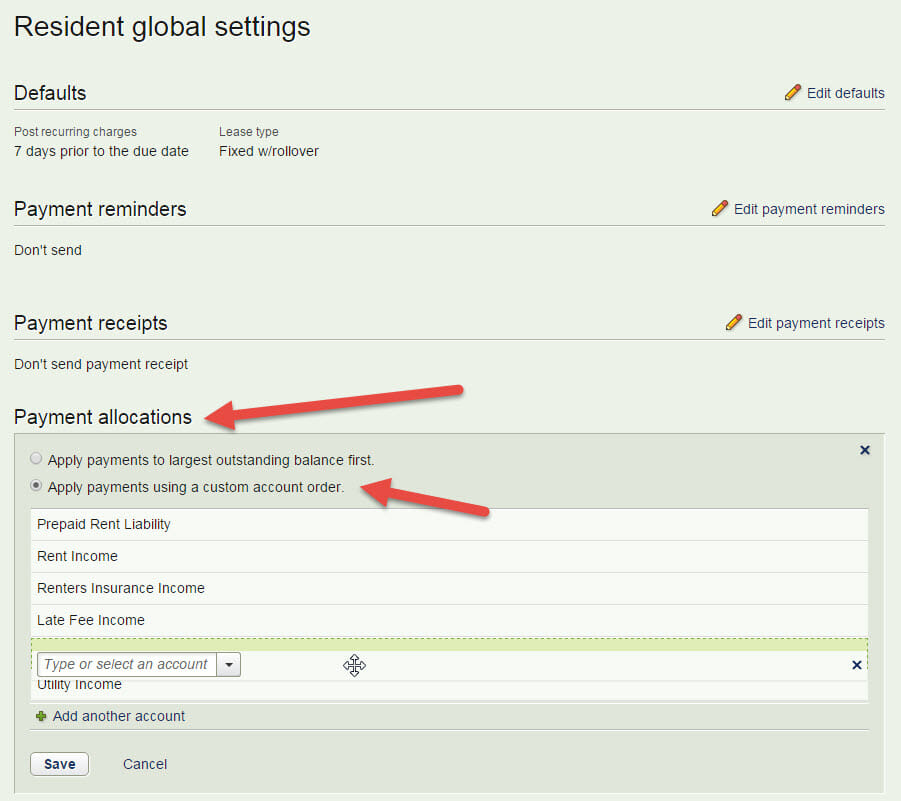

- Globally: Settings > Application Settings > Residents > Payment Allocations.

- On the property level: Rentals > Properties > select the property > Financials > Lease Payment Settings > Override Payment Allocations.

- On a lease-by-lease basis: Rental > Leases > select the lease > Financials > Payment Settings > Override Payment Allocations.

Not sure where to start? Consider prioritizing some of the following accounts:

Renters Insurance Income

If you use Buildium’s Renters Insurance program, it’s easier to ensure that you’ve collected all of your fees if it’s set as a top priority item.

Utility Income / Other CAM income accounts

Reimburse yourself for any expenses the tenant has incurred for utilities.

Management Income Accounts

Prioritize income accounts that are direct revenue sources. Some common management income accounts include:

- Late Fee Income

- Repairs Income

- NSF Income

- Cleaning and Maintenance Income

Payment Plans

Custom allocations are great for residents who pay in installments. Just set allocations at a lease-level to prioritize which balances should be paid first.

Association Charges

Set custom allocations to indicate if there are violation or assessment fees that should be received before other association fees.

If you start taking advantage of these time-saving tips now, the rest of the year will be smooth sailing! As always, let us know what you think of this feature in the comments below.

Read more on Accounting & Reporting