Bookkeeping, collecting receipts, and managing your rent payments isn’t always the most exciting part of property management. But to run a successful business, you’ll need a well-oiled accounting system.

To get that system in place, we’ve created this guide (and video) to walk you through every step of the property management accounting process.

What you’ll learn in this guide:

- How to set up your accounting systems properly

- How to set up your bank accounts

- Tips and shortcuts to save you time and money

- Worry-free solutions that automate your bookkeeping

Let’s dive in!

Property Management Accounting: Article Guide

What Is Property Management Accounting?

Property management accounting is the process of keeping track of the financial aspects of owning and operating rental or association properties, as well as any income or expenses related to the property or to your own business. That can include transactions such as rent collection, property taxes, insurance, repairs and more.

Is Property Accounting Difficult?

While there are nuances to property accounting, it’s no more difficult than any other accounting. There are, however, certain accounting actions that make property management accounting unique.

Staying on top of bookkeeping is incredibly important. It allows you to make better decisions about how you’re running your business and how you’re managing your clients’ properties. Getting property management accounting right saves you time throughout the year. It also prepares you for tax season and major financial events like quarterly meetings with owners or your HOA.

Bad fundamentals, on the other hand, can lead to missing tenant payments, miscalculating your cash flow, and even compliance issues that could lead to fines, all problems that will ultimately stifle your business growth.

What Does a Property Account Manager Do?

To make things easier, you can work with an accountant to handle the financial aspects of your business. They are in charge of accounting, asset management, and bookkeeping duties, to ensure you’re tax compliant and your books are accurate.

Property Management Accounting Terms You Should Absolutely Know

Before we dive into more of the nuts and bolts of accounting, let’s go over some key property management accounting terms. These are terms you might have already heard:

Accounting Period

An accounting period is a specific time frame during which financial transactions and activities are recorded and reported. This period can be monthly, quarterly, or annually, and it helps property managers track income, expenses, and financial performance consistently.

Accounts Payable

Accounts payable refers to the amounts a property management company owes to vendors or suppliers for goods and services received but not yet paid for. This includes bills for maintenance, utilities, and other operational expenses.

Accounts Receivable

Accounts Receivable refers to the money owed to a property management company by tenants or clients for rent, services, or other charges. This includes tracking and managing incoming payments to collect payments on time and stay accurate with financial reporting.

Accrual Accounting

Accrual accounting is a method where revenues and expenses are recorded when they are earned or incurred, regardless of when the cash is actually received or paid. This typically gives you a more accurate picture of a property’s financial health by matching income and expenses to the period in which they occur, rather than when the cash transactions happen.

Allocation

Allocating funds is simply the process of distributing funds to different general ledger accounts or periods. The goal is to ensure that each area has the necessary funds to cover expenses and operate efficiently. You can also allocate funds by assigning expenses to different properties.

Asset

Assets refer to the resources owned by a property management company or its clients that have a dollar value and can provide future benefits. These include physical properties like buildings and land, as well as financial assets such as cash, accounts receivable, and investments.

Bookkeeping

Bookkeeping involves the recording of all financial transactions related to property operations, including tracking income from rent, expenses for maintenance and utilities, and other financial activities.

Bank Reconciliation

Bank reconciliation is the process of matching the cash account balance in the company’s accounting records to the corresponding information in the bank statement. The goal is to identify and reconcile any differences between the two records, keeping your cash records accurate.

Cash Accounting

Cash accounting is a method in which revenues and expenses are recorded only when cash is actually received or paid. This approach provides a straightforward view of cash flow, making it easier to track the actual cash available at any given time. It’s particularly useful for small property management companies that prefer simplicity in their financial reporting.

Chargeback or Expense Recovery

Chargeback or expense recovery refers to the process of recouping costs incurred by the property management company from tenants or clients. This can include expenses for utilities, maintenance, or other services that are initially paid by the property management company but are later billed to the tenants.

Credit

Credit refers to an entry that decreases assets or increases liabilities and equity on the balance sheet. It represents amounts owed by the property management company to others, such as vendors or lenders.

Debit

Debit refers to an entry that increases assets or decreases liabilities and equity on the balance sheet. It represents amounts that the property management company has paid or owes for expenses such as maintenance, utilities, or other operational costs. Assets and expenses increase when they are debited.

Depreciation

Depreciation refers to the process of allocating the cost of a tangible asset over its useful life. This accounting method helps property managers spread out the expense of an asset, such as buildings or equipment, over several years, reflecting its gradual wear and tear.

Equity

Equity refers to the residual interest in the assets of a property management company after deducting liabilities. It represents the ownership value held by the company’s shareholders or owners. Equity can include initial investments, retained earnings, and any additional capital contributions.

Expense

Expenses refer to the costs incurred by a property management company in the course of operating and maintaining properties. These can include maintenance and repair costs, utilities, property taxes, insurance, and administrative expenses.

Fixed Cost

Fixed costs refer to expenses that remain constant regardless of the level of occupancy or activity within a property. These costs include items such as property taxes, insurance, and salaries of permanent staff.

General Ledger (G/L)

The general ledger is a comprehensive record of all financial transactions made by the property management company, including accounts for assets, liabilities, equity, revenues, and expenses.

Generally Accepted Accounting Principles (GAAP)

In property management accounting, generally accepted accounting principles, known as GAAP, are a set of standardized guidelines and rules used to ensure consistency, transparency, and accuracy in financial reporting. These principles cover various aspects of accounting, including revenue recognition, expense matching, and disclosure requirements, helping property management companies maintain reliable and comparable financial statements.

Liability

Put simply, this is what your business or the property owner owes to another party. These can include loans, mortgages, accounts payable, and other accrued expenses.

Overhead

Overhead refers to all the ongoing administrative and operational expenses that are not directly tied to a specific property or project. These costs include salaries of management staff, office supplies, utilities, and other general expenses necessary for running the property management business.

Revenue

Revenue encompasses all the income generated by the property or your business. This can include everything from rent payments from tenants and fees for particular services to other income sources such as parking fees or laundry services.

Property Management Accounting Basics

Building systems can reduce the time you spend on important but mundane tasks significantly. That’s what makes building a strong foundation an absolute must. With the right property management bookkeeping basics, you’ll be able to manage your accounts consistently, proactively, and accurately. Here are the five best ways to do exactly that.

1. Open a Separate Basic Account

The first and arguably most important step is to ensure that you have a proper bank account structure for your business so that funds aren’t passing through a single bank account (which may be illegal in most states). This structure varies depending on the size and scope of your business, but here are the four main bank accounts you’ll generally need to open:

- Property management trust account

- Security deposit account

- Operating account

- Property management reserve (optional)

Several states require security deposits to be held in separate escrow accounts, so funds are able to be accessed when residents move out. If your state allows it, consider placing your security deposits in a trust.

2. Establish a Property Management Chart of Accounts

A chart of accounts for property management is a way to organize all transactions for every property you manage. When set up right, it effectively categorizes each transaction within the general ledger, making property management accounting much easier.

Depending on the complexity of your business, you can start with an Excel spreadsheet or use a comprehensive solution such as Buildium to build it automatically for you.

The chart of accounts is made up of five major types of accounts:

- Assets

- Liabilities

- Equity

- Income

- Expenses

How to organize your chart of accounts

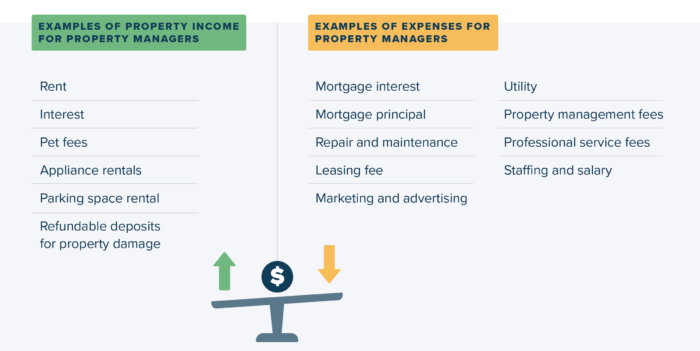

As mentioned above, the five types of transactions listed in a chart of accounts include assets, liabilities, equity, income, and expenses. You can then list categories for each type. For example, under income you can list rent, pet fees, appliance rentals, or parking fees.

Assets

Ensure you’re differentiating current assets with fixed assets. Current assets are variable and include escrow, reserve accounts for insurance, your bank accounts, taxes, capital expenditures, and interest.

Fixed assets are funds tied to your properties and business, including the monetary value of each property and the improvements made on them.

Expenses

Just like your assets, you can categorize each expense by taxes, software, supplies, utilities, repairs, bank fees, cleaning costs, travel expenses, etc.

Liabilities

Liabilities can be categorized between current and long term. Accounts payable, rent due, prepayments, security deposit liability, owner-held security deposits, and note payable.

Want more detail? We’ve put together a guide on setting up an air-tight chart of accounts that will walk you through everything you need to know, with expert advice and even an itemized list of what to include.

3. Decide Between Cash and Accrual Accounting

WIth cash accounting property managers record money as it is received and paid from their bank accounts. Accrual accounting records revenue and expenses when they occur, rather than when the money moves.

4. Decide Between Single-Entry or Double-Entry Bookkeeping

When keeping records, you start by recording detail in a general journal, the initial record where all financial transactions are initially recorded in chronological order. This journal includes detailed information about each transaction, such as the date, accounts affected, amounts, and a brief description. The general journal serves as the first point of entry for financial data before it is posted to the general ledger.

The general ledger consolidates all the transactions recorded in the general journal. It organizes these transactions by account, allowing your team to see the cumulative effect of all transactions on each account.

Single-entry bookkeeping is simply when all financial items are recorded one time in a general ledger. Some smaller property management companies opt for this method of bookkeeping for its simplicity, even though it is more prone to errors and has several limitations

However, double-entry is certainly more common and usually recommended, especially for property management accounting. Most property management companies are required to track more than just cash flow, meaning that you’ll need to distinguish where the money is actually coming from (rent vs late fees, for example), and where it was deposited. Every transaction is entered twice: once as debit and once as credit and is consolidated afterward. Most larger, growth-focused, and detailed-oriented property management companies choose this double-entry approach to bookkeeping.

5. Manage Invoices and Receipts

Whether through accounting software or a more comprehensive property management solution like Buildium, keep a habit of maintaining a record of all statements for money going in and out of your business. Set up a regular reporting schedule and be sure the numbers are checked thoroughly on a regular basis.

Property Management Trust Accounting Procedures

As a property manager, you’re handling other people’s money on a daily basis. Trust accounts are a valuable way to help you keep your owners’ assets organized, stay compliant, and reconcile accounts through more accurate reports.

Trust accounting basically means when a third party—in this case, a property manager—holds funds for the benefit of (in trust for) a beneficiary, the property owner. Having a trust account helps to keep your operating capital separate from the rent and payments you collect from residents.

Dos and Don’ts of Trust Accounting

Do make sure that you have a trust account in place for all payments you receive from residents, not just security deposits. When setting up a trust, the signee should always be the property management business owner or a bonded employee. The same amount of care to keeping your trust accounts up to date. Every 6 months to a year, make sure that the property owner (beneficiary) information for your trusts is accurate.

Do not grant non-bonded employees the ability to release funds from your trust accounts. That includes restricting ACH, billpay, and wire access. Also avoid using signature stamps to sign a trust agreement or other forms of banking authorization. Because these stamps are legal, authorized signatures, you won’t be able to claim fraud if an employee or others use your stamp for unauthorized activity.

Trust accounts are a necessary and useful tool to keep your funds organized and compliant with regulations, especially as you take on more owners, but they come with their own set of rules and risks. Learn more about how to set trust accounts up correctly.

Property Accounting Reports You Should Know

Reports are versatile. They can provide a high-level overview to investors or can be extremely detailed for your monthly HOA meetings. Here are the four reports that will make the biggest impact on your business.

Deep Dive: Knowing your books: which property accounting reports matter most?

Owner report or rental owner statement

This report paints a picture of how the property owner’s investment performs at the beginning and end of every period. This accounts for all the money entrusted to you in an easy-to-understand matter. Here’s what comes with an owner report:

- Property address

- Contact information

- Beginning, end and statement dates

- Beginning and end balances

- Income, broken down by type

- Expenses, broken down by type

- Net income or loss

- Security deposits

- Early payments

- Capital contributions by owner

- Required reserve and operating levels

- Funds received but not yet deposited

Detailed Income Statement or Profit & Loss (P&L) Statement

An income statement documents your cash flow during a month, quarter, or year, so that your partners and shareholders are given accurate records of your company financials. These include:

- Beginning and end dates

- Income

- Property management fees

- Contributed capital

- Tax credits

- Profit from sale of assets

- Adjustments to previous assumptions

- Investment income

- Interest received

- Expenditures

- Taxes

- Rent

- Equipment

- Interest

- Salaries and wages

- Consulting fees

- Advertising and marketing costs

- Legal fees

- Accounting fees

- Software fees

- Insurance premiums

- Depreciation and amortization

Rent Roll

The rent roll report predicts expected revenue based on historical data. Owners use this report to see how they’re pacing against their financial goals. You’ll also see which units are vacant, which leases are up for renewal soon, and which tenants are on month-to-month leases.

The report includes:

- Lease dates

- Recurring charges

- Estimated market rental value

- Sum of all deposit amounts

Depending on how hands-on they are, owners might request the details captured in these reports often, and with little notice. Luckily, Buildium allows you to generate and download rent roll reports with just a few clicks.

Budget vs Actual Report

This report identifies the disparity between your projections and reality, which allows property managers to adjust their budgets and plan for potentially unexpected costs or cash flow issues.

Reports in Just a Few Clicks

No matter the type of report, you’ll want easy access to your accounting data and a way to share that data with owners. Buildium lets you generate and save accounting reports easily, and then send those reports to clients or other members of your team—all within the same platform.

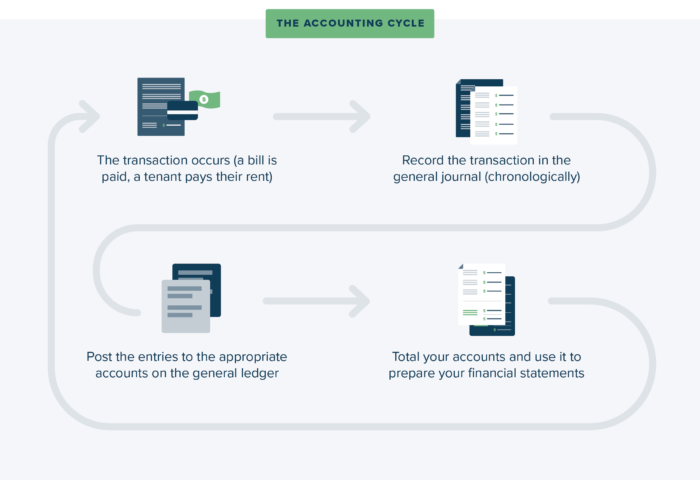

The Property Management Accounting Cycle

Having learned about all the different aspects of property management accounting, let’s see how it all fits together. There are four major steps that take place:

- The transaction occurs (a bill is paid, a tenant pays their rent)

- Record the transaction in the general journal (chronologically)

- Post the entries to the appropriate accounts on the general ledger

- Total your accounts and use it to prepare your financial statements

Actionable Tips: Property Management Accounting Best Practices

Now that we’ve talked through the basics of property management accounting, let’s go through ready-to-use tips that turn property accounting into an asset for your business.

Reconcile Accounts Monthly

Reconciling is the process of ensuring that your records match the money you’ve actually spent. Maintaining a habit of reconciling your accounts at the end of every month helps you find typos, duplicates, missing entries, and bank errors early.

Stay Cash-Flow Positive

Cash flow is how much money you have left over at the end of a measured period of time after collecting rent and paying out your expenses. Making the wrong investments, either in a property or in your business, can be a money sink for you and your clients, creating a negative cash flow. The higher the cash flow in the accounts you manage, the more money you’ll have on hand to make upgrades, grow your business, and pay off any debt. As obvious as this is, it’s one of the best ways to stay in the black is to proactively stay on top of accounting!

Have a Rainy Day Fund

It’s important to have a safety fund so you’re not struggling with unforeseen expenses. Work out the size of a reserve fund with rental owners, so you can stay ahead of the unexpected.

Be sure it’s liquid, or you’re able to tap into it with no risk of penalties or fees. Advisors typically recommend three to six months of expenses in your rainy day fund.

Essential Property Management Accounting Software Features

In the vast ecosystem of property management software, how do you choose the best accounting system for you?

We’ve developed several in-depth posts to help you answer that very question. We recommend reading this article on the benefits of purpose-built accounting software along with this guide on six features to look for in software, before diving into these head-to-head comparisons of specific property management accounting platforms:

- Should You Use Quickbooks for Property Management Software?

- 10 of the Best Rental Property Accounting Software for Better Bookkeeping in 2024

- 5 of the Best HOA Accounting Software Solutions in 2024

Choosing the right one will help you run and scale a growing portfolio, but they’re not all created equally. A purpose-built property management accounting solution should have the following features:

Automatic Bank Reconciliation

Reconciling your accounting records with your banks can be excruciatingly time consuming. One of the biggest timesavers is a software that automatically reconciles each check, deposit, and expense to minimize clerical errors that may end up being extremely costly. Automate reconciliation so you can generate accurate balance sheets, income statements, and rent rolls in real time.

Chart of Accounts

A chart of accounts categorizes all your financial transactions—which can be created automatically in an effective property management software. Instead of worrying about integrating your accounting software with your spreadsheets and your property management software, find a software that does it all in one place—and securely.

Advanced Security

A non-negotiable feature you should look for is the ability to lock your books when you’re ready to file, so it can’t be accidentally or purposefully tampered with—so your reports remain accurate.

Online Rent Payments

Digitizing your online rent payments allows you to record every rent payment you receive automatically. And it makes paying rent much easier for your tenants as well. Automating this will save you a ton of time and most accurately track your transactions. A top payment portal also provides a record of previous payments and allows you to accept rental applications and other fees directly online.

1099 eFiling

If you’re like most property managers, tax season may cause big headaches. An effective property management software will allow you to minimize the hassle by automatically e-filing your 1099 with the IRS.

Accounts Payable

Any property management accounting software you choose should have automated accounts payable. Buildium, for example, includes calculators that show you what you owe your owners, your vendors, and yourself.

It also generates bills from work orders automatically, includes online payments, and allows you to set up recurring payments, as well.

Of course, every business is different, and it’s always a good idea to talk with a professional CPA to understand requirements and details you should look out for that are specific to your company, your clients, and where you operate.

With that in mind, the first steps are easy. You can get started quickly with Buildium’s property management accounting software features and award-winning customer service. Choosing the right property management software is the best way to automate bookkeeping, manage your accounting, and power your properties. So what are you waiting for?

FAQ

What Is Property Management Accounting?

Property management accounting is the specialized practice of managing and recording the financial transactions and activities related to property management. It involves tracking income from rent, managing expenses for maintenance and utilities, and taking all the necessary steps to keep financial reporting accurate and up to date.

The main goals of setting up effective property management accounting is to help your business and your clients maintain financial stability, comply with regulations, and make informed decisions to optimize the performance of their properties.

How Do You Set Up Your Property Management Accounting?

Setting up your property management accounting involves several key steps. One main step is to establish a chart of accounts tailored to your property management needs, including categories for income, expenses, assets, and liabilities.

You should choose reliable accounting software that supports property management functions such as rent collection, expense tracking, and financial reporting. Support this software by implementing a system for regular bank reconciliations to match your records with bank statements.

Finally, stay compliant by making use of GAAP accounting principles and train your staff on proper accounting procedures to maintain consistency and accuracy.

What Does a Property Account Manager Do?

A property account manager provides proactive support to property-level customers, assisting them in maintaining successful utility billing programs. This includes answering questions regarding utility management, monitoring property satisfaction, and escalating concerns related to recovery and meter health. Additionally, they support solution account managers on assigned accounts.

What is Property Management GAAP Accounting?

GAAP accounting, or accounting based on generally accepted accounting principles, is managing your books based on a standardized framework for financial reporting, designed for consistency, transparency, and accuracy. By adhering to GAAP, property managers can maintain reliable financial records, facilitate better decision-making, and ensure compliance with regulatory requirements.

For more details on GAAP accounting you can read our dedicated post on the topic: GAAP Accounting 101.

What Is the Best Accounting Software for Property Management?

When it comes to choosing the best accounting software for property management, several options stand out due to their comprehensive features and ease of use. Buildium is a popular choice, offering a purpose-built solution that includes rent collection, maintenance tracking, and financial reporting. It is suitable for property managers of all sizes and types, including single-family, multifamily, and community associations. You can test out Buildium’s accounting features with a no-risk, 14-day free trial.