Disclaimer: This blog post is meant for informational purposes only and does not constitute legal advice. Consult with a licensed attorney for specific legal guidance.

Start your free trial today!

Try Buildium for free for 14 days. No credit card needed.

Start Your TrialNo property manager wants to assume that potential tenants are lying on their rental applications. Unfortunately, rental application fraud does occur. When it happens, it can lead to costly legal battles—like evictions—that cause headaches for property management staff, as well as drain time and resources.

If you’re ready to protect yourself from falling victim to this trend, here’s what you need to know about rental application fraud. We’ll cover the most common types, how to spot the warning signs, and what you can do to safeguard the properties in your portfolio. Keep reading to learn more.

What Is Rental Application Fraud?

At its core, rental application fraud is the act of deliberately lying on a rental property application. Keep in mind that the intent of the renter is key. While it’s one thing for a tenant to make an honest mistake when filling out an application, it’s another for them to intentionally misrepresent themselves—and the latter scenario is becoming increasingly common.

A recent survey by the National Multifamily Housing Council found that a staggering 80 percent of respondents have caught renters misrepresenting themselves on rental applications in the last year. An additional 84 percent have experienced renters falsifying references or other forms of supporting documentation.

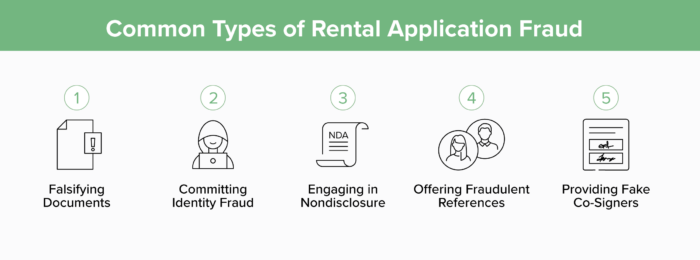

Common Types of Rental Application Fraud

With numbers like those, it’s a good idea for property managers to take steps to educate themselves on this growing trend. Here’s a look at some common types of rental application fraud to keep on your radar.

Falsifying Documents

In this type of fraud, would-be-tenants use document-altering software to create records that make them look like a more attractive rental candidate than they truly are. For example, they may change the income amount on one of their pay stubs or put their name and identifying information on someone else’s credit report.

Committing Identity Fraud

This well-known form of fraud involves taking on someone else’s identity and trying to use their credit rating and income information to get a rental application accepted. Typically, it will take the form of using a driver’s license or passport from a relative who has a more stable financial history.

Engaging in Nondisclosure

Nondisclosure is a lie of omission. A tenant engaging in this type of fraud may purposefully leave information off their rental application, thinking that their application may be denied if it were to be included. For instance, some tenants may leave off past negative financial events like evictions or deny that they have a pet.

As the leasing party, you’re entitled to certain information about your potential tenants. However, the specifics can vary, depending on your location. Be sure to educate yourself on the fair housing laws in your area, so that you know what information you can expect.

Offering Fraudulent References

Tenants with negative rental histories can falsify references by asking family members or close friends to pose as past landlords. This can give you an inaccurate impression of the potential tenant’s qualifications and make it difficult to determine whether they are the best fit for the property.

Providing Fake Co-Signers

Perhaps the most disastrous form of rental application fraud, this type involves providing the names of co-signers in order to boost the chances of having their application approved. However, the co-signers often remain unaware of the commitment. This can result in long, drawn-out litigation scenarios between all parties.

How to Spot Rental Application Fraud

Now that you know more about the different types of rental application fraud that exist, it’s time to learn some ways to spot it. Keep these red flags in mind as you gather leasing information.

- Offering extra (or advance) payment: Those committing rental fraud might try to offer you money in an attempt to get you to skip or accelerate crucial stages of the tenant verification process. Skipping steps can make you miss clear signs that the information they’ve provided doesn’t match up.

- Providing incomplete information: Potential tenants who leave sections of their rental application blank may have something to hide. It’s likely a good idea to require tenants to complete the rental application in full and to only consider renting to those who follow directions.

- Handing over printed documents: If a tenant insists on handing you a printed copy of a credit report or background check, that could be a sign that they’re falsifying documents. Always run your own checks in addition to accepting any supporting documentation from the tenant.

- Finding conflicting details: As you run your own credit and background checks, be wary if you find conflicting information or details that don’t match up. This is often a sign that the potential tenant lied when filling out their rental application.

- Lacking a social media presence: Most people these days are connected to at least one form of social media. If you can’t find someone online, it could be a sign that they’re using a fake identity on their application.

4 Ways to Prevent Rental Application Fraud

A sharp eye isn’t the only tool at your disposal to help you safeguard against these issues. Here a few distinct steps and tools you can take to avoid falling victim to rental application fraud:

- Don’t look past omissions: If part of a rental application is left blank and you still want to consider it, be sure to ask the potential tenant for an explanation.

- Cross-check the information provided on the rental application: Consider independently researching the contact information for employers or previous property references. If the info you find doesn’t match the information provided on the application, it could be a sign of fraud.

- Run your own credit/employment/background checks: In a perfect world, you’d be able to trust the information provided by potential tenants, but that isn’t always the case. Running your own checks will give you a chance to verify the information that the tenant provided is correct.

- Invest in rental history verification software: If running your own checks is taking up too much time in your day, there is property management software that will take care of these tasks for you with consistent attention to detail. Consider investing in a software program that can save you time while offering you peace of mind. Let’s take a closer look at specific software to help you accomplish this.

Using Technology to Stop Application Fraud in Its Tracks

Gathering references from previous property managers or landlords can be one of the most time-consuming parts of the tenant screening process, especially if you have a larger door count. But, it has to be done because the alternative is simply too expensive. According to data from TransUnion, the average eviction costs property managers around $3,500 per unit, between legal fees, lost revenue, and other operating expenses.

Having a thorough application process doesn’t have to mean overburdening your team. Comprehensive property management software such as Buildium has built in tenant background checks and screening capabilities, complete with rapid notifications for residents on the status of their applications. This saves you valuable time by automatically sending the rental history verification form and displaying any responses in applicant records as they come in. It also keeps your screening process thorough and quick, so you’re not losing out on potential tenants while also catching red flags early on.

Celeri®, a Buildium Marketplace partner, is another software solution worth considering. It uses AI to detect falsified income documents in seconds.

These are just some examples of how technology can add an extra layer of security to identity verification. By following the tips in this guide and using purpose-built technology, you can go a long way in protecting your properties and business from rental fraud. Be sure to consult a legal expert for the most specific advice and comprehensive support.

If you’re ready to add an extra level of security to your tenant screening process, get started with a 14-day free trial of Buildium today

Read more on Leasing