The vast majority of real estate companies (including property management businesses) are organized as pass-through entities, not as regular C corporations. The most popular pass-through entity is the limited liability company (LLC), but pass-throughs also include sole proprietorships, partnerships, and S corporations.

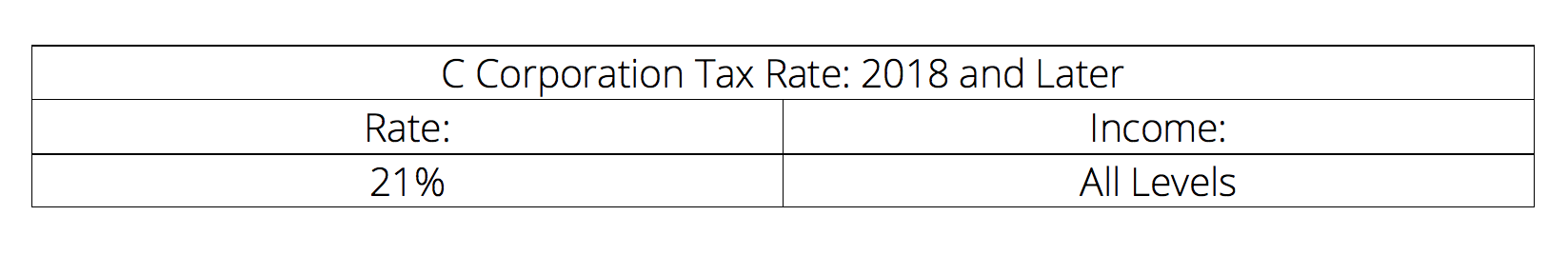

What all of these business forms have in common is that their profits and losses are passed through the business to the owners’ individual returns, who pay taxes on their profits at their individual tax rates. Until now, this has been a feature, not a bug. However, the Tax Cuts and Jobs Act (TCJA) recently enacted by Congress permanently reduces tax rates for regular C corporations from a top rate of 35% to a flat tax of 21% for all C corporation income.

Now, for the first time in decades, corporate tax rates are substantially lower than the income tax rates that higher-income individuals pay on profits from their LLCs or other pass-throughs. Does this mean that you should form a C corporation to take advantage of the new 21% corporate rate? Not necessarily.

Should Property Managers Become C Corporations?

Lower Corporate Tax Rates May Not Save You Taxes

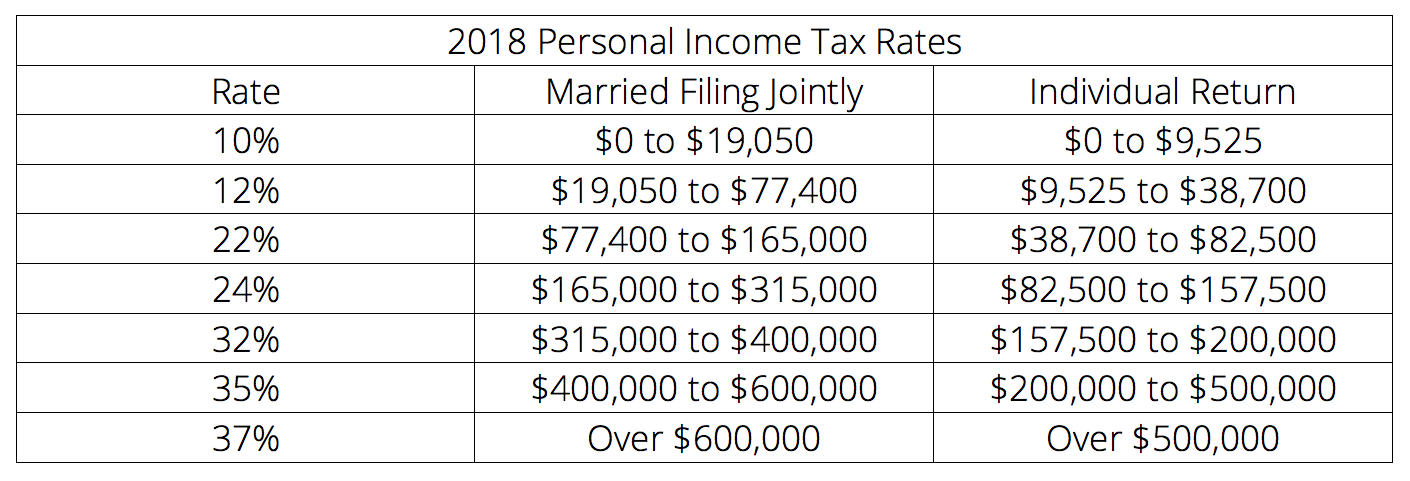

You can compare the rates for individuals and corporations in the charts below. The top individual rate under the TCJA is 37%—16% higher than the 21% rate for corporations. Indeed, singles who earn a minimum of $82,501 pay income tax at a top rate of 24%—3% more than the corporate rate.

However, the fact that the corporate rate is lower than your individual income tax rate doesn’t necessarily mean that you’ll save on taxes if you incorporate your business. There are several reasons for this:

-

- Double taxation of corporate distributions

- You’ll be your corporation’s employee

- Losses are not individually deductible

- You won’t be able to take advantage of the new pass-through tax deduction

We’ll dig into each of these factors one at a time.

Double Taxation

When your business is a pass-through, any profit distributed from the business to you is taxed only once, at your individual tax rates. This is not the case when you form a C corporation to operate your business. Any direct payment of a C corporation’s profits to its owners (the shareholders) will be considered a dividend by the IRS, and thus is taxed twice. First, the corporation pays corporate income tax on the profit at the 21% corporate rate on its own return; then, you’ll pay personal income tax on what you receive from the corporation. This is called “double taxation.”

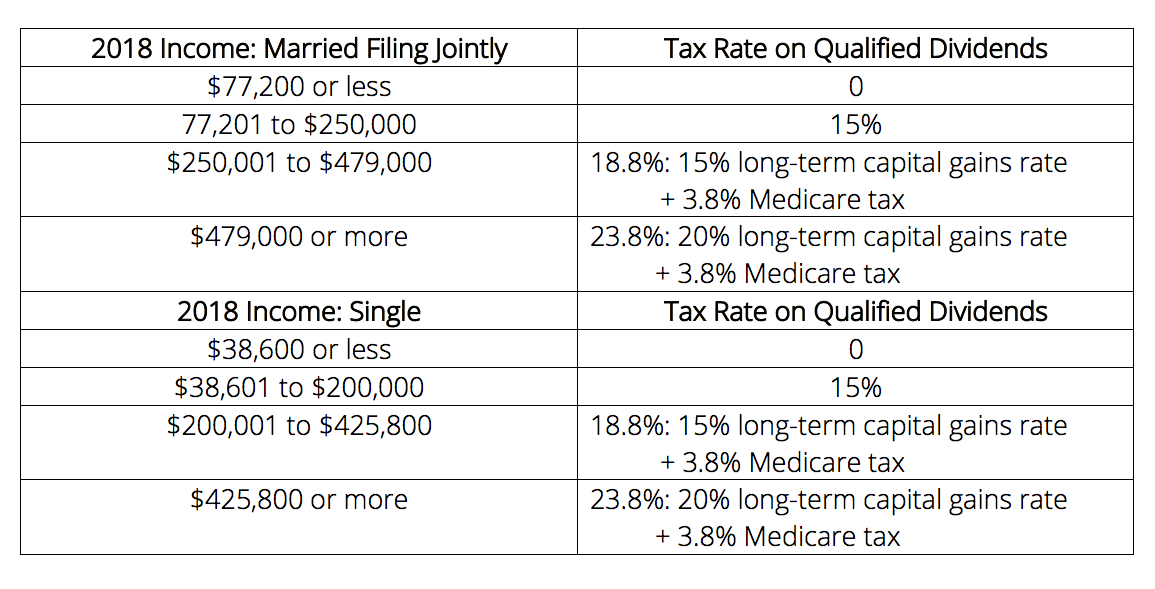

C corporation dividends are usually taxed at capital gains rates. Higher income taxpayers must also pay a 3.8% Medicare tax on net dividend and investment income. Dividends from stock owned more than one year are taxed at the long-term capital gains rate shown in the chart below.

Thus, for example, if you pay tax on your corporation’s dividends at the 15% rate, the total tax on every $100 distributed to you will amount to $32.85. The effective tax rate is 32.85% [21% + (79% x 15%) = 32.85%]. This is less than the 37% top individual rate, but not significantly so. If your income is over $479,000 if you’re married, or $425,800 if you’re single, your total tax on each $100 distributed to you would be $39.80 [21% + (79% x 23.8%) = 39.8%], more than the 37% top individual rate.

Thus, for example, if you pay tax on your corporation’s dividends at the 15% rate, the total tax on every $100 distributed to you will amount to $32.85. The effective tax rate is 32.85% [21% + (79% x 15%) = 32.85%]. This is less than the 37% top individual rate, but not significantly so. If your income is over $479,000 if you’re married, or $425,800 if you’re single, your total tax on each $100 distributed to you would be $39.80 [21% + (79% x 23.8%) = 39.8%], more than the 37% top individual rate.

So, depending on your business income, the total tax you’d have to pay on distributions from your C corporation could be more than you would pay if your business is a pass-through entity, and you pay one level of tax on all of your business profits at your individual income tax rate.

You’ll Be an Employee of Your Corporation

When you form a C corporation and actively work in the business, you must become your corporation’s employee. Your corporation must pay you reasonable employee compensation for your work. You must pay tax on your employee salary, bonus, and other taxable payments from your corporation at your individual tax rates. The corporation gets to deduct employee salaries and benefits from its taxable income, so there is no double taxation on these payments; but there’s no tax savings, either.

However, becoming an employee of your C corporation isn’t all bad. The tax law allows a C corporation to provide its employees with many fringe benefits that it can deduct from the corporation’s income as a business expense. However, the employees need not include the value of the fringe benefits in their taxable income, effectively making them tax-free. This can save substantial taxes. No other business entity can do this. Possible tax-free employee fringe benefits include:

- Health, accident, and dental insurance for you and your family

- Disability insurance

- Reimbursement of medical expenses not covered by insurance

- Deferred compensation plans

- Working condition fringe benefits such as company-owned cars and group term life insurance

No Pass-Through Tax Deduction for C Corporations

The TCJA created a brand new tax deduction for pass-through entities. Between 2018 and 2025, the owner of a pass-through business can deduct up to 20% of the net income from the entity-for example, if your net income from your sole proprietorship or LLC business is $100,000, you get to deduct $20,000 from your income taxes. If you qualify for the full 20% passthrough deduction, the effective tax rate pay on your passthrough income will be 20% lower than the individual rates for non-passthrough income—for example, if you’re in the 24% income tax bracket, your effective rate after the 20% pass-through deduction will be only 19.2%, less than the 21% corporate rate. C corporations do not benefit from the 20% pass-through tax deduction.

Business Losses Are Not Deductible by C Corporation Shareholders

Another potential drawback of the C corporation is that losses are kept in the corporation. Unlike with an LLC or other pass-through business, C corporation losses are not passed through the business to be deducted on the owners’ individual tax returns. This is why C corporations are rarely used for real estate development and rental businesses, which often have losses for tax purposes due to the substantial deductions they are allowed to take.

Should Property Managers Become C Corporations?

The Bottom Line

Higher-income business owners who don’t expect to incur losses can potentially benefit from organizing their business as a C corporation. This is the case if they can benefit substantially from the tax-free employee benefits that a C corporation can provide, or if they’re able to keep a substantial amount of income in the business. Money kept in a C corporation is taxed only once at the 21% rate.

However, don’t do anything without consulting your accountant, and have him or her run the numbers for you. If C corporation tax treatment looks good, you don’t necessarily have to form a corporation to benefit. If you already have an LLC, you can elect to have it taxed as a C corporation by filing a form with the IRS. This enables you to obtain the benefits of C corporation tax treatment without going to the trouble of actually forming a corporation.

You must file the election by March 15 for it to be effective for the full calendar year.

Read more on Accounting & Reporting