Over the past three years, our list of up-and-coming real estate markets has identified a burgeoning trend: High levels of apartment construction in high-growth metro areas have caused rent growth and occupancy rates to stall in regions that had previously been considered up-and-coming.

As cities like Austin, Raleigh, Charlotte, and Nashville remain in institutional investors’ and developers’ spotlight, growth has emerged in regions of the country that have received less attention.

This is, of course, a natural phase of the real estate cycle, though it was exacerbated by pandemic-era migration patterns: Cities that have seen a swell in demand, investment, development, and, as a result, price growth are leveling off.

Meanwhile, less buzzy cities that have remained more affordable are beginning to attract residents’ and investors’ attention. That presents more opportunities to find higher cap rates and greater rent growth in new locations than in the past.

Heading into 2025, we again find that growth is strongest in four areas outside of the traditional Sun Belt region: the Midwest, Mid-Atlantic, South Central U.S., and New England—though with many different cities emerging into the spotlight than we saw on our 2024 list.

In particular, 27 of the 60 cities that made our final list are located in the Midwest. States that frequently rose to the top in our analysis were Wisconsin, Illinois, and Ohio, plus Pennsylvania and New York in the Mid-Atlantic region.

With all that said, here’s what you’ll find in this post:

- Best Real Estate Markets in Each Category: The top 5 cities when it comes to cap rates, rent growth, vacancy rates, and home price appreciation

- Top 60 Up-and-Coming Real Estate Markets 2025: Stats on each of our picks to help you assess the opportunity in each city

- Methodology: The sources from which all of our data was derived, plus a full list of the measures included in our analysis

Cheers to your growth in 2025!

How Do We Identify Up-and-Coming Real Estate Markets?

So, how did we arrive at this year’s list of up-and-coming markets?

First, we examined tried-and-true lists of top-performing and emerging real estate markets from the Wall Street Journal, Realtor.com, PricewaterhouseCoopers, the Urban Land Institute, and U.S. News.

Second, we dove into thousands of data points from the National Association of Realtors to analyze every rental market across the country on measures of rent growth, occupancy, property price appreciation, population growth, employment growth, and more.

Lastly, this year, our analyses took an additional factor into account: climate vulnerability. We used data from the Federal Emergency Management Agency to identify which markets are at greatest risk of natural disasters and extreme conditions, though of course, recent years have seen these factors impact some markets that were previously believed to be safe.

Best Real Estate Markets in Each Category

Dive into data-backed insights for the best real estate markets when it comes to cap rates, rent growth, vacancy rates, and home price appreciation.

Note: These rankings apply solely to the markets on our list.

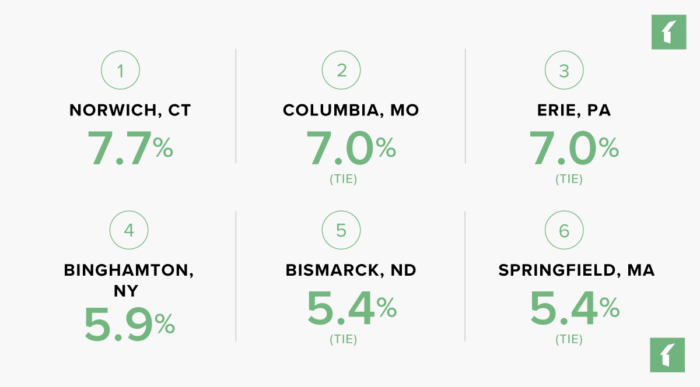

Rental Markets with the Most Rent Growth in 2024

Source: National Association of Realtors – asking rent growth in market-rate multifamily units between Q2-2023 and Q2-2024

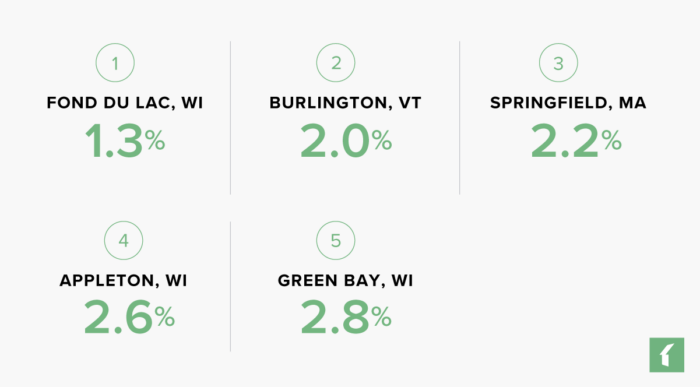

Rental Markets with the Lowest Vacancy Rates in 2024

Source: National Association of Realtors – multifamily vacancy rate as of Q2-2024

Rental Markets with the Highest Cap Rates in 2024

Source: National Association of Realtors – cap rate in market-rate multifamily units as of Q2-2024

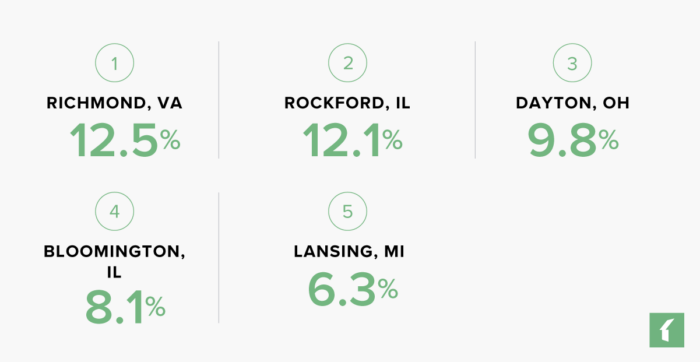

Real Estate Markets with the Most Home Price Growth in 2024

Source: National Association of Realtors – median home price appreciation between Q2-2023 and Q2-2024

Top 60 Up-and-Coming Real Estate Markets 2025

#1: Burlington, VT

Burlington-South Burlington, VT Metro Area Population: 227,719

Burlington, VT Rental Market Statistics:

Rental Inventory (Q2-’24): 6,829

Units Added Since Q2-’23: +86

Asking Rent Growth Since Q2-’23: 5.0%

Asking Rent (Q2-’24): $1,858

Effective Rent (Q2-’24): $1,853

Multifamily Vacancy Rate (Q2-’24): 2.0%

Multifamily Cap Rate (Q2-’24): 7.4%

Source: National Association of Realtors

Burlington, VT Housing Market Statistics:

Median Home Price (Q2-’24): $528,900

Home Price Appreciation Since Q2-’23: 8.7%

Source: National Association of Realtors

Burlington, VT Economic Statistics

Population Growth (2022): 0.7%

GDP Growth (2022): 8.8%

Job Growth (Q2-’24): 1.3%

Source: National Association of Realtors

Lists That Mention Burlington, VT:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #52

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #12

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #6

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #17

#2: Rochester, NY

Rochester, NY Metro Area Population: 1,052,087

Rochester, NY Rental Market Statistics:

Rental Inventory (Q2-’24): 58,900

Units Added Since Q2-’23: +777

Asking Rent Growth Since Q2-’23: 3.7%

Asking Rent (Q2-’24): $1,401

Effective Rent (Q2-’24): $1,392

Multifamily Vacancy Rate (Q2-’24): 5.0%

Multifamily Cap Rate (Q2-’24): 8.6%

Source: National Association of Realtors

Rochester, NY Housing Market Statistics:

Median Home Price (Q2-’24): $268,900

Home Price Appreciation Since Q2-’23: 11.8%

Source: National Association of Realtors

Rochester, NY Economic Statistics

Population Growth (2022): -0.4%

GDP Growth (2022): 7.9%

Job Growth (Q2-’24): 1.9%

Source: National Association of Realtors

Lists That Mention Rochester, NY:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #34

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #32

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #18

Best Real Estate Markets – Mid-Sized Cities (WalletHub): #51

Best Places to Live (U.S. News): #74

#3: Columbia, MO

Columbia, MO Metro Area Population: 215,811

Columbia, MO Rental Market Statistics:

Rental Inventory (Q2-’24): 11,823

Units Added Since Q2-’23: +48

Asking Rent Growth Since Q2-’23: 7.0%

Asking Rent (Q2-’24): $1,119

Effective Rent (Q2-’24): $1,114

Multifamily Vacancy Rate (Q2-’24): 3.7%

Multifamily Cap Rate (Q2-’24): 8.8%

Source: National Association of Realtors

Columbia, MO Housing Market Statistics:

Median Home Price (Q2-’24): $327,100

Home Price Appreciation Since Q2-’23: 5.5%

Source: National Association of Realtors

Columbia, MO Economic Statistics

Population Growth (2022): 0.9%

GDP Growth (2022): 6.0%

Job Growth (Q2-’24): 1.9%

Source: National Association of Realtors

Lists That Mention Columbia, MO:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #77

#4: Johnson City, TN

Johnson City, TN Metro Area Population: 212,561

Johnson City, TN Rental Market Statistics:

Rental Inventory (Q2-’24): 7,904

Units Added Since Q2-’23: +180

Asking Rent Growth Since Q2-’23: 6.3%

Asking Rent (Q2-’24): $1,076

Effective Rent (Q2-’24): $1,070

Multifamily Vacancy Rate (Q2-’24): 4.2%

Multifamily Cap Rate (Q2-’24): 7.5%

Source: National Association of Realtors

Johnson City, TN Housing Market Statistics:

Median Home Price (Q2-’24): $323,000

Home Price Appreciation Since Q2-’23: 9.9%

Source: National Association of Realtors

Johnson City, TN Economic Statistics

Population Growth (2022): 2.9%

GDP Growth (2022): 7.9%

Job Growth (Q2-’24): -0.7%

Source: National Association of Realtors

Lists That Mention Johnson City, TN:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #9

#5: Syracuse, NY

Syracuse, NY Metro Area Population: 652,956

Syracuse, NY Rental Market Statistics:

Rental Inventory (Q2-’24): 34,191

Units Added Since Q2-’23: +30

Asking Rent Growth Since Q2-’23: 4.9%

Asking Rent (Q2-’24): $1,271

Effective Rent (Q2-’24): $1,264

Multifamily Vacancy Rate (Q2-’24): 5.2%

Multifamily Cap Rate (Q2-’24): 8.4%

Source: National Association of Realtors

Syracuse, NY Housing Market Statistics:

Median Home Price (Q2-’24): $233,200

Home Price Appreciation Since Q2-’23: 10.2%

Source: National Association of Realtors

Syracuse, NY Economic Statistics

Population Growth (2022): -0.7%

GDP Growth (2022): 7.4%

Job Growth (Q2-’24): 2.0%

Source: National Association of Realtors

Lists That Mention Syracuse, NY:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #149

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #114

Best Places to Live (U.S. News): #73

#6: Omaha, NE

Omaha-Council Bluffs, NE-IA Metro Area Population: 984,548

Omaha, NE Rental Market Statistics:

Rental Inventory (Q2-’24): 82,913

Units Added Since Q2-’23: +2,395

Asking Rent Growth Since Q2-’23: 3.1%

Asking Rent (Q2-’24): $1,200

Effective Rent (Q2-’24): $1,191

Multifamily Vacancy Rate (Q2-’24): 6.2%

Multifamily Cap Rate (Q2-’24): 7.0%

Source: National Association of Realtors

Omaha, NE Housing Market Statistics:

Median Home Price (Q2-’24): $313,200

Home Price Appreciation Since Q2-’23: 5.3%

Source: National Association of Realtors

Omaha, NE Economic Statistics

Population Growth (2022): 0.5%

GDP Growth (2022): 12.8%

Job Growth (Q2-’24): 2.0%

Source: National Association of Realtors

Lists That Mention Omaha, NE:

Overall Real Estate Prospects (PwC/ULI): #47

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #175

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #101

Best Real Estate Markets – Small Cities (WalletHub): #24

Best Places to Live (U.S. News): #18

#7: Binghamton, NY

Binghamton, NY Metro Area Population: 243,792

Binghamton, NY Rental Market Statistics:

Rental Inventory (Q2-’24): 8,135

Units Added Since Q2-’23: +6

Asking Rent Growth Since Q2-’23: 5.9%

Asking Rent (Q2-’24): $984

Effective Rent (Q2-’24): $980

Multifamily Vacancy Rate (Q2-’24): 4.0%

Multifamily Cap Rate (Q2-’24): 9.6%

Source: National Association of Realtors

Binghamton, NY Housing Market Statistics:

Median Home Price (Q2-’24): $170,400

Home Price Appreciation Since Q2-’23: 6.5%

Source: National Association of Realtors

Binghamton, NY Economic Statistics

Population Growth (2022): 6.8%

GDP Growth (2022): 2.0%

Job Growth (Q2-’24): 4.1%

Source: National Association of Realtors

Lists That Mention Binghamton, NY:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #113

#8: Erie, PA

Erie, PA Metro Area Population: 267,571

Erie, PA Rental Market Statistics:

Rental Inventory (Q2-’24): 7,009

Units Added Since Q2-’23: +126

Asking Rent Growth Since Q2-’23: 7.0%

Asking Rent (Q2-’24): $1,144

Effective Rent (Q2-’24): $1,140

Multifamily Vacancy Rate (Q2-’24): 4.0%

Multifamily Cap Rate (Q2-’24): 8.8%

Source: National Association of Realtors

Erie, PA Housing Market Statistics:

Median Home Price (Q2-’24): $180,200

Home Price Appreciation Since Q2-’23: 6.6%

Source: National Association of Realtors

Erie, PA Economic Statistics

Population Growth (2022): -0.5%

GDP Growth (2022): 6.8%

Job Growth (Q2-’24): 1.0%

Source: National Association of Realtors

Lists That Mention Erie, PA:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #57

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #28

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #14

Best Real Estate Markets – Large Cities (WalletHub): #109

#9: Fort Wayne, IN

Fort Wayne, IN Metro Area Population: 457,842

Fort Wayne, IN Rental Market Statistics:

Rental Inventory (Q2-’24): 24,824

Units Added Since Q2-’23: +809

Asking Rent Growth Since Q2-’23: 3.7%

Asking Rent (Q2-’24): $1,070

Effective Rent (Q2-’24): $1,064

Multifamily Vacancy Rate (Q2-’24): 6.1%

Multifamily Cap Rate (Q2-’24): 7.9%

Source: National Association of Realtors

Fort Wayne, IN Housing Market Statistics:

Median Home Price (Q2-’24): $248,600

Home Price Appreciation Since Q2-’23: 5.1%

Source: National Association of Realtors

Fort Wayne, IN Economic Statistics

Population Growth (2022): 0.7%

GDP Growth (2022): 11.5%

Job Growth (Q2-’24): 0.1%

Source: National Association of Realtors

Lists That Mention Fort Wayne, IN:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #10

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #6

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #1

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #12

Best Real Estate Markets – Mid-Sized Cities (WalletHub): #47

Best Places to Live (U.S. News): #20

#10: Green Bay, WI

Green Bay, WI Metro Area Population: 331,882

Green Bay, WI Rental Market Statistics:

Rental Inventory (Q2-’24): 22,112

Units Added Since Q2-’23: +322

Asking Rent Growth Since Q2-’23: 3.9%

Asking Rent (Q2-’24): $1,084

Effective Rent (Q2-’24): $1,079

Multifamily Vacancy Rate (Q2-’24): 2.8%

Multifamily Cap Rate (Q2-’24): 8.2%

Source: National Association of Realtors

Green Bay, WI Housing Market Statistics:

Median Home Price (Q2-’24): $316,100

Home Price Appreciation Since Q2-’23: 6.6%

Source: National Association of Realtors

Green Bay, WI Economic Statistics

Population Growth (2022): 0.2%

GDP Growth (2022): 8.5%

Job Growth (Q2-’24): 0.7%

Source: National Association of Realtors

Lists That Mention Green Bay, WI:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #86

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #36

Best Real Estate Markets – Large Cities (WalletHub): #31

#11: Springfield, MA

Springfield, MA Metro Area Population: 460,291

Springfield, MA Rental Market Statistics:

Rental Inventory (Q2-’24): 23,742

Units Added Since Q2-’23: +383

Asking Rent Growth Since Q2-’23: 5.4%

Asking Rent (Q2-’24): $1,466

Effective Rent (Q2-’24): $1,460

Multifamily Vacancy Rate (Q2-’24): 2.2%

Multifamily Cap Rate (Q2-’24): 8.2%

Source: National Association of Realtors

Springfield, MA Housing Market Statistics:

Median Home Price (Q2-’24): $364,900

Home Price Appreciation Since Q2-’23: 8.6%

Source: National Association of Realtors

Springfield, MA Economic Statistics

Population Growth (2022): -0.1%

GDP Growth (2022): 6.7%

Job Growth (Q2-’24): 0.1%

Source: National Association of Realtors

Lists That Mention Springfield, MA:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #41

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #11

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #20

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #6

Best Real Estate Markets – Mid-Sized Cities (WalletHub): #89

Best Places to Live (U.S. News): #138

#12: Appleton, WI

Appleton, WI Metro Area Population: 246,433

Appleton, WI Rental Market Statistics:

Rental Inventory (Q2-’24): 12,675

Units Added Since Q2-’23: +389

Asking Rent Growth Since Q2-’23: 2.5%

Asking Rent (Q2-’24): $1,128

Effective Rent (Q2-’24): $1,123

Multifamily Vacancy Rate (Q2-’24): 2.6%

Multifamily Cap Rate (Q2-’24): 8.0%

Source: National Association of Realtors

Appleton, WI Housing Market Statistics:

Median Home Price (Q2-’24): $311,700

Home Price Appreciation Since Q2-’23: 9.5%

Source: National Association of Realtors

Appleton, WI Economic Statistics

Population Growth (2022): 0.3%

GDP Growth (2022): 7.1%

Job Growth (Q2-’24): 0.3%

Source: National Association of Realtors

Lists That Mention Appleton, WI:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #45

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #16

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #10

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #20

#13: Fond du Lac, WI

Fond du Lac, WI Metro Area Population: 103,948

Fond du Lac, WI Rental Market Statistics:

Rental Inventory (Q2-’24): 4,518

Units Added Since Q2-’23: +0

Asking Rent Growth Since Q2-’23: 4.9%

Asking Rent (Q2-’24): $975

Effective Rent (Q2-’24): $971

Multifamily Vacancy Rate (Q2-’24): 1.3%

Multifamily Cap Rate (Q2-’24): 9.7%

Source: National Association of Realtors

Fond du Lac, WI Housing Market Statistics:

Median Home Price (Q2-’24): $237,900

Home Price Appreciation Since Q2-’23: -2.3%

Source: National Association of Realtors

Fond du Lac, WI Economic Statistics

Population Growth (2022): -0.5%

GDP Growth (2022): 8.9%

Job Growth (Q2-’24): 1.7%

Source: National Association of Realtors

Lists That Mention Fond du Lac, WI:

None – this is an under-the-radar pick

#14: Springfield, MO

Springfield, MO Metro Area Population: 490,886

Springfield, MO Rental Market Statistics:

Rental Inventory (Q2-’24): 25,424

Units Added Since Q2-’23: +465

Asking Rent Growth Since Q2-’23: 2.2%

Asking Rent (Q2-’24): $931

Effective Rent (Q2-’24): $926

Multifamily Vacancy Rate (Q2-’24): 4.7%

Multifamily Cap Rate (Q2-’24): 7.9%

Source: National Association of Realtors

Springfield, MO Housing Market Statistics:

Median Home Price (Q2-’24): $250,400

Home Price Appreciation Since Q2-’23: 1.4%

Source: National Association of Realtors

Springfield, MO Economic Statistics

Population Growth (2022): 1.0%

GDP Growth (2022): 9.6%

Job Growth (Q2-’24): 1.7%

Source: National Association of Realtors

Lists That Mention Springfield, MO:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #35

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #5

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #15

Best Real Estate Markets – Mid-Sized Cities (WalletHub): #59

Best Places to Live (U.S. News): #58

#15 (tie): Worcester, MA

Worcester, MA-CT Metro Area Population: 866,866

Worcester, MA Rental Market Statistics:

Rental Inventory (Q2-’24): 31,485

Units Added Since Q2-’23: +953

Asking Rent Growth Since Q2-’23: 2.7%

Asking Rent (Q2-’24): $1,949

Effective Rent (Q2-’24): $1,935

Multifamily Vacancy Rate (Q2-’24): 4.7%

Multifamily Cap Rate (Q2-’24): 6.6%

Source: National Association of Realtors

Worcester, MA Housing Market Statistics:

Median Home Price (Q2-’24): $473,400

Home Price Appreciation Since Q2-’23: 4.7%

Source: National Association of Realtors

Worcester, MA Economic Statistics

Population Growth (2022): 0.2%

GDP Growth (2022): 8.6%

Job Growth (Q2-’24): 1.9%

Source: National Association of Realtors

Lists That Mention Worcester, MA:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #27

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #14

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #17

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #8

Best Real Estate Markets – Mid-Sized Cities (WalletHub): #58

Best Places to Live (U.S. News): #136

#15 (tie): Buffalo, NY

Buffalo-Cheektowaga, NY Metro Area Population: 1,155,604

Buffalo, NY Rental Market Statistics:

Rental Inventory (Q2-’24): 46,219

Units Added Since Q2-’23: +931

Asking Rent Growth Since Q2-’23: 4.1%

Asking Rent (Q2-’24): $1,282

Effective Rent (Q2-’24): $1,275

Multifamily Vacancy Rate (Q2-’24): 4.6%

Multifamily Cap Rate (Q2-’24): 7.4%

Source: National Association of Realtors

Buffalo, NY Housing Market Statistics:

Median Home Price (Q2-’24): $261,000

Home Price Appreciation Since Q2-’23: 10.2%

Source: National Association of Realtors

Buffalo, NY Economic Statistics

Population Growth (2022): -0.1%

GDP Growth (2022): 10.1%

Job Growth (Q2-’24): 1.2%

Source: National Association of Realtors

Lists That Mention Buffalo, NY:

Overall Real Estate Prospects (PwC/ULI): #78

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #107

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #60

Best Real Estate Markets – Mid-Sized Cities (WalletHub): #55

Best Places to Live (U.S. News): #34

#17: Fayetteville, AR

Fayetteville-Springdale-Rogers, AR Metro Area Population: 590,295

Fayetteville, AR Rental Market Statistics:

Rental Inventory (Q2-’24): 41,671

Units Added Since Q2-’23: +1,926

Asking Rent Growth Since Q2-’23: 2.1%

Asking Rent (Q2-’24): $1,119

Effective Rent (Q2-’24): $1,108

Multifamily Vacancy Rate (Q2-’24): 7.6%

Multifamily Cap Rate (Q2-’24): 6.5%

Source: National Association of Realtors

Fayetteville, AR Housing Market Statistics:

Median Home Price (Q2-’24): $372,800

Home Price Appreciation Since Q2-’23: 4.7%

Source: National Association of Realtors

Fayetteville, AR Economic Statistics

Population Growth (2022): 3.3%

GDP Growth (2022): 9.9%

Job Growth (Q2-’24): 3.1%

Source: National Association of Realtors

Lists That Mention Fayetteville, AR:

Overall Real Estate Prospects (PwC/ULI): #46

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #170

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #66

Best Places to Live (U.S. News): #21

#18: Bloomington, IL

Bloomington, IL Metro Area Population: 170,441

Bloomington, IL Rental Market Statistics:

Rental Inventory (Q2-’24): 9,797

Units Added Since Q2-’23: +62

Asking Rent Growth Since Q2-’23: 4.3%

Asking Rent (Q2-’24): $1,103

Effective Rent (Q2-’24): $1,097

Multifamily Vacancy Rate (Q2-’24): 4.6%

Multifamily Cap Rate (Q2-’24): 8.5%

Source: National Association of Realtors

Bloomington, IL Housing Market Statistics:

Median Home Price (Q2-’24): $258,300

Home Price Appreciation Since Q2-’23: 8.1%

Source: National Association of Realtors

Bloomington, IL Economic Statistics

Population Growth (2022): 0.1%

GDP Growth (2022): 6.3%

Job Growth (Q2-’24): 1.1%

Source: National Association of Realtors

Lists That Mention Bloomington, IL:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #61

#19: Canton, OH

Canton-Massillon, OH Metro Area Population: 399,474

Canton, OH Rental Market Statistics:

Rental Inventory (Q2-’24): 12,772

Units Added Since Q2-’23: +0

Asking Rent Growth Since Q2-’23: 3.8%

Asking Rent (Q2-’24): $914

Effective Rent (Q2-’24): $909

Multifamily Vacancy Rate (Q2-’24): 5.1%

Multifamily Cap Rate (Q2-’24): 10.9%

Source: National Association of Realtors

Canton, OH Housing Market Statistics:

Median Home Price (Q2-’24): $207,500

Home Price Appreciation Since Q2-’23: 9.9%

Source: National Association of Realtors

Canton, OH Economic Statistics

Population Growth (2022): -0.3%

GDP Growth (2022): 12.1%

Job Growth (Q2-’24): 0.6%

Source: National Association of Realtors

Lists That Mention Canton, OH:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #3

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #2

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #2

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #1

#20: Waterloo, IA

Waterloo-Cedar Falls, IA Metro Area Population: 168,162

Waterloo, IA Rental Market Statistics:

Rental Inventory (Q2-’24): 3,955

Units Added Since Q2-’23: +0

Asking Rent Growth Since Q2-’23: 2.9%

Asking Rent (Q2-’24): $972

Effective Rent (Q2-’24): $968

Multifamily Vacancy Rate (Q2-’24): 5.2%

Multifamily Cap Rate (Q2-’24): 9.3%

Source: National Association of Realtors

Waterloo, IA Housing Market Statistics:

Median Home Price (Q2-’24): $185,900

Home Price Appreciation Since Q2-’23: 8.4%

Source: National Association of Realtors

Waterloo, IA Economic Statistics

Population Growth (2022): 0.1%

GDP Growth (2022): 5.9%

Job Growth (Q2-’24): 0.2%

Source: National Association of Realtors

Lists That Mention Waterloo, IA:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #89

#21: Madison, WI

Madison, WI Metro Area Population: 694,345

Madison, WI Rental Market Statistics:

Rental Inventory (Q2-’24): 74,597

Units Added Since Q2-’23: +3,844

Asking Rent Growth Since Q2-’23: 3.4%

Asking Rent (Q2-’24): $1,548

Effective Rent (Q2-’24): $1,539

Multifamily Vacancy Rate (Q2-’24): 4.2%

Multifamily Cap Rate (Q2-’24): 6.7%

Source: National Association of Realtors

Madison, WI Housing Market Statistics:

Median Home Price (Q2-’24): $470,800

Home Price Appreciation Since Q2-’23: 9.7%

Source: National Association of Realtors

Madison, WI Economic Statistics

Population Growth (2022): 0.6%

GDP Growth (2022): 7.2%

Job Growth (Q2-’24): 1.0%

Source: National Association of Realtors

Lists That Mention Madison, WI:

Overall Real Estate Prospects (PwC/ULI): #77

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #58

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #38

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #

Best Real Estate Markets – Mid-Sized Cities (WalletHub): #14

Best Places to Live (U.S. News): #14

#22: South Bend, IN

South Bend-Mishawaka, IN-MI Metro Area Population: 324,490

South Bend, IN Rental Market Statistics:

Rental Inventory (Q2-’24): 16,748

Units Added Since Q2-’23: +69

Asking Rent Growth Since Q2-’23: 2.1%

Asking Rent (Q2-’24): $1,199

Effective Rent (Q2-’24): $1,192

Multifamily Vacancy Rate (Q2-’24): 5.9%

Multifamily Cap Rate (Q2-’24): 7.7%

Source: National Association of Realtors

South Bend, IN Housing Market Statistics:

Median Home Price (Q2-’24): $205,300

Home Price Appreciation Since Q2-’23: 2.3%

Source: National Association of Realtors

South Bend, IN Economic Statistics

Population Growth (2022): 0.0%

GDP Growth (2022): 10.9%

Job Growth (Q2-’24): 1.6%

Source: National Association of Realtors

Lists That Mention South Bend, IN:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #56

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #31

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #5

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #11

Best Places to Live (U.S. News): #25

#23: Topeka, KS

Topeka, KS Metro Area Population: 232,322

Topeka, KS Rental Market Statistics:

Rental Inventory (Q2-’24): 9,854

Units Added Since Q2-’23: +0

Asking Rent Growth Since Q2-’23: 4.3%

Asking Rent (Q2-’24): $897

Effective Rent (Q2-’24): $893

Multifamily Vacancy Rate (Q2-’24): 8.2%

Multifamily Cap Rate (Q2-’24): 8.4%

Source: National Association of Realtors

Topeka, KS Housing Market Statistics:

Median Home Price (Q2-’24): $211,800

Home Price Appreciation Since Q2-’23: 8.8%

Source: National Association of Realtors

Topeka, KS Economic Statistics

Population Growth (2022): -0.4%

GDP Growth (2022): 6.6%

Job Growth (Q2-’24): 2.5%

Source: National Association of Realtors

Lists That Mention Topeka, KS:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #16

#24: Wichita Falls, TX

Wichita Falls, TX Metro Area Population: 149,947

Wichita Falls, TX Rental Market Statistics:

Rental Inventory (Q2-’24): 6,565

Units Added Since Q2-’23: +216

Asking Rent Growth Since Q2-’23: 2.3%

Asking Rent (Q2-’24): $881

Effective Rent (Q2-’24): $872

Multifamily Vacancy Rate (Q2-’24): 12.4%

Multifamily Cap Rate (Q2-’24): 7.7%

Source: National Association of Realtors

Wichita Falls, TX Housing Market Statistics:

Median Home Price (Q2-’24): $201,800

Home Price Appreciation Since Q2-’23: 4.4%

Source: National Association of Realtors

Wichita Falls, Texas Economic Statistics

Population Growth (2022): 0.2%

GDP Growth (2022): 10.3%

Job Growth (Q2-’24): 0.2%

Source: National Association of Realtors

Lists That Mention Wichita Falls, TX:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #126

#25: Harrisburg, PA

Harrisburg-Carlisle, PA Metro Area Population: 606,055

Harrisburg, PA Rental Market Statistics:

Rental Inventory (Q2-’24): 32,511

Units Added Since Q2-’23: +1,224

Asking Rent Growth Since Q2-’23: 2.7%

Asking Rent (Q2-’24): $1,338

Effective Rent (Q2-’24): $1,329

Multifamily Vacancy Rate (Q2-’24): 6.3%

Multifamily Cap Rate (Q2-’24): 7.0%

Source: National Association of Realtors

Harrisburg, PA Housing Market Statistics:

Median Home Price (Q2-’24): $273,400

Home Price Appreciation Since Q2-’23: 9.1%

Source: National Association of Realtors

Harrisburg, PA Economic Statistics

Population Growth (2022): 1.2%

GDP Growth (2022): 7.1%

Job Growth (Q2-’24): 1.4%

Source: National Association of Realtors

Lists That Mention Harrisburg, PA:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #53

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #39

Best Places to Live (U.S. News): #109

#26: Abilene, TX

Abilene, TX Metro Area Population: 180,224

Abilene, TX Rental Market Statistics:

Rental Inventory (Q2-’24): 8,467

Units Added Since Q2-’23: +344

Asking Rent Growth Since Q2-’23: 2.9%

Asking Rent (Q2-’24): $977

Effective Rent (Q2-’24): $966

Multifamily Vacancy Rate (Q2-’24): 9.9%

Multifamily Cap Rate (Q2-’24): 7.6%

Source: National Association of Realtors

Abilene, TX Housing Market Statistics:

Median Home Price (Q2-’24): $255,000

Home Price Appreciation Since Q2-’23: 8.5%

Source: National Association of Realtors

Abilene, Texas Economic Statistics

Population Growth (2022): 1.3%

GDP Growth (2022): 11.6%

Job Growth (Q2-’24): 1.3%

Source: National Association of Realtors

Lists That Mention Abilene, TX:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #223

#27: Lincoln, NE

Lincoln, NE Metro Area Population: 343,620

Lincoln, NE Rental Market Statistics:

Rental Inventory (Q2-’24): 32,525

Units Added Since Q2-’23: +1,684

Asking Rent Growth Since Q2-’23: 2.1%

Asking Rent (Q2-’24): $1,140

Effective Rent (Q2-’24): $1,133

Multifamily Vacancy Rate (Q2-’24): 5.6%

Multifamily Cap Rate (Q2-’24): 7.4%

Source: National Association of Realtors

Lincoln, NE Housing Market Statistics:

Median Home Price (Q2-’24): $298,700

Home Price Appreciation Since Q2-’23: 2.0%

Source: National Association of Realtors

Lincoln, NE Economic Statistics

Population Growth (2022): -0.5%

GDP Growth (2022): 10.0%

Job Growth (Q2-’24): 1.7%

Source: National Association of Realtors

Lists That Mention Lincoln, NE:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #140

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #86

Best Real Estate Markets – Mid-Sized Cities (WalletHub): #37

Best Places to Live (U.S. News): #24

#28: Knoxville, TN

Knoxville, TN Metro Area Population: 947,017

Knoxville, TN Rental Market Statistics:

Rental Inventory (Q2-’24): 44,301

Units Added Since Q2-’23: +2,007

Asking Rent Growth Since Q2-’23: 1.7%

Asking Rent (Q2-’24): $1,428

Effective Rent (Q2-’24): $1,417

Multifamily Vacancy Rate (Q2-’24): 6.9%

Multifamily Cap Rate (Q2-’24): 6.4%

Source: National Association of Realtors

Knoxville, TN Housing Market Statistics:

Median Home Price (Q2-’24): $366,400

Home Price Appreciation Since Q2-’23: 7.0%

Source: National Association of Realtors

Knoxville, TN Economic Statistics

Population Growth (2022): 1.5%

GDP Growth (2022): 10.2%

Job Growth (Q2-’24): -0.8%

Source: National Association of Realtors

Lists That Mention Knoxville, TN:

Overall Real Estate Prospects (PwC/ULI): #48

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #32

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #26

Best Real Estate Markets – Mid-Sized Cities (WalletHub): #28

Best Places to Live (U.S. News): #29

#29: Kingsport, TN

Kingsport-Bristol, TN-VA Metro Area Population: 312,490

Kingsport, TN Rental Market Statistics:

Rental Inventory (Q2-’24): 6,036

Units Added Since Q2-’23: +41

Asking Rent Growth Since Q2-’23: 4.1%

Asking Rent (Q2-’24): $1,068

Effective Rent (Q2-’24): $1,062

Multifamily Vacancy Rate (Q2-’24): 6.8%

Multifamily Cap Rate (Q2-’24): 7.1%

Source: National Association of Realtors

Kingsport, TN Housing Market Statistics:

Median Home Price (Q2-’24): $263,000

Home Price Appreciation Since Q2-’23: 2.1%

Source: National Association of Realtors

Kingsport, TN Economic Statistics

Population Growth (2022): 1.0%

GDP Growth (2022): 10.4%

Job Growth (Q2-’24): -0.4%

Source: National Association of Realtors

Lists That Mention Kingsport, TN:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #14

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #9

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #7

#30: Oshkosh, WI

Oshkosh-Neenah, WI Metro Area Population: 171,735

Oshkosh, WI Rental Market Statistics:

Rental Inventory (Q2-’24): 11,249

Units Added Since Q2-’23: +475

Asking Rent Growth Since Q2-’23: 3.3%

Asking Rent (Q2-’24): $1,013

Effective Rent (Q2-’24): $1,007

Multifamily Vacancy Rate (Q2-’24): 5.2%

Multifamily Cap Rate (Q2-’24): 8.2%

Source: National Association of Realtors

Oshkosh, WI Housing Market Statistics:

Median Home Price (Q2-’24): $278,500

Home Price Appreciation Since Q2-’23: 10.8%

Source: National Association of Realtors

Oshkosh, WI Economic Statistics

Population Growth (2022): -0.5%

GDP Growth (2022): 6.7%

Job Growth (Q2-’24): 0.0%

Source: National Association of Realtors

Lists That Mention Oshkosh, WI:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #5

#31: Rockford, IL

Rockford, IL Metro Area Population: 334,124

Rockford, IL Rental Market Statistics:

Rental Inventory (Q2-’24): 8,780

Units Added Since Q2-’23: +60

Asking Rent Growth Since Q2-’23: 4.5%

Asking Rent (Q2-’24): $1,039

Effective Rent (Q2-’24): $1,035

Multifamily Vacancy Rate (Q2-’24): 4.0%

Multifamily Cap Rate (Q2-’24): 8.1%

Source: National Association of Realtors

Rockford, IL Housing Market Statistics:

Median Home Price (Q2-’24): $197,700

Home Price Appreciation Since Q2-’23: 12.1%

Source: National Association of Realtors

Rockford, IL Economic Statistics

Population Growth (2022): -0.3%

GDP Growth (2022): 10.6%

Job Growth (Q2-’24): -0.7%

Source: National Association of Realtors

Lists That Mention Rockford, IL:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #13

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #1

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #8

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #7

Best Real Estate Markets – Large Cities (WalletHub): #94

Best Places to Live (U.S. News): #105

#32: Hartford, CT

Hartford-East Hartford-Middletown, CT Metro Area Population: 1,151,543

Hartford, CT Rental Market Statistics:

Rental Inventory (Q2-’24): 69,139

Units Added Since Q2-’23: +1,125

Asking Rent Growth Since Q2-’23: 4.0%

Asking Rent (Q2-’24): $1,677

Effective Rent (Q2-’24): $1,666

Multifamily Vacancy Rate (Q2-’24): 4.6%

Multifamily Cap Rate (Q2-’24): 7.3%

Source: National Association of Realtors

Hartford, CT Housing Market Statistics:

Median Home Price (Q2-’24): $396,100

Home Price Appreciation Since Q2-’23: 10.7%

Source: National Association of Realtors

Hartford, CT Economic Statistics

Population Growth (2022): 0.8%

GDP Growth (2022): 8.3%

Job Growth (Q2-’24): 1.3%

Source: National Association of Realtors

Lists That Mention Hartford, CT:

Overall Real Estate Prospects (PwC/ULI): #81

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #25

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #37

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #15

Best Real Estate Markets – Large Cities (WalletHub): #124

Best Places to Live (U.S. News): #148

#33: Portland, ME

Portland-South Portland, ME Metro Area Population: 566,329

Portland, ME Rental Market Statistics:

Rental Inventory (Q2-’24): 18,021

Units Added Since Q2-’23: +1,366

Asking Rent Growth Since Q2-’23: 2.2%

Asking Rent (Q2-’24): $1,865

Effective Rent (Q2-’24): $1,850

Multifamily Vacancy Rate (Q2-’24): 5.0%

Multifamily Cap Rate (Q2-’24): 7.7%

Source: National Association of Realtors

Portland, ME Housing Market Statistics:

Median Home Price (Q2-’24): $566,400

Home Price Appreciation Since Q2-’23: 5.1%

Source: National Association of Realtors

Portland, ME Economic Statistics

Population Growth (2022): 0.8%

GDP Growth (2022): 9.2%

Job Growth (Q2-’24): 1.2%

Source: National Association of Realtors

Lists That Mention Portland, ME:

Overall Real Estate Prospects (PwC/ULI): #75

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #18

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #10

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #19

Best Places to Live (U.S. News): #38

#34: Oklahoma City, OK

Oklahoma City, OK Metro Area Population: 1,477,926

Oklahoma City, OK Rental Market Statistics:

Rental Inventory (Q2-’24): 99,237

Units Added Since Q2-’23: +2,568

Asking Rent Growth Since Q2-’23: 2.5%

Asking Rent (Q2-’24): $996

Effective Rent (Q2-’24): $987

Multifamily Vacancy Rate (Q2-’24): 11.7%

Multifamily Cap Rate (Q2-’24): 7.6%

Source: National Association of Realtors

Oklahoma City, OK Housing Market Statistics:

Median Home Price (Q2-’24): $262,700

Home Price Appreciation Since Q2-’23: 6.1%

Source: National Association of Realtors

Oklahoma City, OK Economic Statistics

Population Growth (2022): 1.2%

GDP Growth (2022): 10.6%

Job Growth (Q2-’24): 3.0%

Source: National Association of Realtors

Lists That Mention Oklahoma City, OK:

Overall Real Estate Prospects (PwC/ULI): #41

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #239

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #138

Best Real Estate Markets – Small Cities (WalletHub): #35

Best Places to Live (U.S. News): #16

#35: Bismarck, ND

Bismarck, ND Metro Area Population: 135,589

Bismarck, ND Rental Market Statistics:

Rental Inventory (Q2-’24): 6,967

Units Added Since Q2-’23: +26

Asking Rent Growth Since Q2-’23: 5.4%

Asking Rent (Q2-’24): $1,156

Effective Rent (Q2-’24): $1,152

Multifamily Vacancy Rate (Q2-’24): 3.2%

Multifamily Cap Rate (Q2-’24): 9.7%

Source: National Association of Realtors

Bismarck, ND Housing Market Statistics:

Median Home Price (Q2-’24): $291,400

Home Price Appreciation Since Q2-’23: 5.0%

Source: National Association of Realtors

Bismarck, ND Economic Statistics

Population Growth (2022): 0.3%

GDP Growth (2022): 6.8%

Job Growth (Q2-’24): -0.1%

Source: National Association of Realtors

Lists That Mention Bismarck, ND:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #201

#36: Reading, PA

Reading, PA Metro Area Population: 432,821

Reading, PA Rental Market Statistics:

Rental Inventory (Q2-’24): 10,611

Units Added Since Q2-’23: +289

Asking Rent Growth Since Q2-’23: 4.2%

Asking Rent (Q2-’24): $1,410

Effective Rent (Q2-’24): $1,403

Multifamily Vacancy Rate (Q2-’24): 3.4%

Multifamily Cap Rate (Q2-’24): 7.5%

Source: National Association of Realtors

Reading, PA Housing Market Statistics:

Median Home Price (Q2-’24): $281,100

Home Price Appreciation Since Q2-’23: 5.1%

Source: National Association of Realtors

Reading, PA Economic Statistics

Population Growth (2022): 0.3%

GDP Growth (2022): 7.1%

Job Growth (Q2-’24): 1.3%

Source: National Association of Realtors

Lists That Mention Reading, PA:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #20

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #30

Best Places to Live (U.S. News): #142

#37: Manchester, NH

Manchester-Nashua, NH Metro Area Population: 427,354

Manchester, NH Rental Market Statistics:

Rental Inventory (Q2-’24): 23,858

Units Added Since Q2-’23: +744

Asking Rent Growth Since Q2-’23: 3.0%

Asking Rent (Q2-’24): $2,017

Effective Rent (Q2-’24): $2,003

Multifamily Vacancy Rate (Q2-’24): 4.3%

Multifamily Cap Rate (Q2-’24): 6.4%

Source: National Association of Realtors

Manchester, NH Housing Market Statistics:

Median Home Price (Q2-’24): $568,700

Home Price Appreciation Since Q2-’23: 16.2%

Source: National Association of Realtors

Manchester, NH Economic Statistics

Population Growth (2022): 0.6%

GDP Growth (2022): 6.0%

Job Growth (Q2-’24): 0.7%

Source: National Association of Realtors

Lists That Mention Manchester, NH:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #19

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #7

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #4

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #4

Best Real Estate Markets – Large Cities (WalletHub): #20

Best Places to Live (U.S. News): #103

#38: Toledo, OH

Toledo, OH Metro Area Population: 600,141

Toledo, OH Rental Market Statistics:

Rental Inventory (Q2-’24): 40,531

Units Added Since Q2-’23: +391

Asking Rent Growth Since Q2-’23: 2.4%

Asking Rent (Q2-’24): $956

Effective Rent (Q2-’24): $949

Multifamily Vacancy Rate (Q2-’24): 6.1%

Multifamily Cap Rate (Q2-’24): 9.4%

Source: National Association of Realtors

Toledo, OH Housing Market Statistics:

Median Home Price (Q2-’24): $188,500

Home Price Appreciation Since Q2-’23: 6.4%

Source: National Association of Realtors

Toledo, OH Economic Statistics

Population Growth (2022): -0.6%

GDP Growth (2022): 10.2%

Job Growth (Q2-’24): 0.0%

Source: National Association of Realtors

Lists That Mention Toledo, OH:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #17

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #18

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #13

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #19

Best Real Estate Markets – Mid-Sized Cities (WalletHub): #90

Best Places to Live (U.S. News): #98

#39: Youngstown, OH

Youngstown-Warren-Boardman, OH-PA Metro Area Population: 425,969

Youngstown, OH Rental Market Statistics:

Rental Inventory (Q2-’24): 17,976

Units Added Since Q2-’23: +0

Asking Rent Growth Since Q2-’23: 5.1%

Asking Rent (Q2-’24): $828

Effective Rent (Q2-’24): $824

Multifamily Vacancy Rate (Q2-’24): 5.1%

Multifamily Cap Rate (Q2-’24): 9.9%

Source: National Association of Realtors

Youngstown, OH Housing Market Statistics:

Median Home Price (Q2-’24): $164,700

Home Price Appreciation Since Q2-’23: 4.7%

Source: National Association of Realtors

Youngstown, OH Economic Statistics

Population Growth (2022): -0.5%

GDP Growth (2022): 9.0%

Job Growth (Q2-’24): 0.2%

Source: National Association of Realtors

Lists That Mention Youngstown, OH:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #63

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #41

Best Places to Live (U.S. News): #132

#40: Allentown, PA

Allentown-Bethlehem-Easton, PA Metro Area Population: 873,555

Allentown, PA Rental Market Statistics:

Rental Inventory (Q2-’24): 35,495

Units Added Since Q2-’23: +214

Asking Rent Growth Since Q2-’23: 3.0%

Asking Rent (Q2-’24): $1,654

Effective Rent (Q2-’24): $1,646

Multifamily Vacancy Rate (Q2-’24): 3.6%

Multifamily Cap Rate (Q2-’24): 7.1%

Source: National Association of Realtors

Allentown, PA Housing Market Statistics:

Median Home Price (Q2-’24): $354,400

Home Price Appreciation Since Q2-’23: 7.2%

Source: National Association of Realtors

Allentown, PA Economic Statistics

Population Growth (2022): 0.7%

GDP Growth (2022): 7.1%

Job Growth (Q2-’24): 1.4%

Source: National Association of Realtors

Lists That Mention Allentown, PA:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #59

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #35

Best Real Estate Markets – Large Cities (WalletHub): #48

Best Places to Live (U.S. News): #128

#41: Charleston, WV

Charleston, WV Metro Area Population: 203,259

Charleston, WV Rental Market Statistics:

Rental Inventory (Q2-’24): 7,201

Units Added Since Q2-’23: +0

Asking Rent Growth Since Q2-’23: 4.2%

Asking Rent (Q2-’24): $1,008

Effective Rent (Q2-’24): $1,003

Multifamily Vacancy Rate (Q2-’24): 5.9%

Multifamily Cap Rate (Q2-’24): 8.8%

Source: National Association of Realtors

Charleston, WV Housing Market Statistics:

Median Home Price (Q2-’24): $193,200

Home Price Appreciation Since Q2-’23: 11.4%

Source: National Association of Realtors

Charleston, WV Economic Statistics

Population Growth (2022): -0.9%

GDP Growth (2022): 7.7%

Job Growth (Q2-’24): 0.6%

Source: National Association of Realtors

Lists That Mention Charleston, WV:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #141

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #81

#42: Fargo, ND

Fargo, ND-MN Metro Area Population: 262,620

Fargo, ND Rental Market Statistics:

Rental Inventory (Q2-’24): 38,309

Units Added Since Q2-’23: +1,042

Asking Rent Growth Since Q2-’23: 2.5%

Asking Rent (Q2-’24): $1,024

Effective Rent (Q2-’24): $1,018

Multifamily Vacancy Rate (Q2-’24): 6.2%

Multifamily Cap Rate (Q2-’24): 9.0%

Source: National Association of Realtors

Fargo, ND Housing Market Statistics:

Median Home Price (Q2-’24): $310,800

Home Price Appreciation Since Q2-’23: 3.3%

Source: National Association of Realtors

Fargo, ND Economic Statistics

Population Growth (2022): 2.6%

GDP Growth (2022): 7.6%

Job Growth (Q2-’24): 1.6%

Source: National Association of Realtors

Lists That Mention Fargo, ND:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #254

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #131

#43: Pittsburgh, PA

Pittsburgh, PA Metro Area Population: 2,422,725

Pittsburgh, PA Rental Market Statistics:

Rental Inventory (Q2-’24): 105,078

Units Added Since Q2-’23: +1,103

Asking Rent Growth Since Q2-’23: 2.3%

Asking Rent (Q2-’24): $1,336

Effective Rent (Q2-’24): $1,327

Multifamily Vacancy Rate (Q2-’24): 5.8%

Multifamily Cap Rate (Q2-’24): 8.1%

Source: National Association of Realtors

Pittsburgh, PA Housing Market Statistics:

Median Home Price (Q2-’24): $236,100

Home Price Appreciation Since Q2-’23: 4.5%

Source: National Association of Realtors

Pittsburgh, PA Economic Statistics

Population Growth (2022): -0.2%

GDP Growth (2022): 7.5%

Job Growth (Q2-’24): 1.1%

Source: National Association of Realtors

Lists That Mention Pittsburgh, PA:

Overall Real Estate Prospects (PwC/ULI): #45

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #174

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #95

Best Real Estate Markets – Small Cities (WalletHub): #45

Best Places to Live (U.S. News): #36

#44: Tallahassee, FL

Tallahassee, FL Metro Area Population: 393,414

Tallahassee, FL Rental Market Statistics:

Rental Inventory (Q2-’24): 23,843

Units Added Since Q2-’23: +906

Asking Rent Growth Since Q2-’23: 2.8%

Asking Rent (Q2-’24): $1,353

Effective Rent (Q2-’24): $1,340

Multifamily Vacancy Rate (Q2-’24): 10.3%

Multifamily Cap Rate (Q2-’24): 6.7%

Source: National Association of Realtors

Tallahassee, FL Housing Market Statistics:

Median Home Price (Q2-’24): $342,000

Home Price Appreciation Since Q2-’23: 3.0%

Source: National Association of Realtors

Tallahassee, FL Economic Statistics

Population Growth (2022): 1.2%

GDP Growth (2022): 9.8%

Job Growth (Q2-’24): 3.8%

Source: National Association of Realtors

Lists That Mention Tallahassee, FL:

Overall Real Estate Prospects (PwC/ULI): #69

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #122

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #130

Best Real Estate Markets – Mid-Sized Cities (WalletHub): #62

Best Places to Live (U.S. News): #75

#45: Richmond, VA

Richmond, VA Metro Area Population: 1,350,123

Richmond, VA Rental Market Statistics:

Rental Inventory (Q2-’24): 103,219

Units Added Since Q2-’23: +3,270

Asking Rent Growth Since Q2-’23: 3.3%

Asking Rent (Q2-’24): $1,513

Effective Rent (Q2-’24): $1,501

Multifamily Vacancy Rate (Q2-’24): 7.9%

Multifamily Cap Rate (Q2-’24): 6.4%

Source: National Association of Realtors

Richmond, VA Housing Market Statistics:

Median Home Price (Q2-’24): $444,400

Home Price Appreciation Since Q2-’23: 12.5%

Source: National Association of Realtors

Richmond, VA Economic Statistics

Population Growth (2022): 1.8%

GDP Growth (2022): 8.6%

Job Growth (Q2-’24): 1.7%

Source: National Association of Realtors

Lists That Mention Richmond, VA:

Overall Real Estate Prospects (PwC/ULI): #30

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #104

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #117

Best Real Estate Markets – Mid-Sized Cities (WalletHub): #43

Best Places to Live (U.S. News): #64

#46: Champaign, IL

Champaign-Urbana, IL Metro Area Population: 237,052

Champaign, IL Rental Market Statistics:

Rental Inventory (Q2-’24): 16,353

Units Added Since Q2-’23: +150

Asking Rent Growth Since Q2-’23: 4.2%

Asking Rent (Q2-’24): $1,058

Effective Rent (Q2-’24): $1,053

Multifamily Vacancy Rate (Q2-’24): 6.9%

Multifamily Cap Rate (Q2-’24): 7.6%

Source: National Association of Realtors

Champaign, IL Housing Market Statistics:

Median Home Price (Q2-’24): $223,600

Home Price Appreciation Since Q2-’23: 5.5%

Source: National Association of Realtors

Champaign, IL Economic Statistics

Population Growth (2022): 0.3%

GDP Growth (2022): 8.5%

Job Growth (Q2-’24): 2.1%

Source: National Association of Realtors

Lists That Mention Champaign, IL:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #60

#47: Lansing, MI

Lansing-East Lansing, MI Metro Area Population: 473,177

Lansing, MI Rental Market Statistics:

Rental Inventory (Q2-’24): 31,758

Units Added Since Q2-’23: +92

Asking Rent Growth Since Q2-’23: 2.8%

Asking Rent (Q2-’24): $1,170

Effective Rent (Q2-’24): $1,164

Multifamily Vacancy Rate (Q2-’24): 6.1%

Multifamily Cap Rate (Q2-’24): 7.9%

Source: National Association of Realtors

Lansing, MI Housing Market Statistics:

Median Home Price (Q2-’24): $240,300

Home Price Appreciation Since Q2-’23: 6.3%

Source: National Association of Realtors

Lansing, MI Economic Statistics

Population Growth (2022): 0.1%

GDP Growth (2022): 8.9%

Job Growth (Q2-’24): 1.5%

Source: National Association of Realtors

Lists That Mention Lansing, MI:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #40

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #20

Best Real Estate Markets – Large Cities (WalletHub): #69

Best Places to Live (U.S. News): #104

#48: Peoria, IL

Peoria, IL Metro Area Population: 361,989

Peoria, IL Rental Market Statistics:

Rental Inventory (Q2-’24): 12,481

Units Added Since Q2-’23: +126

Asking Rent Growth Since Q2-’23: 2.8%

Asking Rent (Q2-’24): $1,013

Effective Rent (Q2-’24): $1,009

Multifamily Vacancy Rate (Q2-’24): 4.6%

Multifamily Cap Rate (Q2-’24): 8.3%

Source: National Association of Realtors

Peoria, IL Housing Market Statistics:

Median Home Price (Q2-’24): $168,500

Home Price Appreciation Since Q2-’23: 7.6%

Source: National Association of Realtors

Peoria, IL Economic Statistics

Population Growth (2022): -0.4%

GDP Growth (2022): 13.7%

Job Growth (Q2-’24): -0.8%

Source: National Association of Realtors

Lists That Mention Peoria, IL:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #102

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #59

Best Real Estate Markets – Large Cities (WalletHub): #132

Best Places to Live (U.S. News): #82

#49: El Paso, TX

El Paso, TX Metro Area Population: 872,063

El Paso, TX Rental Market Statistics:

Rental Inventory (Q2-’24): 47,056

Units Added Since Q2-’23: +605

Asking Rent Growth Since Q2-’23: 2.8%

Asking Rent (Q2-’24): $1,062

Effective Rent (Q2-’24): $1,056

Multifamily Vacancy Rate (Q2-’24): 5.0%

Multifamily Cap Rate (Q2-’24): 7.2%

Source: National Association of Realtors

El Paso, TX Housing Market Statistics:

Median Home Price (Q2-’24): $264,400

Home Price Appreciation Since Q2-’23: 19.2%

Source: National Association of Realtors

El Paso, Texas Economic Statistics

Population Growth (2022): 0.0%

GDP Growth (2022): 11.9%

Job Growth (Q2-’24): 1.5%

Source: National Association of Realtors

Lists That Mention El Paso, TX:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #298

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #176

Best Real Estate Markets – Small Cities (WalletHub): #34

Best Places to Live (U.S. News): #62

#50: Indianapolis, IN

Indianapolis-Carmel-Anderson, IN Metro Area Population: 2,139,689

Indianapolis, IN Rental Market Statistics:

Rental Inventory (Q2-’24): 171,325

Units Added Since Q2-’23: +6,878

Asking Rent Growth Since Q2-’23: 2.6%

Asking Rent (Q2-’24): $1,277

Effective Rent (Q2-’24): $1,264

Multifamily Vacancy Rate (Q2-’24): 9.7%

Multifamily Cap Rate (Q2-’24): 6.6%

Source: National Association of Realtors

Indianapolis, IN Housing Market Statistics:

Median Home Price (Q2-’24): $329,700

Home Price Appreciation Since Q2-’23: 5.9%

Source: National Association of Realtors

Indianapolis, IN Economic Statistics

Population Growth (2022): 0.6%

GDP Growth (2022): 10.2%

Job Growth (Q2-’24): 2.1%

Source: National Association of Realtors

Lists That Mention Indianapolis, IN:

Overall Real Estate Prospects (PwC/ULI): #32

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #84

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #40

Best Real Estate Markets – Small Cities (WalletHub): #44

Best Places to Live (U.S. News): #66

#51: Lexington, KY

Lexington-Fayette, KY Metro Area Population: 520,045

Lexington, KY Rental Market Statistics:

Rental Inventory (Q2-’24): 39,468

Units Added Since Q2-’23: +609

Asking Rent Growth Since Q2-’23: 4.2%

Asking Rent (Q2-’24): $1,171

Effective Rent (Q2-’24): $1,163

Multifamily Vacancy Rate (Q2-’24): 7.2%

Multifamily Cap Rate (Q2-’24): 7.0%

Source: National Association of Realtors

Lexington, KY Housing Market Statistics:

Median Home Price (Q2-’24): $280,400

Home Price Appreciation Since Q2-’23: 7.3%

Source: National Association of Realtors

Lexington, KY Economic Statistics

Population Growth (2022): 0.0%

GDP Growth (2022): 9.5%

Job Growth (Q2-’24): 2.0%

Source: National Association of Realtors

Lists That Mention Lexington, KY:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #212

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #92

Best Real Estate Markets – Small Cities (WalletHub): #40

Best Places to Live (U.S. News): #15

#52: Dayton, OH

Dayton-Kettering, OH Metro Area Population: 814,363

Dayton, OH Rental Market Statistics:

Rental Inventory (Q2-’24): 53,443

Units Added Since Q2-’23: +981

Asking Rent Growth Since Q2-’23: 4.2%

Asking Rent (Q2-’24): $1,123

Effective Rent (Q2-’24): $1,115

Multifamily Vacancy Rate (Q2-’24): 6.9%

Multifamily Cap Rate (Q2-’24): 7.8%

Source: National Association of Realtors

Dayton, OH Housing Market Statistics:

Median Home Price (Q2-’24): $257,700

Home Price Appreciation Since Q2-’23: 9.8%

Source: National Association of Realtors

Dayton, OH Economic Statistics

Population Growth (2022): -0.1%

GDP Growth (2022): 6.9%

Job Growth (Q2-’24): 0.7%

Source: National Association of Realtors

Lists That Mention Dayton, OH:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #23

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #13

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #18

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #13

Best Real Estate Markets – Large Cities (WalletHub): #127

Best Places to Live (U.S. News): #101

#53: Pittsfield, MA

Pittsfield, MA Metro Area Population: 126,818

Pittsfield, MA Rental Market Statistics:

Rental Inventory (Q2-’24): 2,045

Units Added Since Q2-’23: +0

Asking Rent Growth Since Q2-’23: 1.1%

Asking Rent (Q2-’24): $1,084

Effective Rent (Q2-’24): $1,081

Multifamily Vacancy Rate (Q2-’24): 3.2%

Multifamily Cap Rate (Q2-’24): 8.8%

Source: National Association of Realtors

Pittsfield, MA Housing Market Statistics:

Median Home Price (Q2-’24): $281,200

Home Price Appreciation Since Q2-’23: -2.2%

Source: National Association of Realtors

Pittsfield, MA Economic Statistics

Population Growth (2022): -0.6%

GDP Growth (2022): 6.7%

Job Growth (Q2-’24): 2.0%

Source: National Association of Realtors

Lists That Mention Pittsfield, MA:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #111

#54: Charleston, SC

Charleston-North Charleston, SC Metro Area Population: 849,417

Charleston, SC Rental Market Statistics:

Rental Inventory (Q2-’24): 69,830

Units Added Since Q2-’23: +3,557

Asking Rent Growth Since Q2-’23: 1.1%

Asking Rent (Q2-’24): $1,790

Effective Rent (Q2-’24): $1,773

Multifamily Vacancy Rate (Q2-’24): 9.7%

Multifamily Cap Rate (Q2-’24): 5.4%

Source: National Association of Realtors

Charleston, SC Housing Market Statistics:

Median Home Price (Q2-’24): $457,000

Home Price Appreciation Since Q2-’23: 6.2%

Source: National Association of Realtors

Charleston, SC Economic Statistics

Population Growth (2022): 2.1%

GDP Growth (2022): 11.0%

Job Growth (Q2-’24): 4.7%

Source: National Association of Realtors

Lists That Mention Charleston, SC:

Overall Real Estate Prospects (PwC/ULI): #35

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #124

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #120

Best Real Estate Markets – Small Cities (WalletHub): #8

Best Places to Live (U.S. News): #13

#55: Florence, SC

Florence, SC Metro Area Population: 199,630

Florence, SC Rental Market Statistics:

Rental Inventory (Q2-’24): 5,874

Units Added Since Q2-’23: +118

Asking Rent Growth Since Q2-’23: 1.8%

Asking Rent (Q2-’24): $1,109

Effective Rent (Q2-’24): $1,103

Multifamily Vacancy Rate (Q2-’24): 5.5%

Multifamily Cap Rate (Q2-’24): 7.3%

Source: National Association of Realtors

Florence, SC Housing Market Statistics:

Median Home Price (Q2-’24): $227,400

Home Price Appreciation Since Q2-’23: 9.2%

Source: National Association of Realtors

Florence, SC Economic Statistics

Population Growth (2022): -0.1%

GDP Growth (2022): 6.8%

Job Growth (Q2-’24): 3.9%

Source: National Association of Realtors

Lists That Mention Florence, SC:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #159

#56 (tie): Norwich, CT

Norwich-New London, CT Metro Area Population: 279,634

Norwich, CT Rental Market Statistics:

Rental Inventory (Q2-’24): 11,455

Units Added Since Q2-’23: +222

Asking Rent Growth Since Q2-’23: 7.7%

Asking Rent (Q2-’24): $1,716

Effective Rent (Q2-’24): $1,708

Multifamily Vacancy Rate (Q2-’24): 3.3%

Multifamily Cap Rate (Q2-’24): 6.7%

Source: National Association of Realtors

Norwich, CT Housing Market Statistics:

Median Home Price (Q2-’24): $380,300

Home Price Appreciation Since Q2-’23: 9.9%

Source: National Association of Realtors

Norwich, CT Economic Statistics

Population Growth (2022): 0.4%

GDP Growth (2022): 8.9%

Job Growth (Q2-’24): 1.6%

Source: National Association of Realtors

Lists That Mention Norwich, CT:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #30

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #55

#56 (tie): Glens Falls, NY

Glens Falls, NY Metro Area Population: 125,427

Glens Falls, NY Rental Market Statistics:

Rental Inventory (Q2-’24): 3,600

Units Added Since Q2-’23: +24

Asking Rent Growth Since Q2-’23: 2.4%

Asking Rent (Q2-’24): $1,230

Effective Rent (Q2-’24): $1,226

Multifamily Vacancy Rate (Q2-’24): 1.0%

Multifamily Cap Rate (Q2-’24): 8.0%

Source: National Association of Realtors

Glens Falls, NY Housing Market Statistics:

Median Home Price (Q2-’24): $270,100

Home Price Appreciation Since Q2-’23: 19.8%

Source: National Association of Realtors

Glens Falls, NY Economic Statistics

Population Growth (2022): -0.1%

GDP Growth (2022): 8.2%

Job Growth (Q2-’24): -0.2%

Source: National Association of Realtors

#58: Kankakee, IL

Kankakee, IL Metro Area Population: 105,940

Kankakee, IL Rental Market Statistics:

Rental Inventory (Q2-’24): 1,605

Units Added Since Q2-’23: +0

Asking Rent Growth Since Q2-’23: 3.2%

Asking Rent (Q2-’24): $896

Effective Rent (Q2-’24): $890

Multifamily Vacancy Rate (Q2-’24): 3.4%

Multifamily Cap Rate (Q2-’24): 8.9%

Source: National Association of Realtors

Kankakee, IL Housing Market Statistics:

Median Home Price (Q2-’24): $209,600

Home Price Appreciation Since Q2-’23: 6.5%

Source: National Association of Realtors

Kankakee, IL Economic Statistics

Population Growth (2022): -0.5%

GDP Growth (2022): 10.6%

Job Growth (Q2-’24): 0.9%

Source: National Association of Realtors

#59: Kalamazoo, MI

Kalamazoo-Portage, MI Metro Area Population: 262,215

Kalamazoo, MI Rental Market Statistics:

Rental Inventory (Q2-’24): 19,634

Units Added Since Q2-’23: +288

Asking Rent Growth Since Q2-’23: 2.1%

Asking Rent (Q2-’24): $1,180

Effective Rent (Q2-’24): $1,170

Multifamily Vacancy Rate (Q2-’24): 8.1%

Multifamily Cap Rate (Q2-’24): 7.2%

Source: National Association of Realtors

Kalamazoo, MI Housing Market Statistics:

Data unavailable

Kalamazoo, MI Economic Statistics

Population Growth (2022): 0.0%

GDP Growth (2022): 7.9%

Job Growth (Q2-’24): -0.4%

Source: National Association of Realtors

Lists That Mention Kalamazoo, MI:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #106

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #23

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #14

Emerging Housing Markets Index – Fall 2024 (WSJ/Realtor.com): #5

Best Places to Live (U.S. News): #90

#60: Trenton, NJ

Trenton-Princeton, NJ Metro Area Population: 381,671

Trenton, NJ Rental Market Statistics:

Rental Inventory (Q2-’24): 20,817

Units Added Since Q2-’23: +0

Asking Rent Growth Since Q2-’23: 2.1%

Asking Rent (Q2-’24): $2,113

Effective Rent (Q2-’24): $2,099

Multifamily Vacancy Rate (Q2-’24): 4.1%

Multifamily Cap Rate (Q2-’24): 6.0%

Source: National Association of Realtors

Trenton, NJ Housing Market Statistics:

Median Home Price (Q2-’24): $467,200

Home Price Appreciation Since Q2-’23: 14.1%

Source: National Association of Realtors

Trenton, NJ Economic Statistics

Population Growth (2022): -1.4%

GDP Growth (2022): 10.0%

Job Growth (Q2-’24): 2.3%

Source: National Association of Realtors

Lists That Mention Trenton, NJ:

Emerging Housing Markets Index – Winter 2024 (WSJ/Realtor.com): #106

Emerging Housing Markets Index – Spring 2024 (WSJ/Realtor.com): #23

Emerging Housing Markets Index – Summer 2024 (WSJ/Realtor.com): #14

Best Places to Live (U.S. News): #145

Methodology: How Do We Calculate Up-and-Coming Real Estate Markets?

Industry Indicators

Measures of opportunity for rental property investors and property managers:

- Markets with the best overall real estate investment prospects, as measured by PwC and the Urban Land Institute

- Housing markets with emerging investment opportunities, as measured by the Wall Street Journal and Realtor.com

- Markets with a greater number of renters relative to homeowners, as measured by the National Association of Realtors

- Markets with a high rate of renter household formation, as measured by the National Association of Realtors

Housing Indicators

Measures of property prices and rent growth:

- Markets with the highest growth in asking rents, as measured by the National Association of Realtors

- Markets with the lowest rental property vacancy rate, as measured by the National Association of Realtors

- Markets with the highest rental property cap rates, as measured by the National Association of Realtors

- Markets with the most home price appreciation, as measured by the National Association of Realtors

- Markets with affordable monthly mortgage payments relative to income, as measured by the National Association of Realtors

Economic and Job Market Indicators

Measures of employment growth:

- Markets with the lowest unemployment rates, as measured by the National Association of Realtors

- Markets with the most employment growth, as measured by the National Association of Realtors

- Markets with the most GDP growth, as measured by the National Association of Realtors

- States with the most economic activity, as measured by the National Association of Realtors

Demographic Indicators

Measures of population growth:

- Markets with the greatest population growth, as measured by the National Association of Realtors

- The fastest-growing real estate markets, as measured by U.S. News

- The best places to live, based on analyses of quality of life and desirability, as measured by U.S. News

Climate Indicators

Measures of climate vulnerability:

- Markets with the lowest risk of natural disasters and extreme conditions, as measured by the Federal Emergency Management Agency

2025 Property Management Industry Trends

Learn more about the forces that will shape the rental market in 2025—download your free copy of our 2025 State of the Property Management Industry Report today. Here’s what you’ll find inside:

- Growth tactics: The strategies that property management companies will use to win new business

- Technology strategies: The tools that will help companies scale their processes as they expand their portfolios

- Market insights: The economic and demographic trends that continue to drive rental demand

- Customer feedback: Opportunities for service-oriented property management companies to create loyal residents and clients