2020 is almost over (thank goodness) and that means it’s about time to do your 1099s for your property management business. But this year, there’s a brand new IRS guideline to know about: the 1099-NEC.

Chart of Accounts

Want clearer, cleaner books? What about a more useful view into your properties or just easier accounting in general?

Get the GuideUp until this tax year, property managers have been sending and reporting 1099-MISC forms for all income not taxed by the IRS—all income you paid out to vendors, legal consultants, contractors, and owners. This year is different.

For the first time since 1982, the IRS has broken out non-employee compensation into a separate form: the 1099-NEC. In this post, we’ll cover what the new form is, how it affects the existing 1099-MISC, and what the net impact is for property managers.

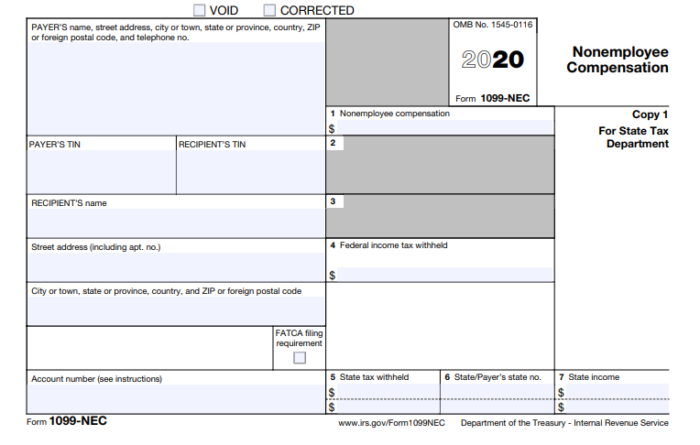

What Is the 1099-NEC?

The 1099-NEC is now the form you use to report payments you made to vendors, contractors, and other non-employees. That would include:

- Maintenance providers such as landscapers, plumbers, and HVAC professionals

- Service providers such as locksmiths, laundry and dry cleaning, or fitness instructors

- COVID-related services such as deep-cleaning and sanitizing services

The form itself looks like this:

According to the Society for Human Resource Management (SHRM), you need to send a 1099-NEC instead of a 1099-MISC if you made a payment

- To anyone who isn’t an employee.

- For services provided as part of your business (including to government agencies and nonprofit organizations).

- To an individual, a partnership, an estate or, in some cases, a corporation.

- Of at least $600 to an individual or organization during the year.

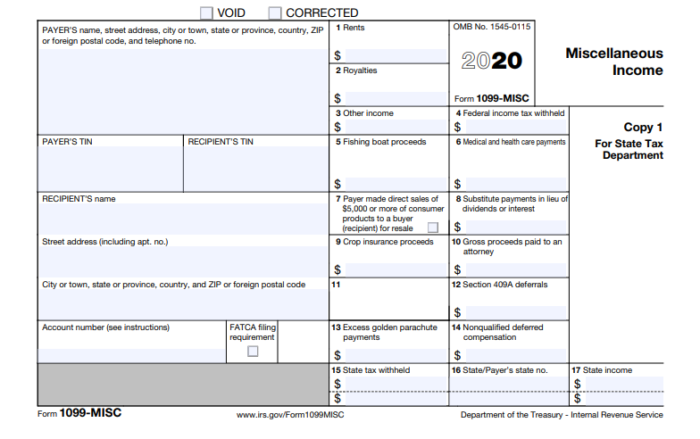

Do You Still Need to Send 1099-MISC Forms?

The short answer is yes. According to the IRS, 1099-MISC forms still cover the following payments:

- Rent income

- Prizes and awards

- Other income payments

- Cash paid from a notional principal contract to an individual, partnership, or estate

- Fishing boat proceeds

- Medical and health care payments

- Crop insurance proceeds

- Payments to an attorney

- Section 409A deferrals

- Non-qualified deferred compensation

Of course, the two categories that stand out for PMs are rent income and payments to an attorney. You most certainly paid out rent to your owners, and so they will still receive a 1099-MISC from you. You may have also used an attorney in 2020, and so you would need to send a 1099-MISC.

Because the payments have been broken out between the two forms, the 1099-MISC has gone through a redesign. It now looks like this:

According to the IRS, the following boxes have changed:

- Payer made direct sales of $5,000 or more (checkbox) in box 7.

- Crop insurance proceeds are reported in box 9.

- Gross proceeds to an attorney are reported in box 10.

- Section 409A deferrals are reported in box 12.

- Non-qualified deferred compensation income is reported in box 14.

- Boxes 15, 16, and 17 report state taxes withheld, state identification number, and amount of income earned in the state, respectively.

How Does the 1099-NEC Affect PMs?

The bad news is, you’ll have two 1099 forms to deal with this year, one for your owners and one for your vendors, contractors, and other non-employees.

The good news is, you can get help with your filing, if you’re using property management software such as Buildium. Through Buildium, you can generate and send 1099s (including the new 1099-NEC) to all of your owners, vendors, and contractors.

You can also start the process a whole month earlier than when filing officially opens with the IRS.

When Should You File and 1099-NEC?

Filing for the 1099-NEC and 1099-MISC happens on different dates. Whether you’re filing by mail or electronically, the 1099-NEC must be filed on or before February 1. If you are filing by mail, that means it has to be postmarked by that date.

For the 1099-MISC, filing has to happen on or before March 1.

It’s true that there’s now another step reporting and sending 1099 forms to your vendors and owners—and there are two filing dates to keep in mind. But that doesn’t mean you have to allocate more time to your taxes. Use your property management software to get them all out early, so when 2021 hits, you’ll have one less thing to worry about.

Read more on Accounting & Reporting